Get the free AML Customer Identification Verification Form.pdf - Cutter & Co

Show details

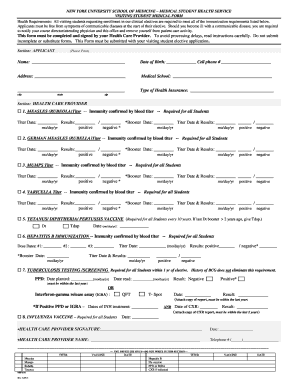

Customer Identification Verification Form The USA Patriot Act requires all financial institutions, including Cutter & Company, Inc., to obtain, verify, and maintain information that identifies each

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign aml customer identification verification

Edit your aml customer identification verification form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your aml customer identification verification form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit aml customer identification verification online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit aml customer identification verification. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out aml customer identification verification

How to fill out AML customer identification verification:

01

Gather all necessary identification documents from the customer, such as a valid passport, driver's license, or national ID card.

02

Verify the authenticity and accuracy of the identification documents by checking for any signs of tampering or forgery.

03

Collect additional information from the customer, such as their full name, date of birth, residential address, and contact details.

04

Conduct a risk assessment to determine the level of due diligence required for the customer based on factors such as the nature of their business, transaction amounts, or country of residence.

05

Verify the customer's identity by comparing the information provided with reliable independent sources, such as government databases or public records.

06

Document the verification process by maintaining a record of the identification documents, additional information collected, and any steps taken to verify the customer's identity.

07

Monitor and update the customer's information regularly to ensure compliance with any changes in regulatory requirements or the customer's circumstances.

Who needs AML customer identification verification:

AML customer identification verification is required for various entities operating in industries vulnerable to money laundering and financial crimes. This includes:

01

Banks and financial institutions: They are obligated to perform AML customer identification verification as part of their compliance with regulatory requirements.

02

Money services businesses: Providers of money transfer services or currency exchange are required to verify the identity of their customers to mitigate the risk of illicit funds entering the financial system.

03

Cryptocurrency exchanges: Due to their digital and decentralized nature, cryptocurrency platforms need to perform AML customer identification verification to deter money laundering and terrorist financing.

04

Gambling and gaming establishments: Casinos, online gambling platforms, and other gaming establishments must conduct AML customer identification verification to prevent money laundering through their operations.

05

Real estate agencies: Certain jurisdictions may require real estate agents to verify the identity of their clients to prevent the use of real estate for money laundering purposes.

06

Dealers in high-value goods: Businesses involved in the sale of high-value items, such as precious metals, jewelry, or artwork, may be required to identify their customers to prevent money laundering.

It is important to note that the specific requirements for AML customer identification verification may vary across jurisdictions and industries, so it is crucial for organizations to stay updated with applicable laws and regulations to ensure compliance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is aml customer identification verification?

AML customer identification verification is the process of verifying the identity of customers to prevent money laundering and terrorist financing.

Who is required to file aml customer identification verification?

Financial institutions, banks, money services businesses, and other entities regulated by AML laws are required to file AML customer identification verification.

How to fill out aml customer identification verification?

To fill out AML customer identification verification, the entity must collect personal information from the customer, verify the information using reliable sources, and keep records of the verification process.

What is the purpose of aml customer identification verification?

The purpose of AML customer identification verification is to prevent money laundering, terrorist financing, and other financial crimes by ensuring that customers are who they claim to be.

What information must be reported on aml customer identification verification?

AML customer identification verification typically requires reporting the customer's name, address, date of birth, identification number, and copies of identity documents.

How do I modify my aml customer identification verification in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your aml customer identification verification as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I execute aml customer identification verification online?

Completing and signing aml customer identification verification online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I make edits in aml customer identification verification without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit aml customer identification verification and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Fill out your aml customer identification verification online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Aml Customer Identification Verification is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.