Get the free usaa brokerage

Show details

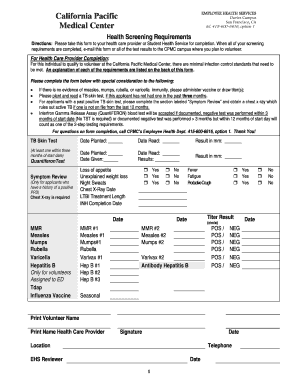

USA Brokerage Services Cost Basis Form P.O. Box 659453 San Antonio, Texas 78265-9825 What is the purpose of this form? If you do not have access to usaa.com, you may use this form to update cost basis

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign usaa brokerage form

Edit your usaa brokerage form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your usaa brokerage form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing usaa brokerage form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit usaa brokerage form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out usaa brokerage form

How to fill out USAA brokerage:

01

Begin by visiting the USAA website and logging into your account. If you don't have an account, you will need to create one.

02

Once logged in, navigate to the brokerage section of the website. This may be located under the "Investments" or "Brokerage" tab.

03

From there, you should see options to open a new brokerage account or manage an existing one. If you are opening a new account, follow the prompts to provide your personal information, such as your name, address, and social security number.

04

Next, you will need to choose the type of brokerage account you want to open. USAA offers a variety of options, including individual, joint, retirement, and education savings accounts. Select the one that best suits your needs.

05

Once you've selected the type of account, you may be asked to make additional choices, such as account features and investment options. Follow the prompts to make these selections.

06

After inputting all the necessary information and making your choices, review and confirm the details of your application. Make sure everything is accurate before submitting.

07

Once your application is submitted, it will typically go through a verification process. This may involve USAA requesting additional documentation or information to verify your identity or financial situation.

08

Once your account is approved, you will receive confirmation and instructions on how to fund your brokerage account. This may involve transferring funds from an existing USAA account or linking an external bank account.

09

After funding your account, you can begin trading and investing through the USAA brokerage platform. Take the time to familiarize yourself with the platform and its features.

10

As you use the USAA brokerage, keep track of your investments and regularly review your portfolio. Adjust your investments as needed to align with your financial goals and risk tolerance.

Who needs USAA brokerage:

01

USAA brokerage can be beneficial for individuals who are looking to invest their money for various financial goals, such as retirement planning, saving for college education, or growing their wealth.

02

Active-duty military members, veterans, and their families may find USAA brokerage particularly attractive due to the company's strong ties to the military community.

03

Investors who prefer a comprehensive financial services provider may appreciate the convenience of having their brokerage account with USAA, along with their banking, insurance, and other financial needs.

04

Those who value low fees and competitive rates may find USAA brokerage appealing, as the company has a reputation for offering competitive pricing compared to other brokerage firms.

05

USAA brokerage also provides access to a wide range of investment options, including stocks, bonds, mutual funds, exchange-traded funds (ETFs), and retirement accounts. This makes it suitable for investors with different risk appetites and investment preferences.

06

Individuals who prefer to have all their financial accounts in one place may find it convenient to have their brokerage account with USAA, as they can easily track and manage their investments alongside their other financial accounts.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is usaa brokerage?

USAA brokerage is a service that offers investment options such as stocks, mutual funds, and retirement accounts to USAA members.

Who is required to file usaa brokerage?

Individuals who have USAA brokerage accounts and earn income from investments are required to file taxes with the brokerage information included.

How to fill out usaa brokerage?

To fill out USAA brokerage information, individuals can use the tax forms provided by USAA or input the information directly into their tax software. They will need to report any income earned from investments.

What is the purpose of usaa brokerage?

The purpose of USAA brokerage is to provide members with access to a variety of investment options to help them grow their wealth and save for retirement.

What information must be reported on usaa brokerage?

Individuals must report any income earned from investments, such as dividends, capital gains, and interest, on their USAA brokerage account.

Where do I find usaa brokerage form?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific usaa brokerage form and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I make edits in usaa brokerage form without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your usaa brokerage form, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Can I edit usaa brokerage form on an iOS device?

Use the pdfFiller mobile app to create, edit, and share usaa brokerage form from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

Fill out your usaa brokerage form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Usaa Brokerage Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.