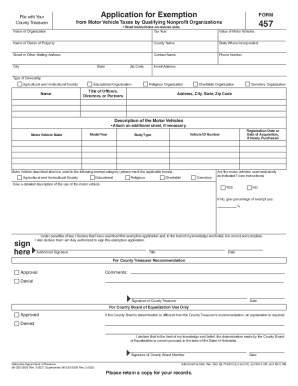

NE DoR 457 2011 free printable template

Get, Create, Make and Sign NE DoR 457

Editing NE DoR 457 online

Uncompromising security for your PDF editing and eSignature needs

NE DoR 457 Form Versions

How to fill out NE DoR 457

How to fill out NE DoR 457

Who needs NE DoR 457?

Instructions and Help about NE DoR 457

Loaded up heading a Nebraska everybody bride minds with TD T outfitters that go hunt some you oldies mule deer hunting in Nebraska how do you feel doctor I love this man we're having a great time got out six or seven mewling over there already I'm having a great time I'm with my best friend care the only about a thousand dollars they're probably 600 yards across property line but who's counting maybe they will sense Woody's gravitational pull come over this way you me do my country girl dance know what you just sit still in control being bored yesterday we don't have any fencer girls out here but well I saw what the dance, but he ain't got new cuts girls we've got a country boy mule deer and I hope he walks over here with itchy butt on TV don't sing that's only please second day we went and tried it out a different spot looking at a different canyon just beautiful view and write that daylight we spot a real nice book slipping around through the canyon, so we had to hurry and try to get around him see if we cut him off we said as soon as he goes over that hill we're going to run over there to the hill top it'd be a perfect you know hundred-yard shot probably easy deal but goes straight to worry was that soon as you went over the hill then the property line was ten yards past where he had been standing this is my handy dandy sticker print off the hog hop beats software, so I can stretch this whole seven mags out to about 550 yards if I have to open then a big old mule deer come strolling through this King if he do we are going to unleash the fury, and we're going to sling some live at it dear weren't cooperating seems like we'd go to one spot, and they'd be spotting deer you know back where we just left from the day before, and it dropped at least what seven or eight inches of snow yeah on the last night before you know we had one more day to hunt pretty exciting for us because we needed that cold air, and it was a whole new world and that afternoon we drive up to where we had seen the first one on the second day and there he is with a bunch of those five hundred yards, and we're going to try to get around and move on them and see if we can get a better shot are you Simon he's going back to left yeah he's trying to run that buck off he just took off after a nice coming up the hill where'd he go he's just coming down I see him Brian asked me says 457 yards in your range I told him I said we're about to find out he's top Singh you'll try and woody I'm only there you go stopped him in his tracks that is a stud dude, and he's got I guard yeah look at that big of son of a gun come here Brian gets over here look at that that is a stud that's the first mule deer ever shot congrats buddy now oh man that's awesome a five by five man fuck no one to see ya for before how most folks call Mr. count as I guard he's a five by five, but he's a stud 27-minute bucks baby man I can't believe that you hit him dead I mean you made a great shot Kevin that's oh my god...

People Also Ask about

What is claiming an exemption?

How do I file for tax exemption in Nebraska?

How do I get homestead exemption in Nebraska?

What qualifies as exempt on w4?

Who qualifies for the Nebraska homestead exemption?

Is it good to claim exemptions?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send NE DoR 457 for eSignature?

How can I get NE DoR 457?

How do I fill out the NE DoR 457 form on my smartphone?

What is NE DoR 457?

Who is required to file NE DoR 457?

How to fill out NE DoR 457?

What is the purpose of NE DoR 457?

What information must be reported on NE DoR 457?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.