Get the free To open the 2016 Membership Form - Winkler Golf Club

Show details

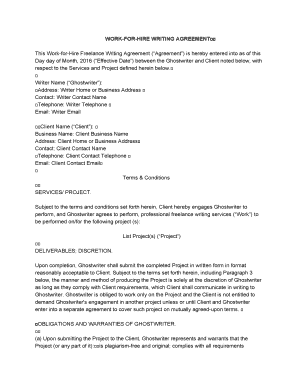

2016 Winkler Centennial Golf Club Membership Fees Season ends Oct 16th 2016 FAMILY ADULT SENIOR(60+)** INTERMEDIATE(1925) JUNIOR(18 AND UNDER) CORPORATE MEN LEAGUE LADIES LEAGUE FULL CART*** SINGLE

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign to open the 2016

Edit your to open the 2016 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your to open the 2016 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit to open the 2016 online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit to open the 2016. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out to open the 2016

How to fill out to open the 2016:

01

Gather all necessary documents: Begin by collecting all relevant documents for the year 2016, such as tax forms, financial statements, receipts, and any other paperwork related to your finances.

02

Review previous year's records: Take the time to review your 2015 records to ensure you have a clear understanding of your financial situation and any carry-over items that may affect the opening of the 2016.

03

Organize your paperwork: Create a systematic approach to organize your documents. This may include labeling folders or creating digital folders on your computer to keep everything in order.

04

Determine the appropriate tax forms: Identify the specific tax forms required for your situation. This may vary depending on your employment status, income sources, deductions, and credits.

05

Fill out the necessary information: Complete the tax forms accurately and thoroughly. Make sure to fill in all relevant sections, providing accurate details about your income, expenses, and any applicable deductions or credits.

06

Double-check for accuracy: After completing the forms, review them carefully to ensure there are no errors or missing information. Incorrect or incomplete forms could lead to delays or penalties.

07

Seek professional assistance if needed: If you are unsure about certain tax regulations or have a complex financial situation, don't hesitate to seek help from a tax professional or accountant. They can provide guidance and ensure your forms are filled out correctly.

Who needs to open the 2016?

01

Individuals: Any individual who earned income or had financial transactions in the year 2016 needs to open the 2016 tax year. This includes employees, self-employed individuals, investors, and retirees.

02

Business owners: Business owners, whether operating as sole proprietors, partnerships, or corporations, must also open the 2016 tax year to report their business income, expenses, and other financial transactions.

03

Non-profit organizations: Non-profit organizations are also required to open the 2016 tax year to report their financial activities, donations, and other relevant information.

04

Estates and trusts: Estates and trusts that exist in 2016 due to inheritance or other circumstances need to open the 2016 tax year to report any income, expenses, and distributions.

05

Other entities: Depending on the jurisdiction and specific regulations, other entities such as investment funds, charities, and government agencies may also need to open the 2016 tax year.

Remember, it's crucial to comply with the tax regulations in your jurisdiction and accurately fill out the necessary forms to avoid any potential penalties or legal issues.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is to open the membership?

To open the membership means to apply for and gain access to the benefits and privileges of belonging to a particular organization or group.

Who is required to file to open the membership?

Individuals who meet the eligibility criteria set by the organization or group and wish to become members are required to file to open the membership.

How to fill out to open the membership?

To open the membership, individuals typically need to complete an application form, provide any required documentation or information, and pay any associated fees.

What is the purpose of to open the membership?

The purpose of opening the membership is to allow individuals to become part of a community or organization, access its resources and benefits, and participate in its activities.

What information must be reported on to open the membership?

Information required to open the membership may include personal details, contact information, qualifications, references, and any other relevant information requested by the organization.

How do I complete to open the 2016 online?

pdfFiller has made it easy to fill out and sign to open the 2016. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

Can I sign the to open the 2016 electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your to open the 2016 in seconds.

Can I edit to open the 2016 on an iOS device?

You certainly can. You can quickly edit, distribute, and sign to open the 2016 on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

Fill out your to open the 2016 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

To Open The 2016 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.