Get the free MORTGAGE INTEREST SAVER

Show details

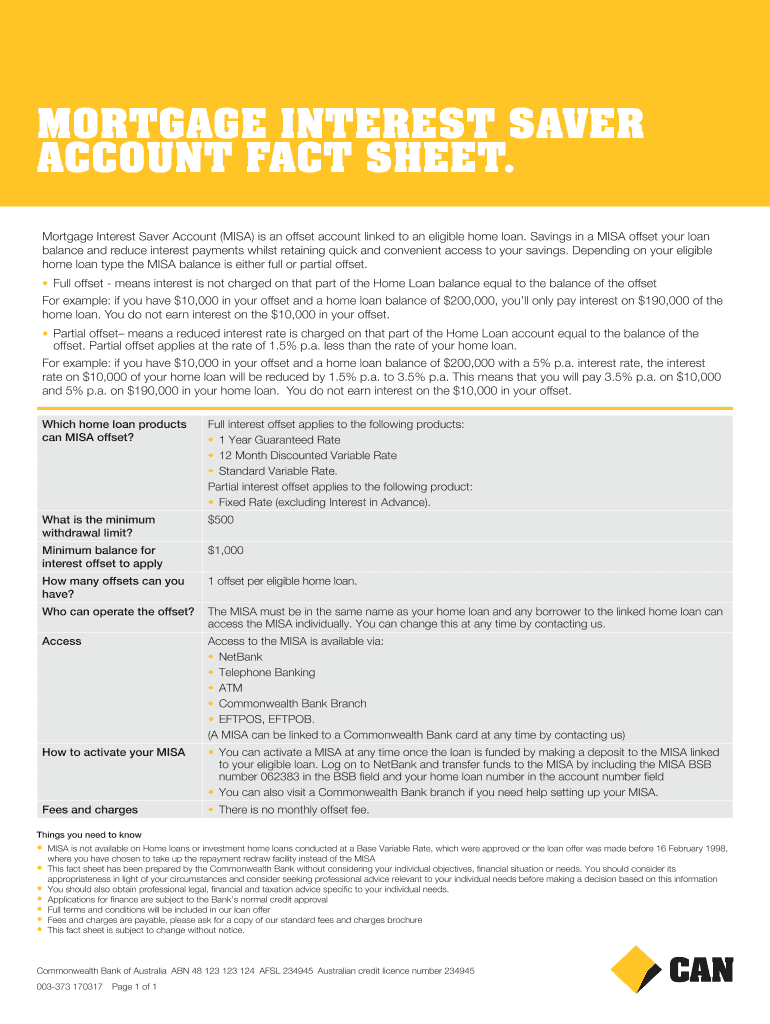

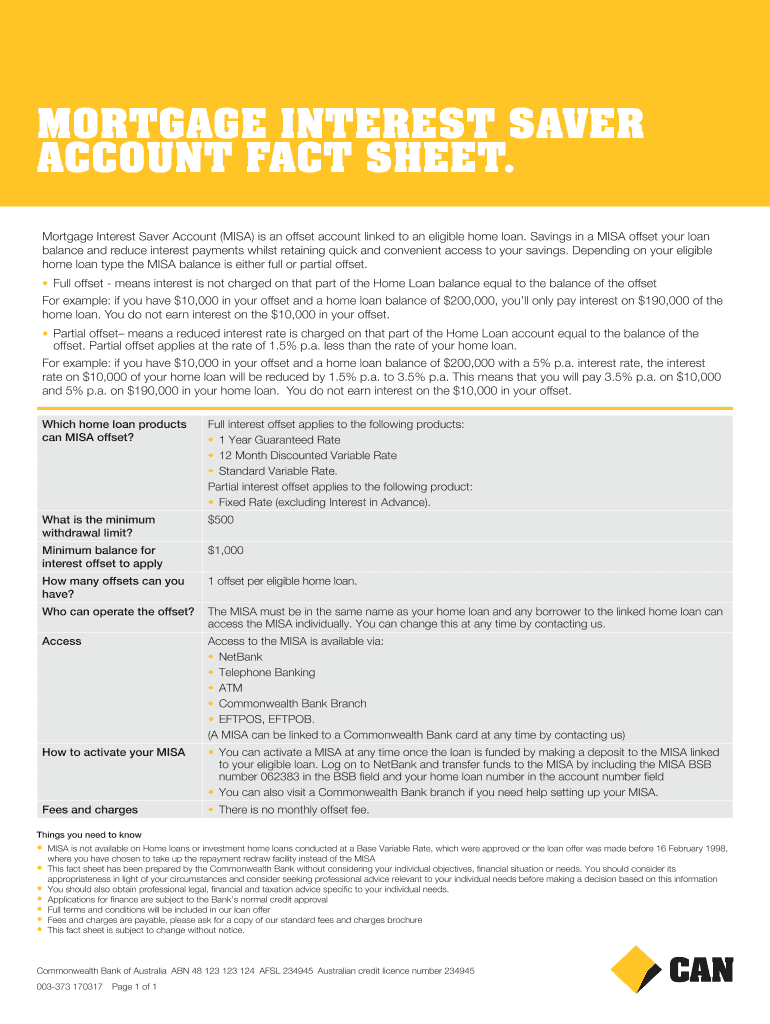

MORTGAGE INTEREST SAVER ACCOUNT FACT SHEET. Mortgage Interest Saver Account (MISS) is an offset account linked to an eligible home loan. Savings in a MISS offset your loan balance and reduce interest

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mortgage interest saver

Edit your mortgage interest saver form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage interest saver form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mortgage interest saver online

Follow the guidelines below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit mortgage interest saver. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mortgage interest saver

How to fill out mortgage interest saver?

01

Begin by gathering all the necessary documents such as your mortgage statement, income proof, and any other relevant financial information.

02

Review your mortgage interest saver application form and ensure you understand all the questions and requirements.

03

Fill in the personal details section of the form, providing accurate information about yourself, including your name, address, contact details, and social security number.

04

Provide details about your current mortgage, such as the loan amount, interest rate, and term.

05

Specify the purpose of your mortgage interest saver application, whether it is to reduce your interest payments, shorten the loan term, or achieve another financial goal.

06

Provide proof of your income, such as recent pay stubs or bank statements, ensuring that the documents clearly show your regular income.

07

Include any additional information or documents requested by the lender or mortgage interest saver program, such as proof of insurance or property tax information.

08

Review and double-check all the information filled in the form, ensuring its accuracy and completeness.

09

Sign and date the form, acknowledging that all the information provided is true and accurate.

10

Submit the completed mortgage interest saver application form along with all the required documents to your lender or the relevant program.

Who needs mortgage interest saver?

01

Homeowners who want to lower their monthly mortgage payments may benefit from a mortgage interest saver. By reducing the interest rate or term of their mortgage, they can potentially save a significant amount of money over time.

02

Individuals who wish to pay off their mortgage faster can also consider a mortgage interest saver. By shortening the loan term, they can save on interest expenses and become debt-free sooner.

03

Homeowners facing financial difficulties or struggling to meet their current mortgage payments may find a mortgage interest saver program helpful. It can provide them with the opportunity to modify their loan terms and make their mortgage more affordable.

04

Individuals who are planning to refinance their mortgage may explore mortgage interest saver options as an alternative to traditional refinancing. It can offer them a more cost-effective way to achieve their financial goals while minimizing closing costs and fees.

05

Both first-time homebuyers and existing homeowners looking to purchase a property can benefit from a mortgage interest saver. It can provide them with more favorable loan terms and help them save money over the life of the loan.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is mortgage interest saver?

Mortgage interest saver is a tax deduction that allows homeowners to deduct the interest they pay on their mortgage from their taxable income.

Who is required to file mortgage interest saver?

Homeowners who have a mortgage and wish to claim the mortgage interest deduction on their taxes are required to file mortgage interest saver.

How to fill out mortgage interest saver?

To fill out mortgage interest saver, homeowners need to gather their mortgage interest statements from their lender and report the total amount of interest paid on their mortgage during the tax year.

What is the purpose of mortgage interest saver?

The purpose of mortgage interest saver is to provide homeowners with a tax deduction to help reduce the overall cost of homeownership.

What information must be reported on mortgage interest saver?

Homeowners must report the total amount of interest paid on their mortgage during the tax year, as well as the name and address of the lender.

How can I edit mortgage interest saver from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your mortgage interest saver into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How do I execute mortgage interest saver online?

Completing and signing mortgage interest saver online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I fill out mortgage interest saver using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign mortgage interest saver and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

Fill out your mortgage interest saver online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortgage Interest Saver is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.