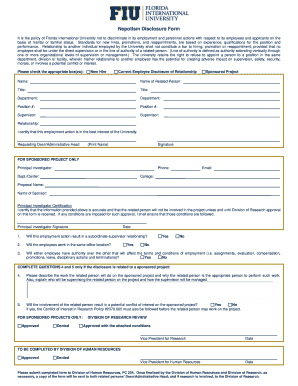

Get the free life insurance form

Show details

Life Insurance Underwriting Guide Product issued by National Life Insurance Company Last Updated February 2012 30% For Agent Use Only Not For Use With The Public 60111 MK1200(0212) TC66099(0212) Our

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign life insurance form

Edit your life insurance form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your life insurance form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing life insurance form online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit life insurance form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

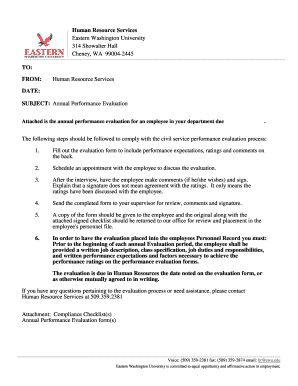

How to fill out life insurance form

How to fill out a life insurance form?

01

Start by gathering personal information: Begin by filling out the personal details section of the form, including your full name, date of birth, address, contact information, and social security number.

02

Provide information about your health: Life insurance companies require information about your health to assess the risk involved. Answer questions about your medical history, any existing medical conditions, medications you are currently taking, and any past surgeries or treatments. Be honest and accurate while providing this information.

03

Disclose your lifestyle habits: Some life insurance forms may ask about your lifestyle choices, such as smoking, drinking, or engaging in any high-risk activities. Be transparent and provide complete information to avoid any discrepancies later.

04

Determine the coverage amount: Decide the amount of life insurance coverage you need based on your financial obligations, such as mortgage payments, outstanding debts, and future financial goals. If you are unsure about the coverage amount, consider consulting with a financial advisor.

05

Choose a beneficiary: A beneficiary is the person or entity who will receive the life insurance benefits upon your passing. Specify the beneficiary's name, relationship to you, and their contact information. You can choose multiple beneficiaries and assign a percentage of the benefits to each.

06

Review and sign the form: Once you have filled out all the necessary sections of the form, carefully review the information to ensure its accuracy. Check for any missing or incomplete sections and make corrections as needed. Finally, sign the form and date it to validate your submission.

Who needs a life insurance form?

01

Individuals seeking financial protection: Life insurance forms are necessary for individuals who want to secure financial protection for their loved ones in the event of their death. It helps ensure that the beneficiaries are financially supported and can cover expenses such as mortgage payments, outstanding debts, education costs, and daily living expenses.

02

Young parents or families with dependents: Life insurance forms are particularly important for young parents or families with dependents who rely on their income. This form of insurance can provide a safety net, ensuring that the financial needs of children or dependents are met even if the breadwinner passes away.

03

Individuals with financial obligations: If you have outstanding debts, such as a mortgage, car loan, or other loans, a life insurance form can protect your loved ones from inheriting these financial obligations. The proceeds from the life insurance policy can be used to pay off debts, preventing the burden from falling on your family.

04

Business owners or partners: Life insurance forms are also essential for business owners or partners. It can protect the business in the event of the death of a key employee or partner, providing funds to cover lost income, assist with business continuity, or facilitate a smooth transition of ownership.

05

Individuals with estate planning needs: Life insurance forms are commonly used in estate planning to ensure a smooth transfer of wealth to beneficiaries. This can help cover estate taxes, funeral expenses, or provide financial support to loved ones.

Remember, it is always recommended to consult with a qualified insurance agent or financial advisor who can guide you in filling out the life insurance form accurately and help you choose the best policy that aligns with your needs and goals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is life insurance form?

Life insurance form is a document that individuals fill out to apply for a life insurance policy.

Who is required to file life insurance form?

Any individual looking to purchase a life insurance policy is required to fill out a life insurance form.

How to fill out life insurance form?

To fill out a life insurance form, individuals need to provide personal information, medical history, and details about the desired coverage.

What is the purpose of life insurance form?

The purpose of a life insurance form is to assess the risk level of the individual applying for the policy and determine the premium amount.

What information must be reported on life insurance form?

Personal details, medical history, lifestyle habits, and desired coverage amount must be reported on a life insurance form.

How can I edit life insurance form from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including life insurance form. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I edit life insurance form online?

With pdfFiller, the editing process is straightforward. Open your life insurance form in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Can I edit life insurance form on an Android device?

You can make any changes to PDF files, like life insurance form, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

Fill out your life insurance form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Life Insurance Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.