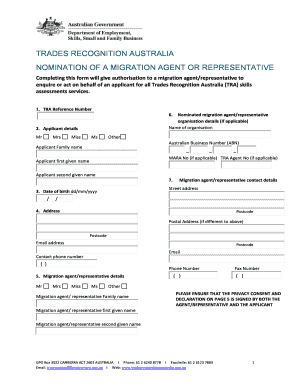

Get the free CONSUMER CREDIT CARD CUSTOMER AGREEMENT & DISCLOSURE STATEMENT

Show details

Este documento es un acuerdo y una declaración informativa para los titulares de tarjetas de crédito de Wells Fargo, que detalla los términos y condiciones, incluidas las tarifas, tasas de interés,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign consumer credit card customer

Edit your consumer credit card customer form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your consumer credit card customer form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit consumer credit card customer online

To use our professional PDF editor, follow these steps:

1

Sign into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit consumer credit card customer. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out consumer credit card customer

How to fill out CONSUMER CREDIT CARD CUSTOMER AGREEMENT & DISCLOSURE STATEMENT

01

Read the agreement carefully to understand terms and conditions.

02

Fill in your personal information including name, address, and contact information.

03

Provide your Social Security number or tax identification number.

04

Enter your financial information, such as your income and employment details.

05

Review the credit limit and interest rates specified in the agreement.

06

Read the disclosures regarding fees, penalties, and payment due dates.

07

Sign and date the agreement to acknowledge your acceptance.

Who needs CONSUMER CREDIT CARD CUSTOMER AGREEMENT & DISCLOSURE STATEMENT?

01

Individuals applying for a consumer credit card.

02

Consumers looking to understand their rights and responsibilities regarding the credit card.

03

Anyone who wants to compare different credit card offers effectively.

04

Those seeking to maintain an organized record of credit terms and conditions.

Fill

form

: Try Risk Free

People Also Ask about

What is the minimum payment disclosure on a credit card?

Your credit card statement should also include a disclosure about your minimum payment. This disclosure will explain how long it may take to pay off your statement balance if you only make the minimum payments.

What is a credit card disclosure?

Credit card disclosure must include a list of fees associated with your card. Some common credit card fees include annual fees, cash advance fees, foreign transaction fees, often called a "currency conversion" fee. Other fees include late payment fees, over-the-limit fees, and returned payment fees.

What is the credit card agreement?

The cardholder agreement is the document specifying the exact provisions of a credit card. Due to consumer protection laws, cardholder agreements must be written in language that can be easily read and understood by the public.

How to get a credit card billing statement?

To get your credit card statement, log into your bank's online portal or mobile app. Navigate to the 'Statements' or 'Documents' section, select the desired month, and download or view the PDF. If unavailable online, contact customer service for mailed copies.

What is the 2/3/4 rule for credit cards?

The 2/3/4 rule for credit cards suggests spacing out applications — no more than two in two months, three in a year, or four in two years. Following a slower pace may help you avoid multiple hard inquiries in a short time.

What is a customer card statement?

Updated: 13-11-2024 AM. A credit card statement is a vital financial document that provides crucial information about an individual's credit card. It is issued once a month and provides details of all the different payments made using the card as well as any amount credited into it.

What must credit card companies disclose to consumers?

Credit card issuers are required to give consumers at least a 45-day notice before charging a higher interest rate and at least a 21-day “grace period” between receiving a monthly statement and a due date for payment.

What is a credit card disclosure agreement?

Understand the purpose of the disclosure form: The purpose of a credit card disclosure form is to provide information about the terms and conditions of a credit card agreement. This includes things like interest rates, fees, and other charges that may be associated with using the card.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CONSUMER CREDIT CARD CUSTOMER AGREEMENT & DISCLOSURE STATEMENT?

The CONSUMER CREDIT CARD CUSTOMER AGREEMENT & DISCLOSURE STATEMENT is a legal document that outlines the terms and conditions of credit card usage, including interest rates, fees, and customer rights.

Who is required to file CONSUMER CREDIT CARD CUSTOMER AGREEMENT & DISCLOSURE STATEMENT?

Financial institutions that issue consumer credit cards are required to provide and file the CONSUMER CREDIT CARD CUSTOMER AGREEMENT & DISCLOSURE STATEMENT to comply with regulatory requirements.

How to fill out CONSUMER CREDIT CARD CUSTOMER AGREEMENT & DISCLOSURE STATEMENT?

To fill out the CONSUMER CREDIT CARD CUSTOMER AGREEMENT & DISCLOSURE STATEMENT, consumers should carefully read the agreement, provide necessary personal information, and acknowledge understanding of the terms by signing the document.

What is the purpose of CONSUMER CREDIT CARD CUSTOMER AGREEMENT & DISCLOSURE STATEMENT?

The purpose of the CONSUMER CREDIT CARD CUSTOMER AGREEMENT & DISCLOSURE STATEMENT is to inform consumers about the terms, fees, and conditions associated with their credit card, ensuring transparency and informed decision-making.

What information must be reported on CONSUMER CREDIT CARD CUSTOMER AGREEMENT & DISCLOSURE STATEMENT?

The information reported on the CONSUMER CREDIT CARD CUSTOMER AGREEMENT & DISCLOSURE STATEMENT includes the interest rate, fees, payment terms, rewards, and other significant terms and conditions related to the credit card.

Fill out your consumer credit card customer online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Consumer Credit Card Customer is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.