Get the free Business Borrower Loan Underwriting Form - ibsprovidercom

Show details

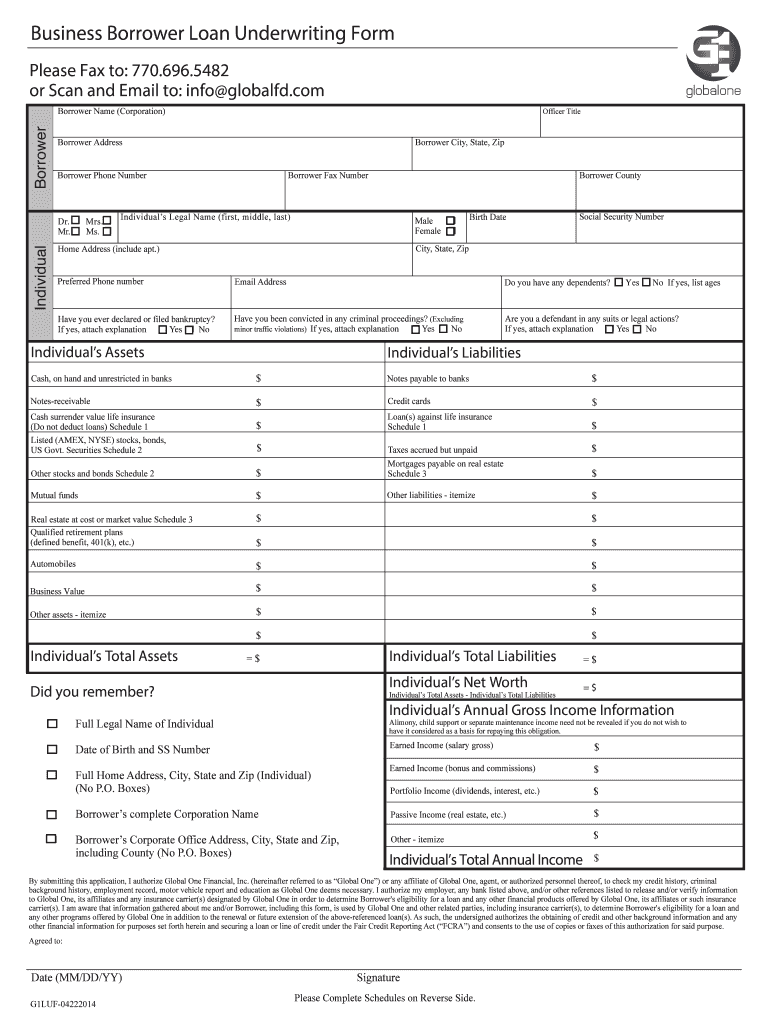

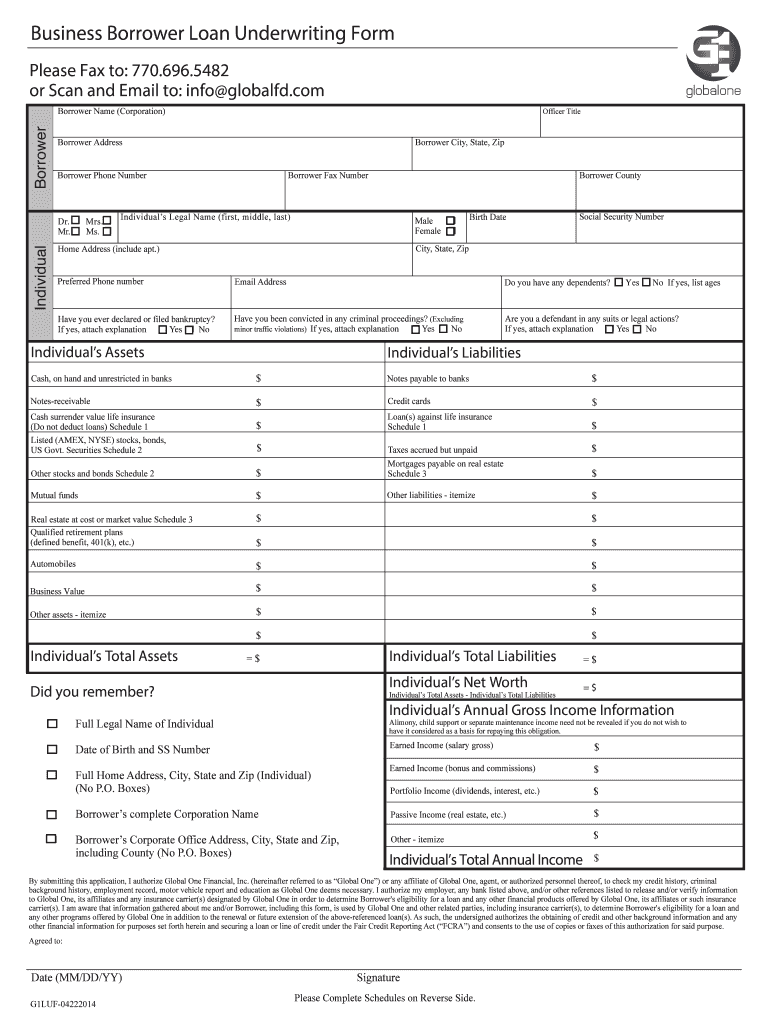

Individual s Annual Gross Income Information Business Borrower Loan Underwriting Form Cash, on hand and unrestricted in banks Notes payable to banks

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business borrower loan underwriting

Edit your business borrower loan underwriting form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business borrower loan underwriting form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit business borrower loan underwriting online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit business borrower loan underwriting. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out business borrower loan underwriting

How to fill out business borrower loan underwriting:

01

Gather all the necessary documentation such as personal and business financial statements, tax returns, bank statements, and legal documents.

02

Fill out the loan application form accurately and completely, providing detailed information about your business, its financial history, and future projections.

03

Prepare a comprehensive business plan highlighting the purpose of the loan, your business objectives, market analysis, and strategies for growth.

04

Present a strong credit history by ensuring that your personal and business credit reports are accurate and up-to-date.

05

Provide collateral, if required, by identifying and valuing assets that can secure the loan.

06

Include a detailed analysis of your business's cash flow, demonstrating your ability to repay the loan on time.

07

Double-check all the information filled in the application form for accuracy and completeness.

08

Submit the completed loan application along with the supporting documents to the lending institution or online platform.

Who needs business borrower loan underwriting:

01

Small business owners who are looking for financing options to expand their operations or invest in new projects may require business borrower loan underwriting.

02

Startups or entrepreneurs seeking capital to launch their business or fund initial expenses can benefit from the underwriting process to secure loans.

03

Established businesses aiming to invest in new equipment, hire additional staff, or expand their product lines may need business borrower loan underwriting to access adequate funding.

04

Individuals or companies with poor credit history may need professional underwriting services to strengthen their loan application and improve their chances of approval.

05

Businesses planning to acquire another company or merge with another entity may require business borrower loan underwriting to evaluate the financial risks and opportunities involved in the transaction.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send business borrower loan underwriting for eSignature?

When your business borrower loan underwriting is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How can I get business borrower loan underwriting?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific business borrower loan underwriting and other forms. Find the template you want and tweak it with powerful editing tools.

Can I create an electronic signature for the business borrower loan underwriting in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your business borrower loan underwriting in minutes.

What is business borrower loan underwriting?

Business borrower loan underwriting is the process of evaluating the creditworthiness and financial stability of a business applying for a loan.

Who is required to file business borrower loan underwriting?

Lenders or financial institutions are required to file business borrower loan underwriting for each business loan application.

How to fill out business borrower loan underwriting?

Business borrower loan underwriting is typically filled out by providing detailed information about the business's financial history, current financial status, and the purpose of the loan.

What is the purpose of business borrower loan underwriting?

The purpose of business borrower loan underwriting is to assess the risk involved in lending money to a business and to determine the terms of the loan.

What information must be reported on business borrower loan underwriting?

Information such as the business's credit score, financial statements, cash flow projections, and collateral may need to be reported on business borrower loan underwriting.

Fill out your business borrower loan underwriting online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Borrower Loan Underwriting is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.