Get the free APPLICATION FOR BUSINESS CREDIT - bIDb bEnhancementsb

Show details

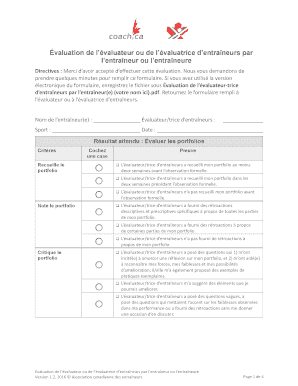

APPLICATION FOR BUSINESS CREDIT WITH ID Enhancements, Inc. P O BOX 1557, Huntsville, SC 29551 Tel No. (843) 3323707 Fax No. (843) 3324866 DATE: BUSINESS INFORMATIONMUST BE COMPLETED Bill To: NAME:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for business credit

Edit your application for business credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for business credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit application for business credit online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit application for business credit. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for business credit

How to fill out an application for business credit:

01

Gather all necessary information: Before starting the application, make sure you have all the required information ready. This may include your business's legal name, address, tax identification number, financial statements, and other relevant documents.

02

Research and choose a suitable lender: It's essential to choose a reputable lender that offers business credit. Research different lenders and compare their terms, interest rates, and credit requirements. Select the one that best fits your business needs.

03

Start the application process: Visit the lender's website or go to their physical location to begin the application process. Look for the section or link that specifically mentions business credit applications.

04

Provide basic information: The application will require you to provide basic information about your business. This may include its legal structure (sole proprietorship, partnership, corporation, etc.), industry type, number of employees, and years in operation.

05

Submit financial information: To assess your creditworthiness, the lender will ask for financial details about your business. This will typically include your business's annual revenue, profit/loss statements, balance sheet, and cash flow projections. Be prepared to provide accurate and up-to-date financial information.

06

Personal credit information: In some cases, the lender may also require personal credit information from the business owner or primary stakeholders. This is to evaluate the creditworthiness of the individuals associated with the business.

07

Provide collateral information (if required): Depending on the lender and the loan amount, you may be asked to provide collateral to secure the credit. Collateral can be assets like real estate, inventory, or equipment. Provide detailed information about the collateral you are willing to offer.

08

Business plan and purpose of credit: Some lenders may ask for a business plan or a description of how you plan to use the credit. Be prepared to explain how the credit will benefit your business and contribute to its growth.

09

Review and double-check: Before submitting the application, review all the information you have provided thoroughly. Double-check for accuracy and completeness. Any errors or missing information could delay the approval process.

10

Submit the application: After ensuring everything is accurate and complete, submit the application as per the lender's instructions. Some lenders allow online submissions, while others may require physical copies. Follow the provided guidelines carefully.

Who needs an application for business credit?

Business owners or entrepreneurs who need financial assistance to support their business operations, expansion, purchase inventory, invest in new equipment, or manage cash flow may need to fill out an application for business credit. This could include startups, small businesses, established companies, or even freelance/self-employed individuals looking to establish credit for their business. Whether you require a short-term loan, a line of credit, or a business credit card, applying for business credit can provide the necessary funds to meet your business's financial goals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send application for business credit to be eSigned by others?

When you're ready to share your application for business credit, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I fill out application for business credit using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign application for business credit and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

Can I edit application for business credit on an iOS device?

Create, modify, and share application for business credit using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

Fill out your application for business credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Business Credit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.