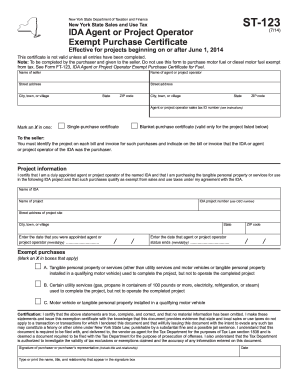

NY ST-123 2014 free printable template

Get, Create, Make and Sign NY ST-123

How to edit NY ST-123 online

Uncompromising security for your PDF editing and eSignature needs

NY ST-123 Form Versions

How to fill out NY ST-123

How to fill out NY ST-123

Who needs NY ST-123?

Instructions and Help about NY ST-123

Before you begin business in New York State there are certain things you need to know about your sales tax responsibilities for example anyone who plans to sell taxable goods or services in New York State must register as a sales tax vendor with the tax department at least 20 days before beginning business once registered you will receive a certificate of authority to collect sales tax you will then be responsible for collecting sales tax from your customers and forwarding the tax to the tax department you must never use the sales tax you collect to pay off business or personal expenses to avoid this we recommend that you maintain a separate bank account for your sales tax receipts this will ensure that you're able to pay the sales tax when do you must also begin filing sales tax returns even if you've not made any sales or begun business it's important that you file and pay the sales tax on time you must file a sales tax return by its due date even if you have no tax due, or you may be charged a penalty for late filing good record-keeping is essential for any business and as a sales tax vendor you must keep accurate records of all sales and purchases that you make keeping detailed records of your business operation will help you prepare accurate and complete sales tax returns in the event of an audit you will be asked to produce these records to verify the accuracy of your returns it's important that you know the tax ability of your sales so if you're uncertain of your sales tax obligations you should consult the tax professional if you don't collect sales tax on sales that are taxable you may be responsible for paying those taxes yourself an easy way to manage many of your sales tax responsibilities is with an online service account with an online service account you can web file sales tax returns make payments receive email notifications and view and pay tax bills if you plan on taking over an existing business be sure to check out our buying a business web page to learn more about your sales tax responsibilities and to create an online service account visit us today at with in guv

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send NY ST-123 to be eSigned by others?

Can I create an electronic signature for the NY ST-123 in Chrome?

How can I fill out NY ST-123 on an iOS device?

What is NY ST-123?

Who is required to file NY ST-123?

How to fill out NY ST-123?

What is the purpose of NY ST-123?

What information must be reported on NY ST-123?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.