Get the free Gift Aid declaration for past, present & future ... - Ministry at Work - ministr...

Show details

Edinburgh House, Harding Road, Stoke-on-Trent, ST1 3AE Charity No. 1154061 Gift Aid declaration for past, present & future donations Please treat as Gift Aid donations all qualifying gifts of money

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign gift aid declaration for

Edit your gift aid declaration for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gift aid declaration for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit gift aid declaration for online

Follow the steps down below to use a professional PDF editor:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit gift aid declaration for. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out gift aid declaration for

How to fill out gift aid declaration for:

01

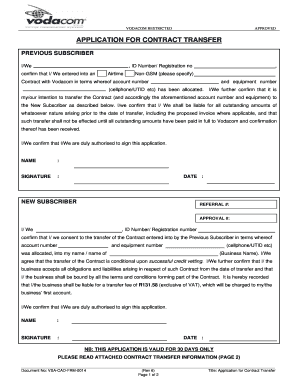

Obtain the gift aid declaration form from the organization: Contact the organization or visit their website to request a gift aid declaration form. They may provide a physical copy or an online version that can be downloaded.

02

Provide personal information: Fill out your personal details accurately. This would typically include your full name, address, and postal code. Make sure to double-check the information for any errors.

03

Confirm your eligibility: Before signing the declaration, make sure you are eligible for gift aid. Generally, this means you must be a UK taxpayer and have paid sufficient income or capital gains tax to cover the amount being reclaimed.

04

Confirm your donation details: Specify the details of your donation, such as the date, amount, and purpose. This information helps the organization identify your contribution correctly.

05

Tick the relevant boxes: Ensure that you tick the appropriate boxes confirming that you understand the declaration's terms and conditions. Read through the declaration carefully to comprehend your responsibilities and rights.

06

Sign and date the form: After completing all the necessary sections, sign and date the gift aid declaration form. By doing so, you are confirming the accuracy of the information provided and giving permission for the organization to claim gift aid on your donations.

Who needs gift aid declaration for:

01

Individuals making charitable donations: Anyone making a donation to a UK charity or community amateur sports club (CASC) can complete a gift aid declaration. This declaration allows the organization to claim an additional 25% on top of the donation amount from the UK government.

02

UK taxpayers: To qualify for gift aid, you must be a UK taxpayer. This means that you should have paid income tax or capital gains tax equal to or exceeding the amount the organization will be reclaiming through gift aid.

03

Donors seeking to maximize their support: By completing a gift aid declaration, donors can significantly increase the value of their donations. The additional funding obtained through the gift aid scheme can have a substantial impact on the organization's activities and the causes they support.

Remember, it's important to keep a record of your gift aid declarations and donations for your own reference and to ensure accuracy in case of any audits or queries from HM Revenue and Customs (HMRC).

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is gift aid declaration for?

Gift aid declaration is a way for charities or community amateur sports clubs (CASCs) to claim an extra 25p for every £1 donated by UK taxpayers.

Who is required to file gift aid declaration for?

Individuals who have paid enough tax (Income Tax or Capital Gains Tax) to cover the amount that charities will claim in Gift Aid.

How to fill out gift aid declaration for?

Gift Aid declarations can usually be done online through the charity's website or by filling out a form provided by the charity.

What is the purpose of gift aid declaration for?

The purpose of gift aid declaration is to enable charities to claim 25% extra on donations made by UK taxpayers.

What information must be reported on gift aid declaration for?

Personal details such as name, address, and confirmation that the individual is a UK taxpayer and has paid enough tax to cover the Gift Aid claimed.

Where do I find gift aid declaration for?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific gift aid declaration for and other forms. Find the template you need and change it using powerful tools.

Can I edit gift aid declaration for on an Android device?

You can make any changes to PDF files, like gift aid declaration for, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

How do I fill out gift aid declaration for on an Android device?

Use the pdfFiller mobile app and complete your gift aid declaration for and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

Fill out your gift aid declaration for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Gift Aid Declaration For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.