Get the free dr 0563 - 66 101 206

Show details

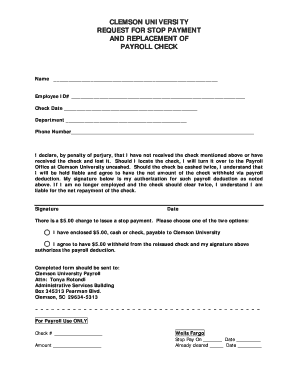

DR 0563 (01/05/04) COLORADO DEPARTMENT OF REVENUE 1375 SHERMAN STREET DENVER COLORADO 80261 SALES TAX EXEMPTION CERTIFICATE MULTI — JURISDICTION See reverse side for instructions. Issued to (Seller)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign dr 0563 - 66

Edit your dr 0563 - 66 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your dr 0563 - 66 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing dr 0563 - 66 online

Follow the steps down below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit dr 0563 - 66. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out dr 0563 - 66

How to fill out the DR 0563:

01

Start by entering your personal information, such as your name, address, and contact details, in the designated fields on the form.

02

Next, provide any relevant identification numbers, such as your social security number or driver's license number.

03

Proceed to fill out the form's sections or boxes according to the instructions given. Be sure to follow any specific guidelines or requirements mentioned.

04

Double-check all the information you have entered to ensure its accuracy and correctness.

05

Finally, sign and date the form in the appropriate space provided.

Who needs the DR 0563:

01

The DR 0563 form is required for individuals who are involved in certain legal proceedings, such as court cases or legal claims.

02

It may also be necessary for individuals who are applying for specific permits or licenses, as determined by the governing body or authority.

03

Additionally, anyone who is required to report certain information to the relevant authorities may need to use the DR 0563 form.

Fill

form

: Try Risk Free

People Also Ask about

Who is exempt from Colorado state tax?

Colorado statute exempts from state and state-collected sales tax all sales to the United States government and the state of Colorado, its departments and institutions, and its political subdivisions (county and local governments, school districts and special districts) in their governmental capacities only (§39-26-

Who has to pay Colorado state income tax?

Colorado imposes a tax on the income of every Colorado resident individual. Colorado income tax also applies to the Colorado-source income of any nonresident individual.

Is a sales tax license the same as a resale certificate in Colorado?

The Colorado sales tax license (in other parts of the country, may be called a reseller's license, a vendor's license or a resale certificate) is for state and state-administered sales and use taxes.

Who is exempt from Colorado state income tax?

Colorado charges the same income tax rate for its residents regardless of how much you make. The standard deduction in Colorado is $12,550 for single taxpayers and $25,100 for married filers. The state does not have personal exemptions.

How do I get agricultural tax exemption in Colorado?

To qualify for the exemption, purchasers must present an Affidavit for Colorado Sales Tax Exemption for Farm Equipment (Form DR 0511) to vendors stating that they meet the qualifications for the exemption.

What is a sales tax exemption certificate in Colorado?

Standard Colorado Affidavit of Exempt Sale This form is required by the State of Colorado for any transaction on which an exemption from state tax is claimed for charitable and government entities. The seller is required to maintain a completed form for each tax-exempt sale.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my dr 0563 - 66 directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your dr 0563 - 66 and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

Can I create an eSignature for the dr 0563 - 66 in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your dr 0563 - 66 directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I complete dr 0563 - 66 on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your dr 0563 - 66. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is dr 0563?

DR 0563 is a form used for reporting certain information to the relevant authority.

Who is required to file dr 0563?

Entities or individuals specified by the authority are required to file DR 0563.

How to fill out dr 0563?

DR 0563 can be filled out by providing the requested information in the designated fields of the form.

What is the purpose of dr 0563?

The purpose of DR 0563 is to collect specific data for regulatory or compliance reasons.

What information must be reported on dr 0563?

DR 0563 typically requires information such as name, address, financial data, and other relevant details.

Fill out your dr 0563 - 66 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Dr 0563 - 66 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.