Get the free 2003 SPECIAL TAX BONDS

Show details

ANNUAL REPORT FOR COMMUNITY FACILITIES DISTRICT NO. 5 OF NOWAY UNIFIED SCHOOL DISTRICT January 31, 2005, FISCAL YEAR 2003-04 ANNUAL REPORT $1,670,000 COMMUNITY FACILITIES DISTRICT NO. 5 OF NOWAY UNIFIED

We are not affiliated with any brand or entity on this form

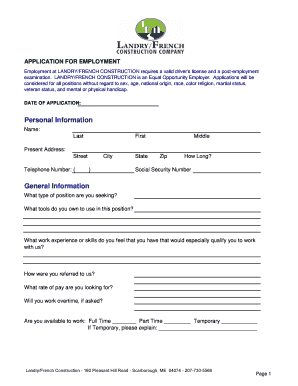

Get, Create, Make and Sign 2003 special tax bonds

Edit your 2003 special tax bonds form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2003 special tax bonds form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2003 special tax bonds online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 2003 special tax bonds. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2003 special tax bonds

How to fill out 2003 special tax bonds:

01

Start by obtaining the necessary forms for filling out 2003 special tax bonds. These forms can often be obtained from the local government or the issuing authority.

02

Carefully read through the instructions provided on the forms. It is crucial to understand the requirements and guidelines for completing the bonds accurately.

03

Begin by entering the relevant information in the appropriate fields, such as the name of the issuer, bond series, and maturity date. Make sure to double-check the accuracy of the information entered.

04

Proceed to fill in the details of the bondholders, including their names, addresses, and the amount of bonds they hold. Ensure that this information is entered correctly to avoid any potential issues in the future.

05

Calculate the amount of interest or coupon payments to be made on the bonds. This may involve referring to the bond agreement or consulting with a financial professional to ensure accuracy.

06

Determine the payment dates and frequencies for the bond interest or coupon payments. This information is essential for both the issuer and the bondholders.

07

Sign and date the completed forms. It is crucial to have the necessary authorized signatures to validate the bonds.

08

Submit the filled-out forms to the appropriate authority or entity responsible for processing and registering the bonds. Follow any additional instructions or requirements provided during the submission process.

Who needs 2003 special tax bonds:

01

Municipalities or local governments looking to finance public projects may consider issuing 2003 special tax bonds. These bonds can provide funding for infrastructure improvements, schools, parks, or other community development initiatives.

02

Investors seeking fixed-income securities with potentially higher yields may be interested in purchasing 2003 special tax bonds. These bonds often offer attractive interest rates compared to other investment options.

03

Financial professionals, such as brokers or investment advisors, may recommend 2003 special tax bonds to clients looking for tax-advantaged investment opportunities. These bonds can provide tax benefits, such as exemption from federal income tax or certain state and local taxes, depending on the specific circumstances.

04

Individuals or institutions who want to support local government projects and positively contribute to their communities may choose to invest in 2003 special tax bonds as a socially responsible investment.

05

Banks or financial institutions may hold 2003 special tax bonds as part of their investment portfolios, seeking to diversify their holdings and potentially earn income from interest payments.

06

Public agencies or authorities responsible for overseeing the issuance and management of special tax bonds may also need them for administrative and regulatory purposes.

07

Bondholders who already own 2003 special tax bonds may need to keep track of their investments, receive their interest payments, and consider reinvestment options.

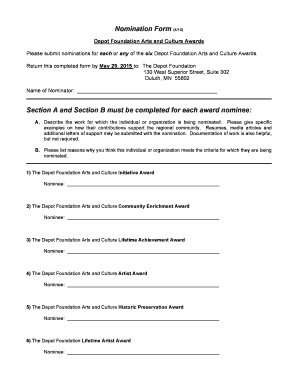

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find 2003 special tax bonds?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific 2003 special tax bonds and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

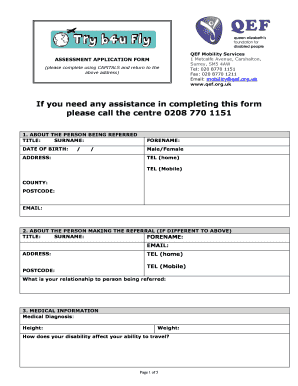

How do I complete 2003 special tax bonds online?

Filling out and eSigning 2003 special tax bonds is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Can I create an electronic signature for signing my 2003 special tax bonds in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your 2003 special tax bonds directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

What is special tax bonds?

Special tax bonds are bonds issued by local governments that are secured by specific tax revenues, such as property taxes or sales taxes.

Who is required to file special tax bonds?

Any municipality or government agency looking to finance specific projects can issue special tax bonds.

How to fill out special tax bonds?

To fill out special tax bonds, you will need to provide detailed information about the bond issuer, the project being financed, and the specific tax revenue that will secure the bond.

What is the purpose of special tax bonds?

The purpose of special tax bonds is to provide a way for local governments to finance specific projects without using general tax revenue.

What information must be reported on special tax bonds?

Special tax bonds typically require information about the issuer, project details, tax revenue pledged, and repayment terms.

Fill out your 2003 special tax bonds online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2003 Special Tax Bonds is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.