Get the free BCERTIFICATEb OF INSURANCE - Ameritas

Show details

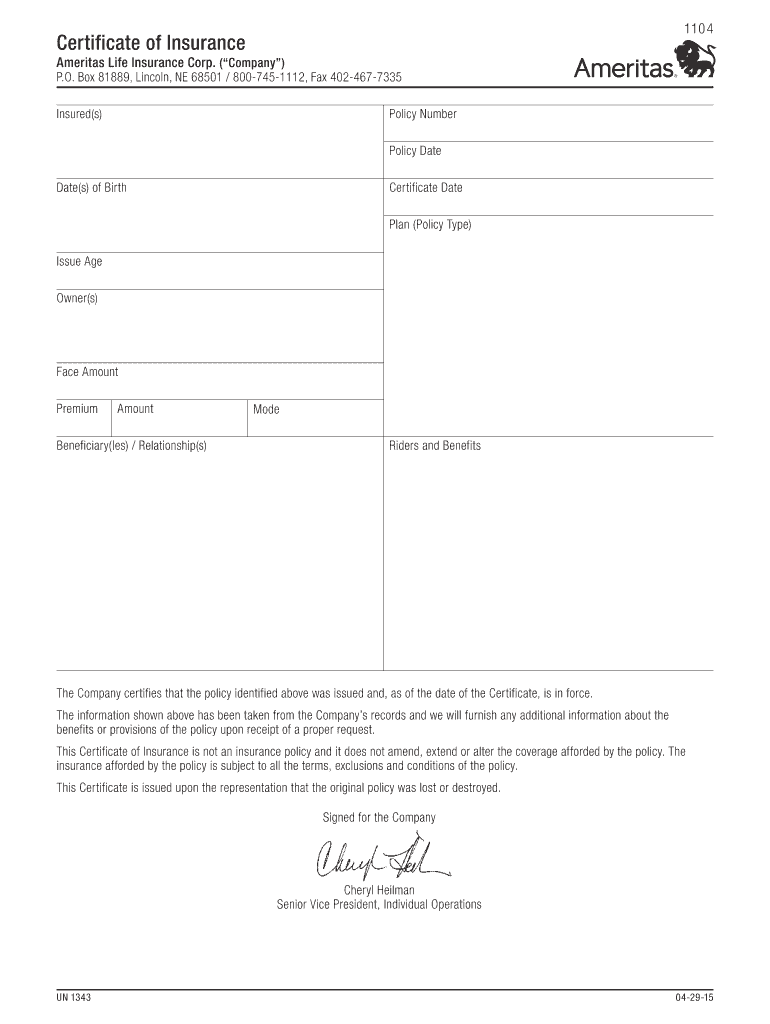

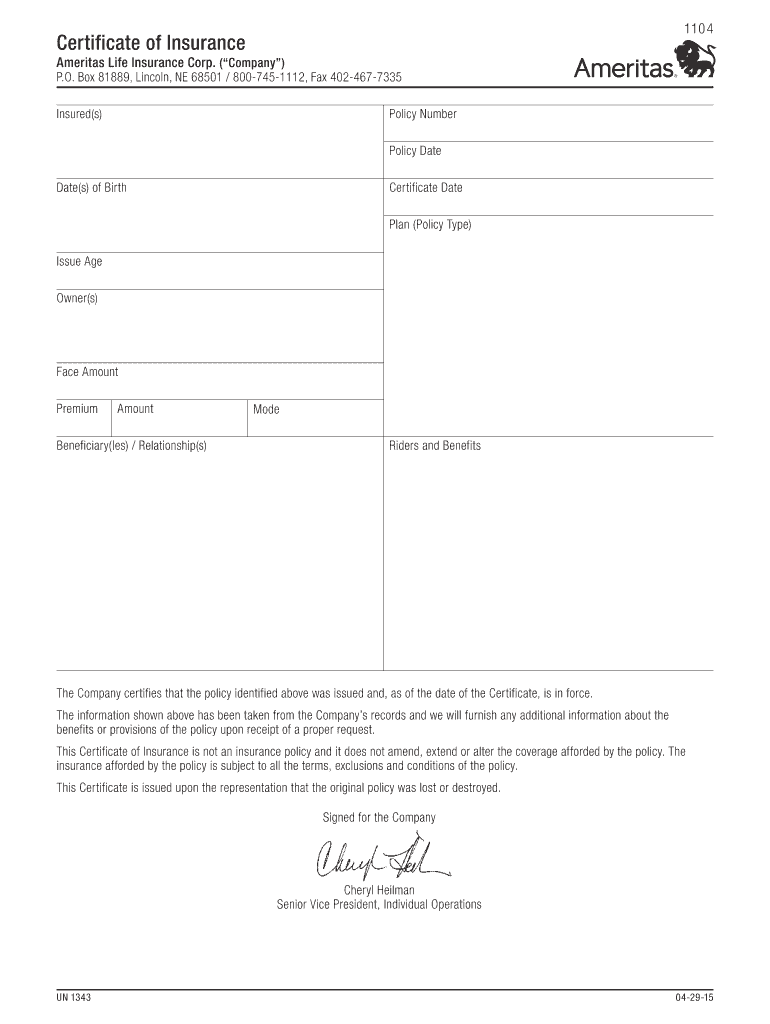

110 4 Certificates of Insurance Americas Life Insurance Corp. (Company) P.O. Box 81889, Lincoln, NE 68501 / 8007451112, Fax 4024677335 Insured(s) Policy Number Policy Date(s) of Birth Certificate

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign bcertificateb of insurance

Edit your bcertificateb of insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bcertificateb of insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit bcertificateb of insurance online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit bcertificateb of insurance. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out bcertificateb of insurance

How to fill out a certificate of insurance:

01

Obtain the appropriate form: Contact your insurance provider or agent to obtain the specific form or template for a certificate of insurance. They can guide you on the required information and any specific format or language requirements.

02

Identify the insured party: Provide the name and address of the individual or organization that needs to be listed as the insured party. This is typically the entity that is requesting proof of insurance coverage.

03

Include the policyholder information: Indicate the name and contact information of the policyholder. This is the individual or organization that holds the insurance policy.

04

Specify the policy details: Include the insurance policy number, effective dates, and expiration dates. This information is crucial for verifying the validity and coverage period of the insurance policy.

05

Outline the coverage types: Clearly state the types of insurance coverage provided by the policy. This may include general liability, property damage, professional liability, or any other specific coverage relevant to the insured party.

06

Provide additional insured information: If required, list any additional parties that need to be included as additional insured on the certificate. This is commonly requested in contracts or agreements where a third party wants to be protected under the policy.

07

Indicate policy limits: Specify the limits of insurance coverage for each type of coverage mentioned. This helps the requesting party understand the extent of protection provided by the insurance policy.

08

Include special endorsements or modifications: If there are any special endorsements, modifications, or exclusions applicable to the policy, make sure to mention them clearly on the certificate of insurance.

09

Obtain signatures and date: Once all the necessary details have been filled out, ensure the certificate is signed and dated by an authorized representative of the insurance company.

Who needs a certificate of insurance:

01

Contractors: Many clients, especially in the construction industry, require contractors to provide a certificate of insurance to demonstrate that they have the necessary coverage to perform the job and protect against any liability.

02

Vendors and suppliers: When working with vendors or suppliers, businesses often request a certificate of insurance to confirm that they have the proper coverage in case any issues arise from the products or services provided.

03

Event organizers: Event organizers may require vendors, performers, or participants to provide a certificate of insurance as proof of liability coverage in case of any accidents or property damage during the event.

04

Landlords: Property owners often require tenants to provide a certificate of insurance showing that they have renters or property insurance to protect against any damages or liability that may occur within the leased premises.

05

Individuals hiring contractors or services: If you are hiring a contractor or service provider for your personal needs, such as home renovations or landscaping, you may want to request a certificate of insurance to ensure they have the appropriate coverage in case of any accidents or property damage.

Remember, the specific requirements for a certificate of insurance may vary depending on the industry, location, and individual circumstances. It's crucial to consult with your insurance provider or agent to ensure you accurately fill out the certificate and provide the required information.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find bcertificateb of insurance?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the bcertificateb of insurance. Open it immediately and start altering it with sophisticated capabilities.

Can I create an electronic signature for signing my bcertificateb of insurance in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your bcertificateb of insurance and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I complete bcertificateb of insurance on an Android device?

On an Android device, use the pdfFiller mobile app to finish your bcertificateb of insurance. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is bcertificateb of insurance?

Certificate of insurance is a document provided by an insurance company as proof that a particular individual or organization has insurance coverage.

Who is required to file bcertificateb of insurance?

Various parties may require a certificate of insurance, including landlords, lenders, contractors, and event organizers.

How to fill out bcertificateb of insurance?

To fill out a certificate of insurance, you will need to provide information about the insured party, the type of insurance coverage, policy limits, and additional insureds.

What is the purpose of bcertificateb of insurance?

The purpose of a certificate of insurance is to provide proof of insurance coverage to third parties who may require verification of coverage.

What information must be reported on bcertificateb of insurance?

The certificate of insurance should include the name of the insured party, the type of insurance coverage, policy limits, effective dates, and any additional insured parties.

Fill out your bcertificateb of insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bcertificateb Of Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.