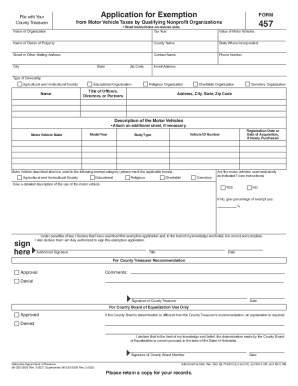

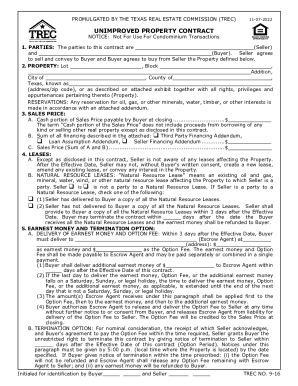

NE DoR 457 2011 free printable template

Show details

Print Application for Exemption Reset FORM from Motor Vehicle Taxes by Qualifying Nonprofit Organizations 457 be filed with your county treasurer. To Read instructions on reverse side. Applicant s

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NE DoR 457

Edit your NE DoR 457 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NE DoR 457 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NE DoR 457 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit NE DoR 457. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NE DoR 457 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NE DoR 457

How to fill out NE DoR 457

01

Obtain the NE DoR 457 form from the Nebraska Department of Revenue website or your local office.

02

Fill out your personal information at the top of the form, including your name, address, and Social Security number.

03

Indicate the type of income you are reporting and any applicable deductions.

04

Provide information on any credits you are claiming.

05

Double-check all entries for accuracy and ensure all required signatures are included.

06

Submit the completed form to the Nebraska Department of Revenue by the specified deadline.

Who needs NE DoR 457?

01

Individuals who need to report their income and pay state taxes in Nebraska.

02

Those claiming specific deductions or credits related to Nebraska state income tax.

03

Residents and non-residents earning income within the state of Nebraska.

Fill

form

: Try Risk Free

People Also Ask about

What is claiming an exemption?

An exemption is a dollar amount that can be deducted from an individual's total income, thereby reducing. the taxable income. Taxpayers may be able to claim two kinds of exemptions: • Personal exemptions generally allow taxpayers to claim themselves (and possibly their spouse)

How do I file for tax exemption in Nebraska?

To apply for a Nebraska sales tax exemption, the nonprofit corporation must apply for a certificate of exemption by submitting a Nebraska Exemption Application for Sales and Use Tax, Form 4, to the Department of Revenue.

How do I get homestead exemption in Nebraska?

Stat. 77-3502. To qualify for a homestead exemption under this category, an individual must: ❖ Be 65 or older before January 1 of the application year; ❖ Own and occupy a homestead continuously from January 1 through August 15; and ❖ Have qualifying household income – see Table I. Maximum Exempt Amount.

What qualifies as exempt on w4?

Exemption From Withholding To qualify for this exempt status, the employee must have had no tax liability for the previous year and must expect to have no tax liability for the current year. A Form W-4 claiming exemption from withholding is valid for only the calendar year in which it's furnished to the employer.

Who qualifies for the Nebraska homestead exemption?

In Nebraska, a homestead exemption is available to the following groups of persons: • Persons over the age of 65; • Qualified disabled individuals; or • Qualified disabled veterans and their widow(er)s. Some categories are subject to household income limitations and residence valuation requirements.

Is it good to claim exemptions?

If you are not tax-exempt, you are going to have to pay your taxes eventually, and filing a withholding exemption is not going to change that. If you claim exempt on your Form W-4 without actually being eligible, anticipate a large tax bill and possible penalties after you file your tax return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send NE DoR 457 for eSignature?

When your NE DoR 457 is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How can I get NE DoR 457?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific NE DoR 457 and other forms. Find the template you need and change it using powerful tools.

How do I fill out the NE DoR 457 form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign NE DoR 457 and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is NE DoR 457?

NE DoR 457 is a form used for reporting certain tax-related information to the Nebraska Department of Revenue.

Who is required to file NE DoR 457?

Entities that have a requirement to report specific transactions or tax liabilities, as defined by Nebraska tax laws, are required to file NE DoR 457.

How to fill out NE DoR 457?

To fill out NE DoR 457, gather the necessary financial information, follow the provided instructions on the form, and ensure all sections are completed accurately before submitting it to the Nebraska Department of Revenue.

What is the purpose of NE DoR 457?

The purpose of NE DoR 457 is to collect information on tax obligations and to ensure compliance with Nebraska tax regulations.

What information must be reported on NE DoR 457?

Information required on NE DoR 457 includes details about income, deductions, and other relevant tax-related information as specified in the filing instructions.

Fill out your NE DoR 457 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NE DoR 457 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.