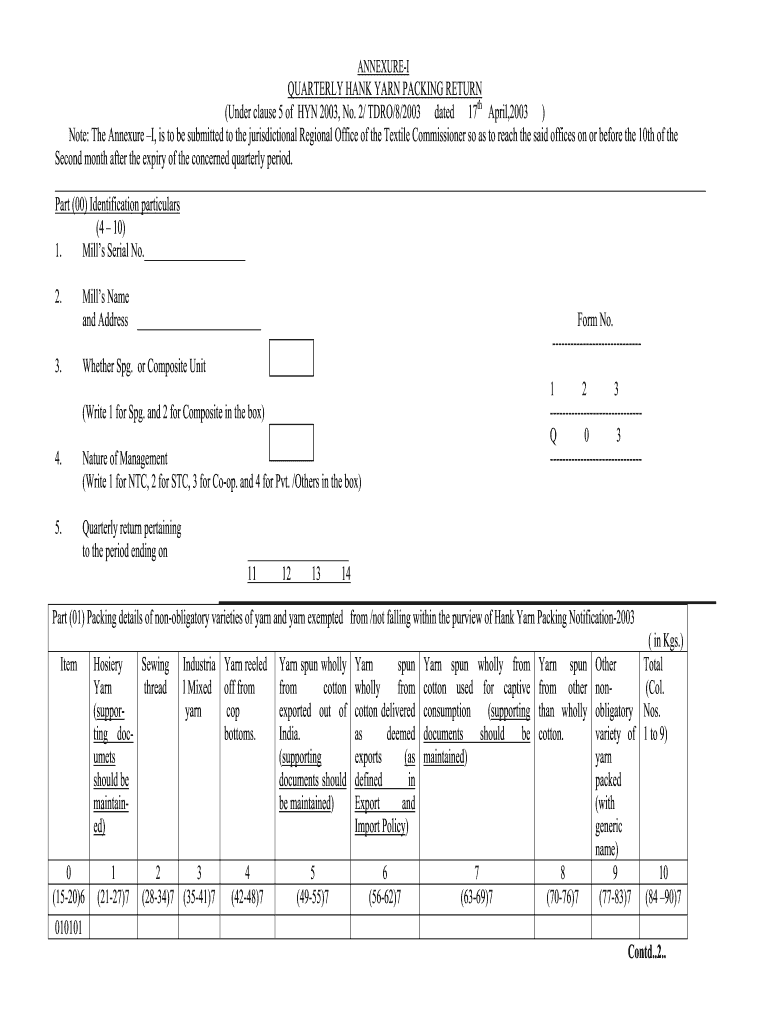

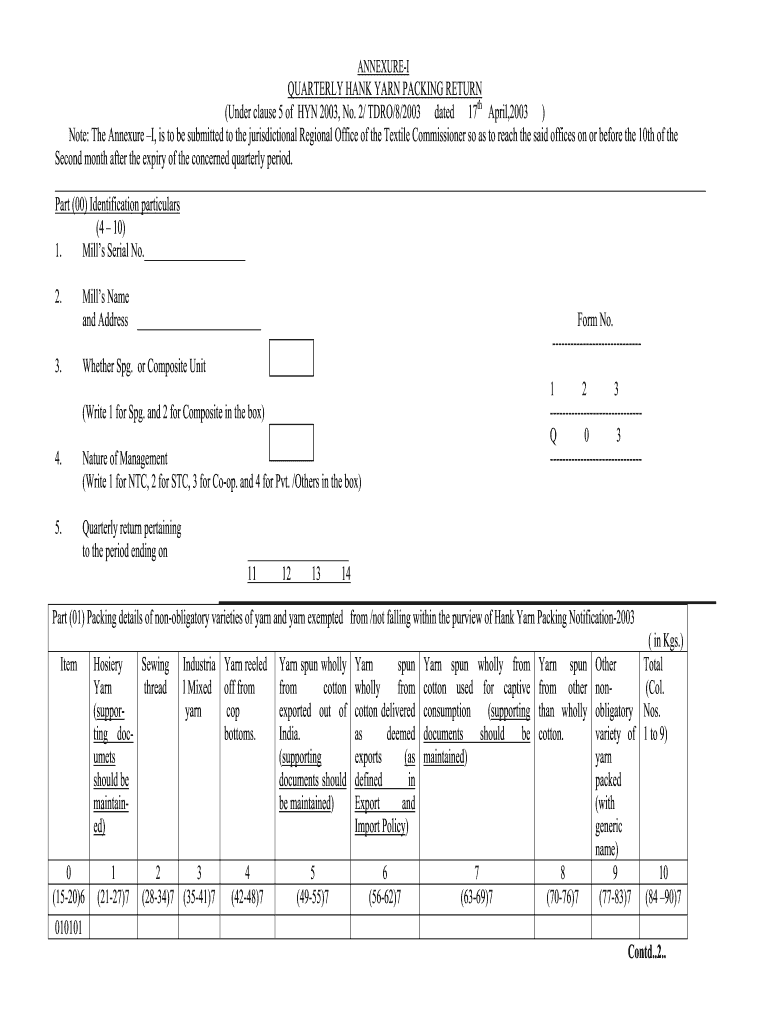

India Quarterly Hank Yarn Packing Return 2003-2025 free printable template

Get, Create, Make and Sign quarterly hank fillable form

Editing quarterly hank template online

Uncompromising security for your PDF editing and eSignature needs

How to fill out quarterly packing return form

How to fill out India Quarterly Hank Yarn Packing Return

Who needs India Quarterly Hank Yarn Packing Return?

Video instructions and help with filling out and completing india quarterly hank

Instructions and Help about quarterly hank return

Laws calm legal forms guide form 990 is a United States Internal Revenue Service tax return form used by organizations that are claiming tax-exempt status this tax return should be used by qualifying religious organizations' education services or qualifying charitable organizations the form 990 can be obtained through the IRS s website or by obtaining the documents through a local tax office first provide your organization's name and contact information in the top box of the form for Parts A through M in the top box enter any applicable information about your organization and leave blank any parts that do not apply in Part 1 you must indicate the activities and basic governance of your organization include as much detail as possible to show your tax-exempt status in this part report all revenue your organization has received over the past tax year and the current tax year you are reporting next report all expenses the organization has incurred during both the previous tax year and the current year indicate total assets total liabilities and net assets on the books and lines 20 through 22 for both the previous and current tax year have an authorized person sign and date the form in part two you must fill out the part three sections indicating the accomplishments of your tax-exempt organization you must describe the achievements in detail on the provided lines in line for a tax-exempt organization may have to file numerous schedules along with their form 990 tax return review the checklist of required schedules in part 4 to ensure that you have all applicable schedules you must next move to part 5 which requires that you disclose information from other IRS filings to ensure compliance with all I RS regulations fill out any lines on part 5 that apply to your organization in part 6 detail your governance and management structure of your tax-exempt organization this information should be taken directly from your organization's Charter or incorporation papers similarly detail in part 7 all compensation distributed to employees and officers of your tax-exempt Corporation provide your statement of revenue in part 8 and functional expenses part nine provide a final balance sheet in part 10 once completed file the form 990 with the IRS with all required attached schedules and retain a copy for future reference to watch more videos please make sure to visit laws comm

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in hank yarn return?

How can I fill out quarterly hank printable on an iOS device?

Can I edit hank packing pdf on an Android device?

What is India Quarterly Hank Yarn Packing Return?

Who is required to file India Quarterly Hank Yarn Packing Return?

How to fill out India Quarterly Hank Yarn Packing Return?

What is the purpose of India Quarterly Hank Yarn Packing Return?

What information must be reported on India Quarterly Hank Yarn Packing Return?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.