Get the free tfn no of oman form

Show details

Tax File No. Sultanate of Oman. Ministry of Finance. Secretariat General for Taxation. Income Tax Form No (14) Final Return of Income of Omani Company for tax year.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tfn no of oman

Edit your tfn no of oman form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tfn no of oman form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tfn no of oman online

Follow the steps below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit tfn no of oman. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

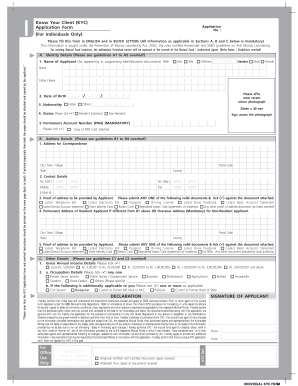

How to fill out tfn no of oman

How to fill out tfn no of oman:

01

Visit the official website of the Oman Tax Authority.

02

Locate the section for applying for a taxpayer number (tfn).

03

Fill out the online application form with accurate personal and contact information.

04

Provide the necessary supporting documents such as passport copies, residency permit, and employment contract.

05

Double-check all the information provided in the application form.

06

Submit the online application and wait for a confirmation email or notification from the Oman Tax Authority.

Who needs tfn no of oman:

01

Individuals who are employed or planning to work in Oman and are required to pay taxes.

02

Companies or organizations that operate in Oman and are subject to taxation.

03

Non-resident individuals or businesses that have taxable activities in Oman.

Fill

form

: Try Risk Free

People Also Ask about

How much is tourist tax in Oman?

"In order to promote positive economic impact in tourism amid the COVID-19 crisis, it was decided by the Supreme Committee to exempt tax for all facilities related to tourism until December 2021 to recalculate 4 per cent tourism taxes starting from January 1, 2022," the Ministry of Heritage and Tourism said in a

How to pay withholding tax in Oman?

Withholding tax (WHT) Foreign persons with no permanent establishment in Oman are subject to WHT at a rate of 10% on gross amounts paid to them. WHT is generally withheld at the source by the Omani company making payment to the foreign person.

How do I get a TIN number in Canada?

Three steps to applying for an ITIN from Canada STEP 1: Complete a Form W-7, Application for IRS Individual Taxpayer Identification Number. Complete the form W-7, Application for IRS Individual Taxpayer Identification Number. STEP 2: Obtain proof of identity and foreign status. STEP 3: Submit the application to the IRS.

What is tax certificate in Oman?

Certificate of Tax Residency is given to taxpayers, Omanis or residents as a proof that they have fulfilled the requirements of the Tax Law and Regulations. Such certificate can be submitted to the competent authorities in other countries.

What is Oman tax identification number?

Oman Tax Authority issue TINs for the purposes of Companies Income Tax, Value Added Tax, and Excise Tax. There is no personal Tax in Oman. There structure of TIN may differ depending on type of taxes. For the VAT and Excise Tax, the TIN consists of 12 alphabetic- numeric characters.

Does Oman have tax identification number?

Oman Tax Authority issue TINs for the purposes of Companies Income Tax, Value Added Tax, and Excise Tax. There is no personal Tax in Oman. There structure of TIN may differ depending on type of taxes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit tfn no of oman from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including tfn no of oman. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How can I send tfn no of oman to be eSigned by others?

Once you are ready to share your tfn no of oman, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I edit tfn no of oman in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your tfn no of oman, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

What is tfn no of oman?

The Tax Identification Number (TFN) in Oman is a unique identification number assigned to taxpayers for the purpose of tracking tax liabilities and compliance.

Who is required to file tfn no of oman?

Individuals and entities engaged in business activities or earning income in Oman are required to file for a TFN.

How to fill out tfn no of oman?

To apply for a TFN in Oman, individuals and businesses must complete a registration form provided by the tax authority, providing required identification and financial information.

What is the purpose of tfn no of oman?

The purpose of the TFN is to facilitate tax administration, making it easier for the government to manage tax collection and ensure compliance among taxpayers.

What information must be reported on tfn no of oman?

When filing for a TFN in Oman, taxpayers must report personal identification details, business registration information, and income sources.

Fill out your tfn no of oman online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tfn No Of Oman is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.