Get the free Money Purchase Pension Plan Adoption Agreement - Thinkorswim

Show details

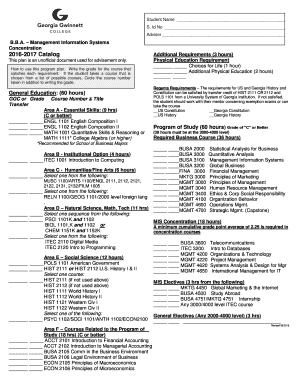

SIMPLIFIED STANDARDIZED MONEY PURCHASE PENSION PLAN A Guide to Establishing a Qualified Retirement Plan Getting Started Once you've decided to establish a qualified retirement plan, the process of

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign money purchase pension plan

Edit your money purchase pension plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your money purchase pension plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit money purchase pension plan online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit money purchase pension plan. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out money purchase pension plan

How to fill out a money purchase pension plan?

01

Gather necessary information: Start by gathering all the relevant documents and information required to fill out the money purchase pension plan. This may include personal identification details, employment information, and financial data.

02

Understand the plan: Read and comprehend the details of the money purchase pension plan before filling it out. Take note of any eligibility criteria, contribution limits, vesting periods, and investment options available.

03

Complete personal details: Begin by providing your personal information accurately. This typically includes your full name, date of birth, address, and social security number. Ensure that all the details entered are correct and up-to-date.

04

Employment details: Fill out the section relating to your employment information. This may include details such as your employer's name, address, and employee identification number. If you are self-employed, provide information about your business or profession.

05

Contribution details: Specify how much you intend to contribute to the money purchase pension plan. This can usually be a percentage of your salary or a fixed amount. Take note of any contribution limits set by the plan or government regulations, as exceeding these limits may have tax implications.

06

Beneficiary designation: Designate the individuals who will receive your pension benefits in the event of your death. Provide their full names, dates of birth, and relationship to you. It's essential to regularly review and update your beneficiary designation as life circumstances change.

07

Investment choices: If the money purchase pension plan allows for investment choices, review the available options and select your preferred investments. Consider factors such as risk tolerance, time horizon, and diversification to create a well-balanced investment portfolio.

08

Seek professional guidance if needed: If you are unsure about any aspect of filling out the money purchase pension plan or need assistance, don't hesitate to consult a financial advisor or plan administrator. They can provide personalized guidance based on your specific circumstances.

Who needs a money purchase pension plan?

01

Self-employed individuals: Money purchase pension plans are particularly attractive for self-employed individuals, as they provide a tax-advantaged way to save for retirement and potentially reduce their taxable income.

02

Employers offering retirement benefits: Employers looking to offer retirement benefits to their employees may choose to establish a money purchase pension plan. These plans can help attract and retain talented employees while allowing them to save for retirement.

03

Individuals seeking tax advantages: Money purchase pension plans offer tax advantages, such as deductible contributions and tax-deferred growth. People who wish to minimize their current taxable income while investing for retirement may opt for this type of plan.

04

Individuals seeking to maximize retirement savings: Money purchase pension plans typically have higher contribution limits compared to other retirement plans, such as IRAs or 401(k)s. This makes them suitable for individuals who want to maximize their retirement savings in a tax-efficient manner.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is money purchase pension plan?

A money purchase pension plan is a type of retirement plan where both the employer and employee make contributions to the plan.

Who is required to file money purchase pension plan?

Employers who offer money purchase pension plans are required to file the plan with the appropriate government authorities.

How to fill out money purchase pension plan?

To fill out a money purchase pension plan, employers must provide detailed information about the plan, contributions made, and participants.

What is the purpose of money purchase pension plan?

The purpose of a money purchase pension plan is to provide employees with a retirement benefit based on the contributions made to the plan.

What information must be reported on money purchase pension plan?

Information such as participant contributions, employer contributions, investment earnings, and beneficiary information must be reported on a money purchase pension plan.

How do I execute money purchase pension plan online?

Completing and signing money purchase pension plan online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I edit money purchase pension plan on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as money purchase pension plan. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

How do I complete money purchase pension plan on an Android device?

Complete your money purchase pension plan and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

Fill out your money purchase pension plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Money Purchase Pension Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.