Get the free Nebraska Corporation Estimated Income Tax

Show details

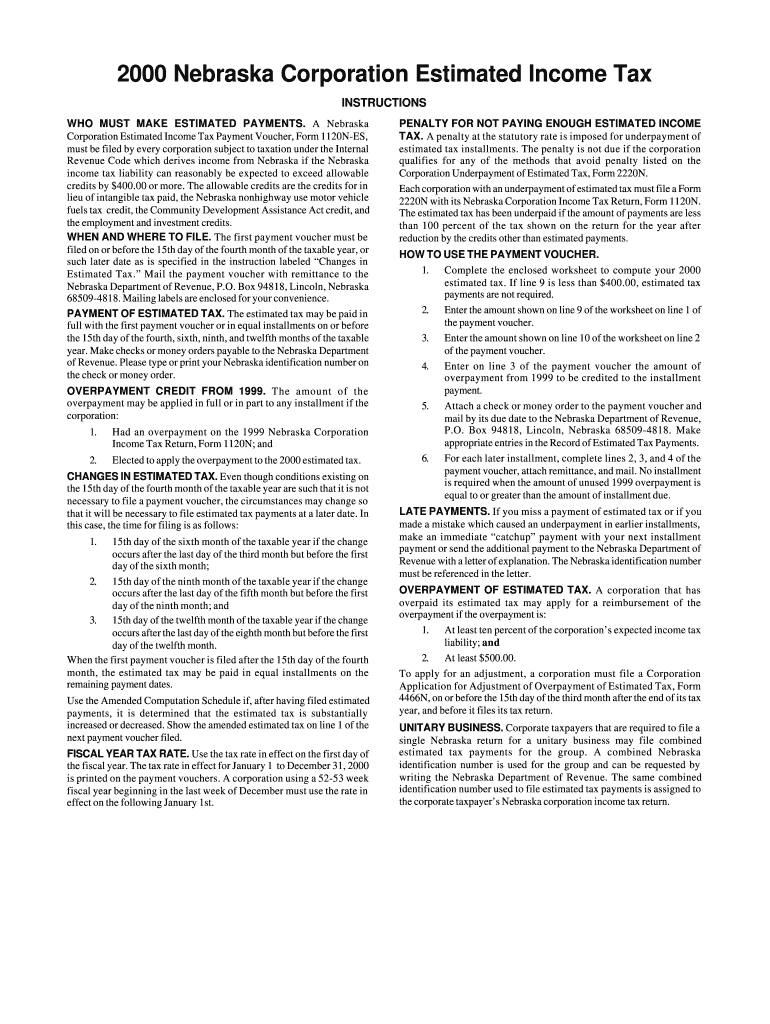

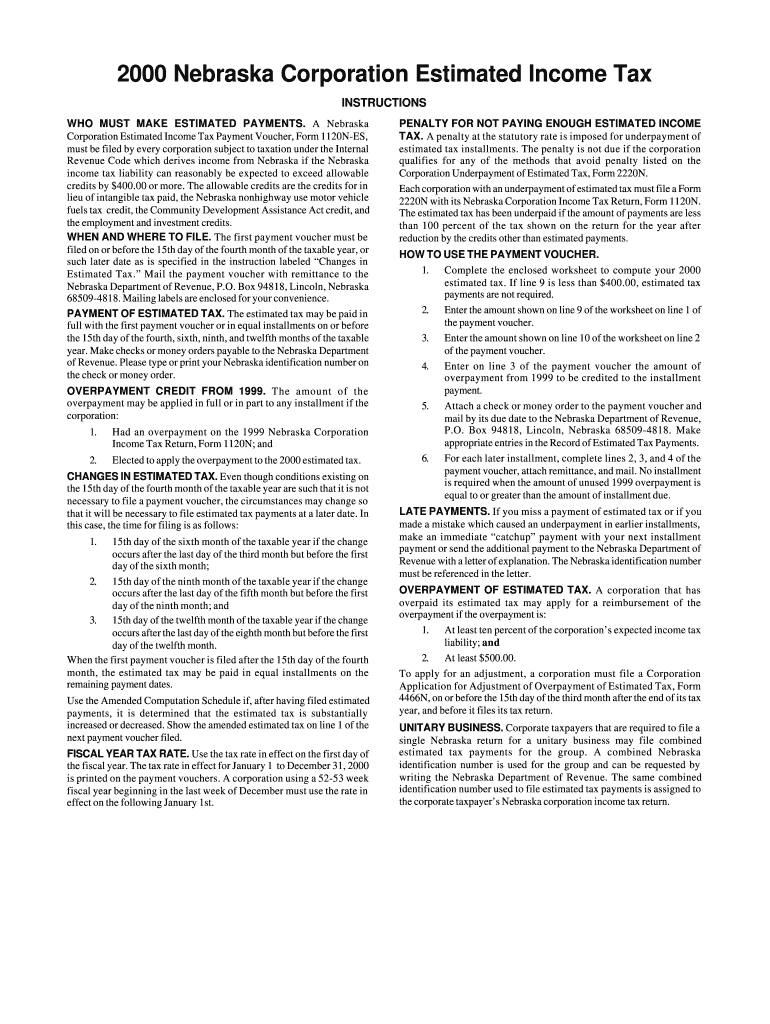

This document provides guidelines for Nebraska corporations on how to file estimated income tax payments, detailing who must file, payment schedules, and penalties for underpayment.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign nebraska corporation estimated income

Edit your nebraska corporation estimated income form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nebraska corporation estimated income form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing nebraska corporation estimated income online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit nebraska corporation estimated income. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out nebraska corporation estimated income

How to fill out Nebraska Corporation Estimated Income Tax

01

Gather necessary financial documents including income statements and expenses.

02

Determine your estimated annual income for the year.

03

Calculate your estimated Nebraska taxable income by subtracting allowable deductions.

04

Use the Nebraska corporation income tax rate to calculate your estimated tax liability.

05

Fill out the Nebraska Corporation Estimated Income Tax form (Form 1120N) with your estimated tax amount.

06

Submit the completed form and payment by the due date, which is typically the 15th day of the fourth month after the end of your fiscal year.

Who needs Nebraska Corporation Estimated Income Tax?

01

All corporations operating in Nebraska that expect to owe $500 or more in state income tax during the year.

02

Corporations that have a business presence in Nebraska and generate income sourced from Nebraska.

Fill

form

: Try Risk Free

People Also Ask about

Does Nebraska require estimated tax payments?

Nebraska Individual Estimated Income Tax Payments must be filed by every resident and nonresident of Nebraska if the individual's Nebraska income tax after allowance of personal exemption credits can reasonably be expected to exceed withholding and other credits by $500 or more.

Is Nebraska getting rid of income tax?

From 2023 to 2027, Nebraska's income tax cuts will phase in. During this time, income tax rates will be consolidated and slashed by over 30%. The final top rate is scheduled to be 3.99%.

Is Nebraska getting rid of state income tax?

From 2023 to 2027, Nebraska's income tax cuts will phase in. During this time, income tax rates will be consolidated and slashed by over 30%. The final top rate is scheduled to be 3.99%.

What is the Nebraska corporate income tax rate?

State Corporate Income Tax Rates as of January 1, 2024 StateRates Mississippi 5.0% > Missouri 4.0% > Montana 6.75% > Nebraska 5.58% >79 more rows • Jan 23, 2024

How much is $100,000 after taxes in Nebraska?

If you make $100,000 a year living in the region of Nebraska, United States of America, you will be taxed $28,201. That means that your net pay will be $71,799 per year, or $5,983 per month. Your average tax rate is 28.2% and your marginal tax rate is 38.2%.

Is Nebraska going to stop taxing Social Security?

Missouri and Nebraska have decided to stop taxing Social Security benefits in 2024. Kansas also joined in with a bill signed midway through 2024, so the state will not tax Social Security going forward.

What is the income tax for Nebraska?

Nebraska state income tax rates SingleMarried filing jointlyTax rate $0 to $2,999 $0 to $5,999 2.46% $3,000 to $17,999 $6,000 to $35,999 3.51% $18,000 to $28,999 $36,000 to $57,999 5.01% $29,000 and over $58,000 and over 5.84% Feb 24, 2025

Is Nebraska having financial problems?

LINCOLN — Nebraska's projected budget deficit for the next two years has grown by $190 million after the state's economic forecasting board fixed its previous estimates to be more on target. State lawmakers have less than a month to fill the gap.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Nebraska Corporation Estimated Income Tax?

Nebraska Corporation Estimated Income Tax is a prepayment system where corporations are required to estimate and pay their expected income tax liability for the upcoming year in quarterly installments.

Who is required to file Nebraska Corporation Estimated Income Tax?

Corporations that expect to owe $5,000 or more in Nebraska income tax for the year are required to file Nebraska Corporation Estimated Income Tax.

How to fill out Nebraska Corporation Estimated Income Tax?

To fill out Nebraska Corporation Estimated Income Tax, corporations must use Form 1120N, estimate their taxable income, calculate the estimated tax liability, and submit the payments along with the form by the specified due dates.

What is the purpose of Nebraska Corporation Estimated Income Tax?

The purpose of Nebraska Corporation Estimated Income Tax is to ensure that corporations pay their income tax obligations in a timely manner throughout the year, reducing the burden of a large tax payment at the end of the fiscal year.

What information must be reported on Nebraska Corporation Estimated Income Tax?

Corporations must report their estimated taxable income, the amount of estimated tax liability, and any credits or adjustments on the Nebraska Corporation Estimated Income Tax form.

Fill out your nebraska corporation estimated income online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nebraska Corporation Estimated Income is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.