Get the free 15 Detailed Income Statement

Show details

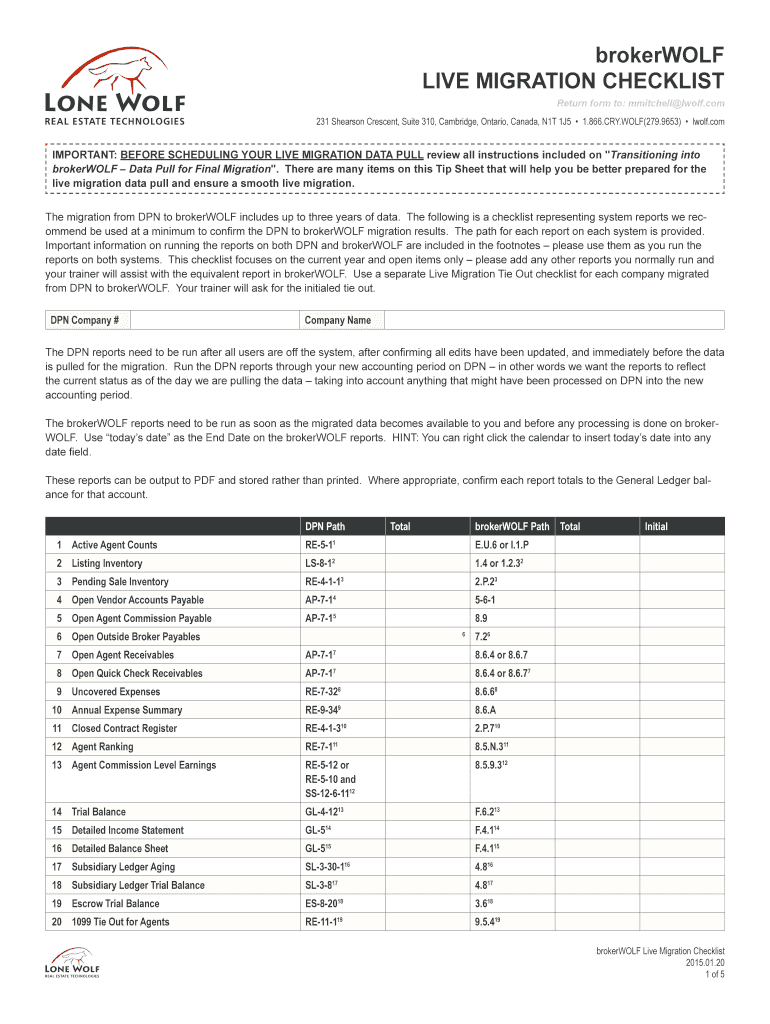

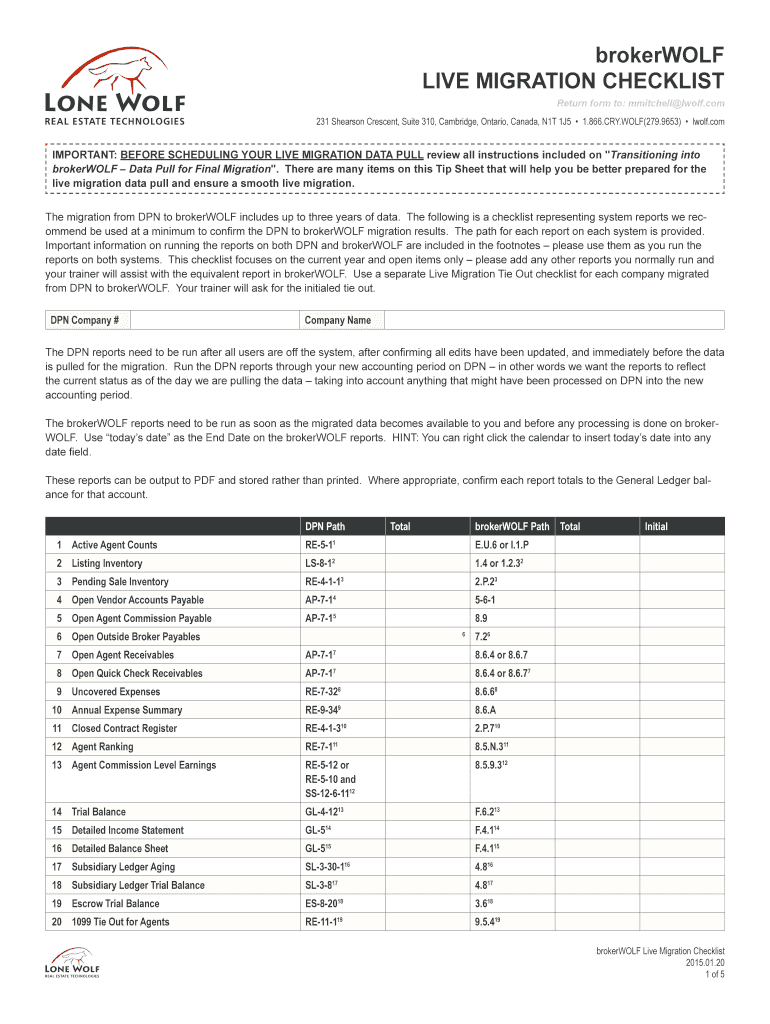

20 Jan 2015 ... 15 Detailed Income Statement. GL-514 ... 31 W2 Earnings ... Start the tie out with the Summary refer to the Detail if the Summary doesn't#39’t tie).

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 15 detailed income statement

Edit your 15 detailed income statement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 15 detailed income statement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 15 detailed income statement online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit 15 detailed income statement. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 15 detailed income statement

How to fill out a 15 detailed income statement:

01

Start by gathering all relevant financial data, such as sales revenue, operating expenses, cost of goods sold, taxes, and any other income or expenses.

02

Organize the income statement into categories, such as revenue, expenses, and net income. Include subcategories within each category to provide more detailed information.

03

Begin with the revenue section, listing all sources of income for the period. This may include sales revenue, interest income, rental income, or any other sources of revenue.

04

Moving on to the expense section, list all costs incurred during the period. This may include expenses such as salaries and wages, rent, utilities, marketing expenses, and any other operating expenses.

05

Ensure all expenses are properly classified and allocated to the appropriate subcategories. This will help provide a clearer picture of where the company's money is being spent.

06

Calculate important financial ratios, such as gross profit margin, operating profit margin, and net profit margin, to analyze the company's financial performance.

07

Include any non-operating income or expenses, such as gains or losses from investments or other activities outside the regular course of business.

08

Deduct taxes from the net income to arrive at the final net profit or loss.

09

Ensure all calculations are accurate and that the income statement balances.

10

Prepare a detailed report explaining the findings of the income statement and any significant trends or changes.

Who needs a 15 detailed income statement:

01

Small business owners: A detailed income statement can provide valuable insights into the financial health of the business and help make informed decisions.

02

Accountants: Professionals in the accounting field often require detailed income statements to analyze a company's financial performance and determine its profitability.

03

Investors: Potential investors may request a detailed income statement to assess the financial viability of a company before making investment decisions.

04

Financial analysts: Analysts use income statements to evaluate a company's financial health, compare it to industry benchmarks, and make recommendations to clients or stakeholders.

05

Banks and lenders: When evaluating loan applications or creditworthiness, banks and lenders may require a detailed income statement to assess the borrower's ability to repay the debt.

06

Government agencies: Tax authorities and regulatory bodies may request detailed income statements to verify compliance with tax laws or industry regulations.

07

Internal stakeholders: CEOs, business managers, and board members rely on detailed income statements to assess business performance, identify areas for improvement, and make strategic decisions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit 15 detailed income statement straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing 15 detailed income statement right away.

Can I edit 15 detailed income statement on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign 15 detailed income statement on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

How do I complete 15 detailed income statement on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your 15 detailed income statement. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is 15 detailed income statement?

15 detailed income statement is a financial document that provides a detailed breakdown of an individual or organization's income, expenses, and profits over a specific period of time.

Who is required to file 15 detailed income statement?

Individuals or organizations who have income that falls within certain thresholds set by the tax authorities are required to file 15 detailed income statement.

How to fill out 15 detailed income statement?

To fill out 15 detailed income statement, one must gather all income and expense information, calculate net income, and report the information accurately on the form provided by the tax authorities.

What is the purpose of 15 detailed income statement?

The purpose of 15 detailed income statement is to provide a clear and accurate overview of an individual or organization's financial performance during a specific period.

What information must be reported on 15 detailed income statement?

On 15 detailed income statement, one must report all sources of income, including wages, investments, and any other sources, as well as expenses such as rent, utilities, and other business-related costs.

Fill out your 15 detailed income statement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

15 Detailed Income Statement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.