MUIH Individual Course(s) Withdrawal Request Form 2014-2025 free printable template

Get, Create, Make and Sign muih form

Editing MUIH Individual Courses Withdrawal Request Form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out MUIH Individual Courses Withdrawal Request Form

How to fill out MUIH Individual Course(s) Withdrawal Request Form

Who needs MUIH Individual Course(s) Withdrawal Request Form?

Video instructions and help with filling out and completing individual withdrawal request form

Instructions and Help about MUIH Individual Courses Withdrawal Request Form

Laws calm legal forms guide form 5498 is a United States internal revenue service tax form filed by financial institutions to report individual retirement account information the form is reported yearly and indicates that the taxpayer is in a qualified IRA and the amounts reported are confirmed a form 5498 can be obtained through the IRS's website or by obtaining the documents through a local tax office the form has three copies the red copy is to be sent to the IRS for electronic filing the remaining copies are to be retained by the financial institution and to be sent to the IRA account holder for their records first the financial institution that manages the IRA must provide their name and address in the upper left box the institution must also provide their taxpayer identification number indicate the taxpayers name and social security number in the left boxes also providing their current address in box one indicate the total amount contributed to the taxpayers IRA during the tax year if there are any rollover contributions indicate so in box to enter any Roth IRA conversion amounts or recharacterized contributions in boxes three and four in box five indicate the current fair market value of the IRA if any life insurance amounts are included in the total contributions indicate this amount in box six if the taxpayer has any SCP contributions simple contributions or Roth IRA contributions enter the amounts in the corresponding boxes enter the RED date and amount in box 12 if any postponed contributions have been made enter the total amount in box 13 enter any repayment in box 14 once completed the form 5498 must be filed with the IRS a copy must be retained by the financial institution and a copy sent to the taxpayer to watch more videos please make sure to visit laws calm

People Also Ask about

What is the 5 year rule for Social Security disability?

What is a SSA 521 form?

How do I stop SSA benefits after death?

Can I pull money from my Social Security?

What is a withdrawal form?

Why would someone withdraw their Social Security application?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in MUIH Individual Courses Withdrawal Request Form?

Can I create an electronic signature for signing my MUIH Individual Courses Withdrawal Request Form in Gmail?

How do I fill out MUIH Individual Courses Withdrawal Request Form using my mobile device?

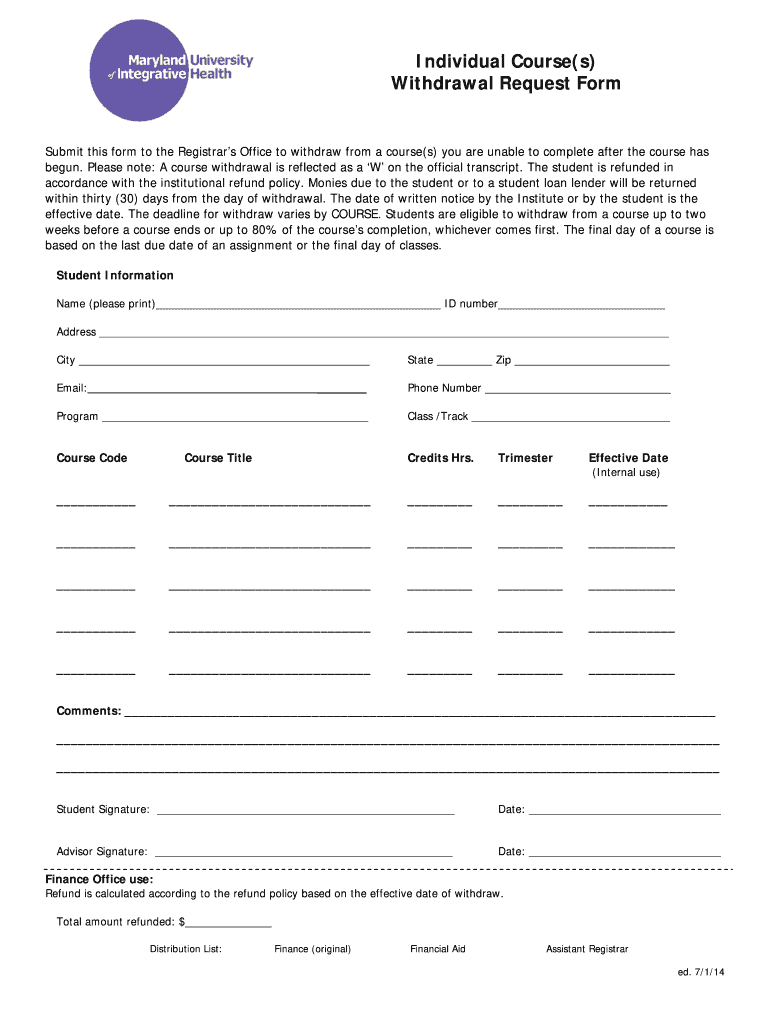

What is MUIH Individual Course(s) Withdrawal Request Form?

Who is required to file MUIH Individual Course(s) Withdrawal Request Form?

How to fill out MUIH Individual Course(s) Withdrawal Request Form?

What is the purpose of MUIH Individual Course(s) Withdrawal Request Form?

What information must be reported on MUIH Individual Course(s) Withdrawal Request Form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.