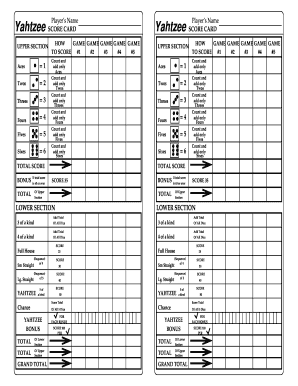

Get the free 1031 TAX-DEFERRED REAL ESTATE EXCHANGES

Show details

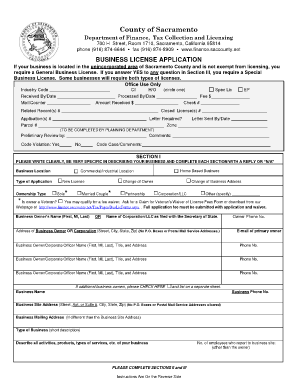

1031 DEFERRED REAL ESTATE EXCHANGESWhat is a 1031 Tax deferred Real Estate Exchange? In a typical real estate transaction, a seller is taxed on any gain realized from the sale of a property. By doing

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 1031 tax-deferred real estate

Edit your 1031 tax-deferred real estate form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 1031 tax-deferred real estate form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 1031 tax-deferred real estate online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 1031 tax-deferred real estate. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 1031 tax-deferred real estate

How to fill out 1031 tax-deferred real estate:

01

Research and understand the basics of a 1031 exchange. Familiarize yourself with the rules and requirements set by the Internal Revenue Service (IRS) for a successful tax-deferred exchange.

02

Identify a qualified intermediary (QI). A QI is a third-party facilitator who will hold the proceeds from your property sale and help you carry out the exchange. Find a reputable QI with experience in handling 1031 exchanges.

03

Sell your investment property. Locate a buyer and negotiate the sale of your property. Ensure that the sales contract includes specific language stating your intent to execute a 1031 exchange.

04

Notify your QI. Once the sale is complete, inform your QI about the impending exchange and provide them with the necessary documentation. This includes copies of the purchase and sale agreement, closing statements, and other relevant paperwork.

05

Begin the identification process. Within 45 days from the sale of your property, you must identify potential replacement properties to complete the exchange. Adhere to the IRS rules by identifying up to three properties or any number of properties with a total value not exceeding 200% of the sold property's value.

06

Close on the replacement property. Move quickly to finalize the purchase of your chosen replacement property within 180 days from the sale of your original property. Work with your QI to transfer the funds from the sale into the purchase of the new property.

07

Report the exchange on your tax return. When filing your tax return for the year in which the exchange took place, complete IRS Form 8824 to report the 1031 exchange. Consult a tax professional to ensure accuracy and compliance with tax regulations.

Who needs 1031 tax-deferred real estate?

01

Real estate investors who want to defer capital gains tax on the sale of investment properties.

02

Property owners planning to reinvest their proceeds into like-kind properties to maintain and grow their real estate portfolio.

03

Individuals looking to leverage the tax advantages of a 1031 exchange to increase their investment potential and future financial stability.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 1031 tax-deferred real estate?

A 1031 tax-deferred real estate exchange allows an investor to sell a property and reinvest the proceeds in a new property without paying capital gains taxes.

Who is required to file 1031 tax-deferred real estate?

Investors who sell a property and wish to defer paying capital gains taxes by reinvesting in a similar property are required to file for a 1031 tax-deferred exchange.

How to fill out 1031 tax-deferred real estate?

To fill out a 1031 tax-deferred real estate exchange, investors must select a qualified intermediary, identify replacement property within 45 days of the sale, and complete the purchase of replacement property within 180 days.

What is the purpose of 1031 tax-deferred real estate?

The purpose of a 1031 tax-deferred exchange is to allow investors to defer paying capital gains taxes when selling and reinvesting in a new property, thus promoting the continued investment in real estate.

What information must be reported on 1031 tax-deferred real estate?

On a 1031 tax-deferred exchange, investors must report details of the relinquished property, details of the replacement property, and information regarding the timing of the exchange.

How do I modify my 1031 tax-deferred real estate in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your 1031 tax-deferred real estate and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How do I edit 1031 tax-deferred real estate online?

The editing procedure is simple with pdfFiller. Open your 1031 tax-deferred real estate in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I complete 1031 tax-deferred real estate on an Android device?

Use the pdfFiller mobile app and complete your 1031 tax-deferred real estate and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

Fill out your 1031 tax-deferred real estate online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

1031 Tax-Deferred Real Estate is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.