Get the free Erklrung zu den vom LfA gewhrten Ersatzleistungen Muster 74bis Hinterbliebenenpensio...

Show details

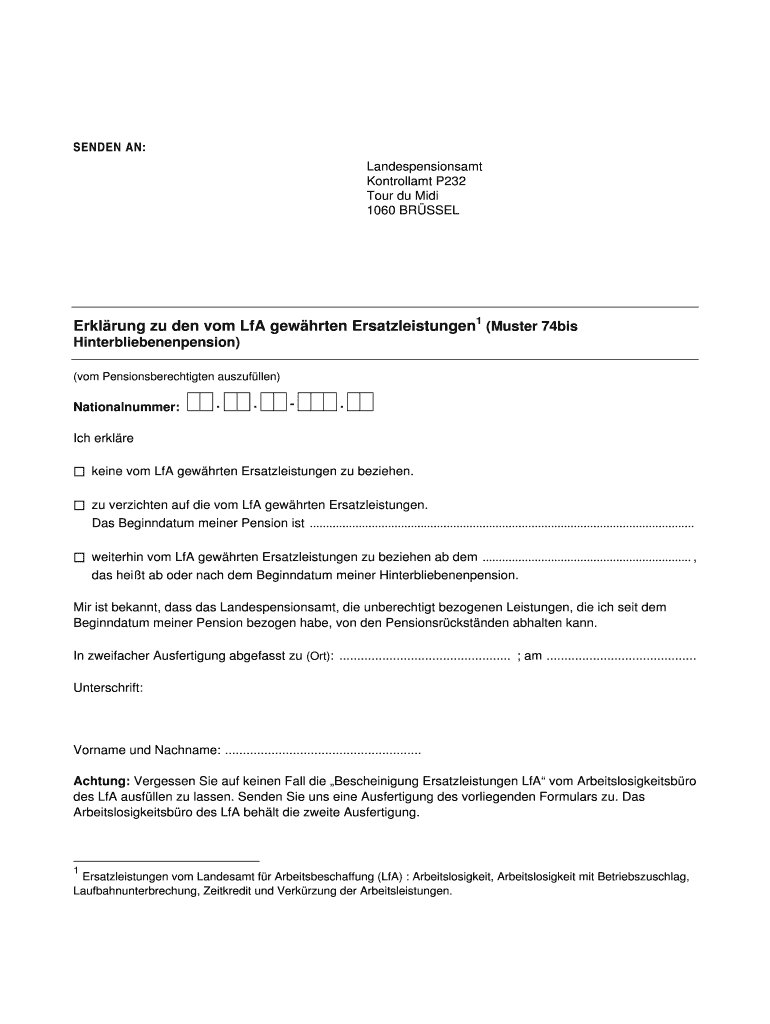

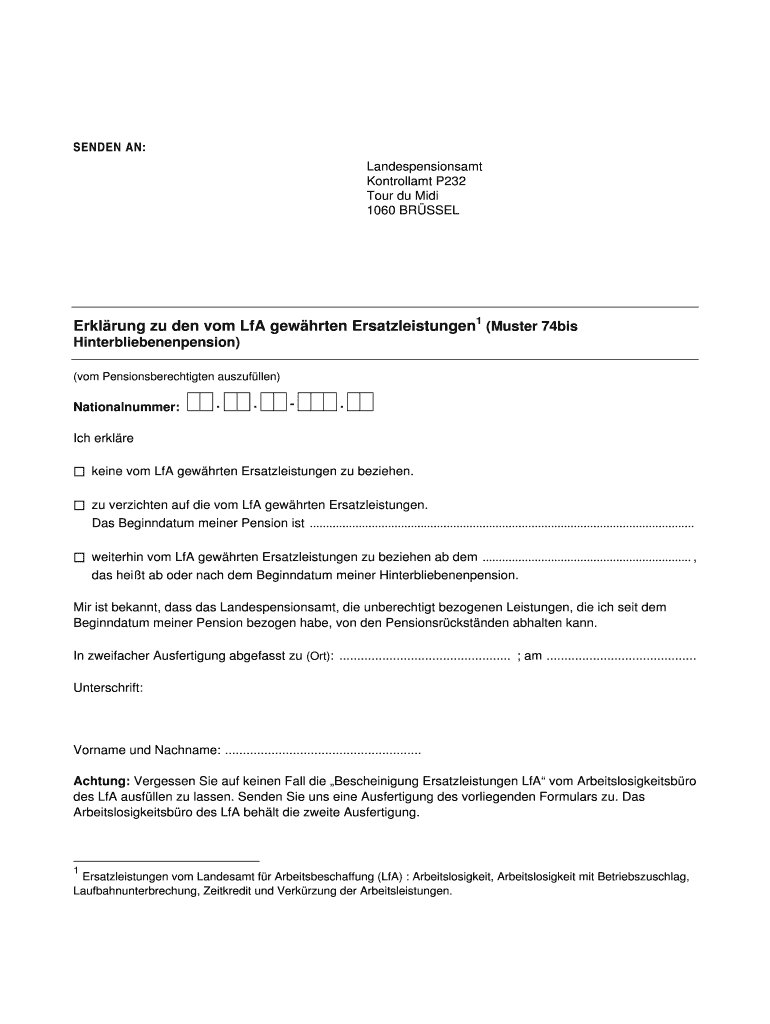

SENDER AN: Landespensionsamt Kontrollamt P232 Tour du Midi 1060 BRS SEL ERK rung EU den com LA good hr ten Ersatzleistungen1 (Muster 74bis Hinterbliebenenpension)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign erklrung zu den vom

Edit your erklrung zu den vom form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your erklrung zu den vom form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing erklrung zu den vom online

In order to make advantage of the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit erklrung zu den vom. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out erklrung zu den vom

01

To fill out "Erklärung zu den VOM" (Declaration regarding the VOM), you will need the following information and documents:

1.1

Personal information: Provide your full name, address, date of birth, and identification number (if applicable).

1.2

Purpose of the declaration: State the reason for filling out this form, whether it is for employment, residency, or any other specific purpose.

1.3

Relevant dates: Mention the period for which the declaration is valid or applicable.

1.4

Supporting documents: Attach any necessary supporting documents that are required for this declaration, such as employment contracts, tenancy agreements, or other relevant paperwork.

02

Individuals who are applying for a job or seeking employment may need to fill out the "Erklärung zu den VOM" form. This declaration helps employers and organizations verify the accuracy of information provided by applicants and ensures compliance with applicable laws and regulations.

03

Individuals who are applying for a residence permit or visa may also need to fill out the "Erklärung zu den VOM" form. This declaration is often required by immigration authorities to confirm the legitimacy of the applicant's residency or visa application.

04

Landlords may require tenants to fill out the "Erklärung zu den VOM" form to declare their income, previous rental history, or any other relevant information needed for renting a property.

05

Government agencies or institutions may request individuals to fill out the "Erklärung zu den VOM" form for various purposes, such as eligibility for social benefits, tax obligations, or declaration of income.

06

It is important to carefully read the instructions provided with the "Erklärung zu den VOM" form and ensure that all required fields are completed accurately and truthfully. Any false or misleading information provided in this declaration could lead to legal consequences.

07

It is advisable to keep a copy of the filled-out "Erklärung zu den VOM" form and any attached supporting documents for your records. These documents may be needed for future reference or in case of any discrepancies or audits.

Overall, the "Erklärung zu den VOM" form is used in various situations where it is necessary to provide a declaration regarding specific information or circumstances. It is important to follow the guidelines and accurately fill out the form to meet the requirements of the requesting entity or authority.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send erklrung zu den vom for eSignature?

Once your erklrung zu den vom is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

Where do I find erklrung zu den vom?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific erklrung zu den vom and other forms. Find the template you need and change it using powerful tools.

How do I edit erklrung zu den vom on an iOS device?

Create, modify, and share erklrung zu den vom using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

What is erklrung zu den vom?

Erklrung zu den vom is a German term which translates to 'explanation of the expenses' in English.

Who is required to file erklrung zu den vom?

Individuals or entities who have incurred expenses that need to be reported for tax purposes are required to file erklrung zu den vom.

How to fill out erklrung zu den vom?

Erklrung zu den vom is typically filled out by providing details of the expenses incurred, including the nature of the expense, amount spent, and the date of expenditure.

What is the purpose of erklrung zu den vom?

The purpose of erklrung zu den vom is to provide a detailed explanation of expenses incurred by an individual or entity for tax reporting purposes.

What information must be reported on erklrung zu den vom?

The information that must be reported on erklrung zu den vom includes details of expenses incurred, such as the nature of the expense, amount spent, and the date of expenditure.

Fill out your erklrung zu den vom online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Erklrung Zu Den Vom is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.