Get the free Individual Term Life Insurance Application Package

Show details

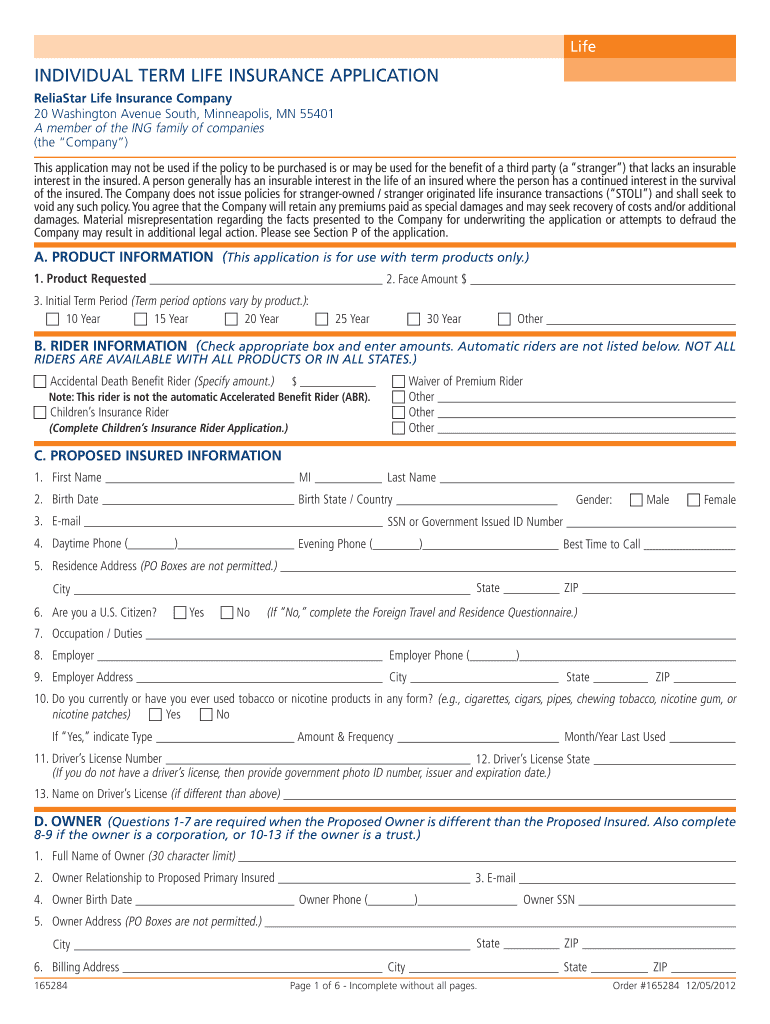

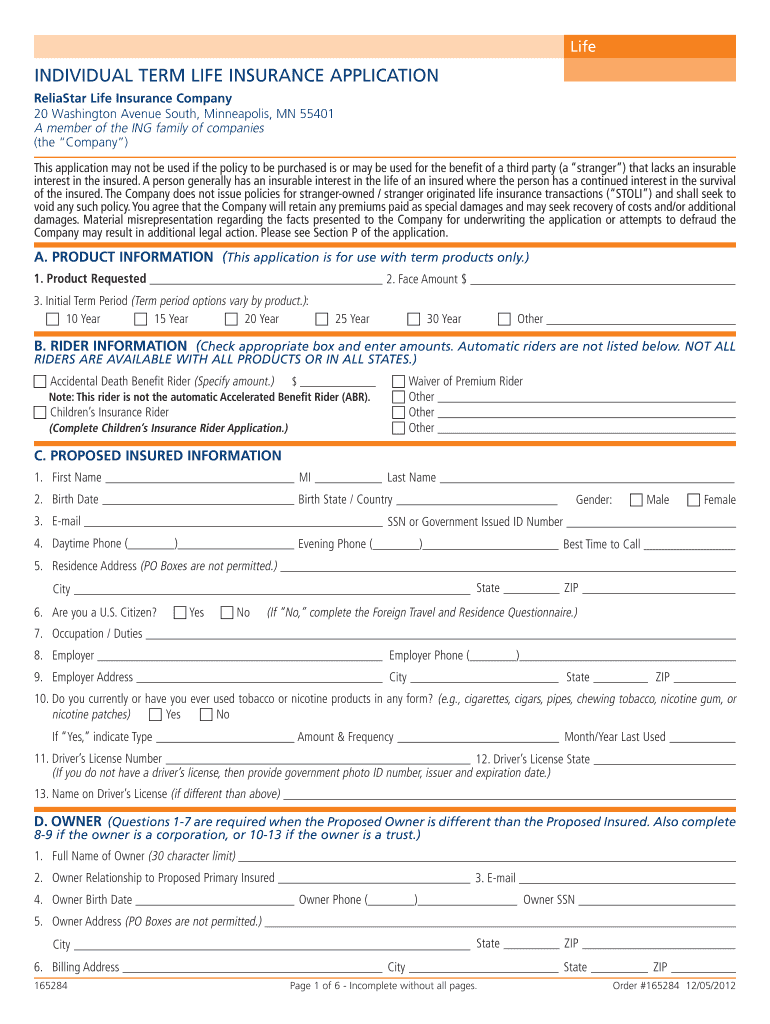

Register Life Insurance Company A member of the ING family of companies Individual Term Life Insurance Application Package Term Products For your convenience, this Application Package contains 8 forms:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign individual term life insurance

Edit your individual term life insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your individual term life insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing individual term life insurance online

Follow the steps below to take advantage of the professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit individual term life insurance. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out individual term life insurance

How to fill out individual term life insurance:

01

Start by researching different insurance providers to find the one that offers the best coverage and rates for your specific needs. You can do this by comparing quotes online or contacting insurance agents directly.

02

Gather all necessary information, such as your personal details, financial information, and any relevant medical history. This will be required when filling out the application for individual term life insurance.

03

Fill out the application form accurately and completely. Make sure to provide all requested information and double-check for any errors or missing details. Be honest about your medical history and any pre-existing conditions, as this can affect your coverage and premiums.

04

Consider adding any optional riders or additional coverage options that may be available. These can provide extra benefits, such as coverage for critical illnesses or disabilities, that may be useful depending on your individual needs and circumstances.

05

Review the terms and conditions of the policy carefully before submitting the application. Make sure you understand the coverage limits, premium payment schedule, and any other important details. If you have any questions or concerns, don't hesitate to reach out to the insurance provider for clarification.

06

Once the application is complete, submit it to the insurance provider along with any required supporting documents, such as proof of identity or medical records. Some providers may require a medical exam or require you to undergo certain tests before finalizing the policy, so be prepared for that if necessary.

07

After the application is submitted, wait for the insurance provider to review and process it. This may take some time, so be patient. If any additional information or documents are required, make sure to provide them promptly to avoid any delays.

Who needs individual term life insurance:

01

Individuals who have dependents or financial obligations, such as a mortgage or outstanding debts, may benefit from individual term life insurance. It provides financial protection for your loved ones in the event of your untimely death, helping to cover expenses and maintain their quality of life.

02

Those who do not have substantial savings or assets to leave behind can use individual term life insurance as a way to provide their family with financial security and stability after they are gone.

03

Individuals who have specific financial goals, such as ensuring their children's education or supporting their spouse's retirement, can use individual term life insurance as a means to achieve those goals even if they are no longer around.

04

Young, healthy individuals can benefit from individual term life insurance as it is typically more affordable compared to other types of life insurance policies. It allows them to secure coverage for a specific term, such as until their children are grown or their mortgage is paid off, without breaking the bank.

05

Self-employed individuals or those without access to employer-sponsored life insurance policies should consider individual term life insurance to protect their loved ones' financial well-being in case of their death.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find individual term life insurance?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the individual term life insurance in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I fill out the individual term life insurance form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign individual term life insurance and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

Can I edit individual term life insurance on an Android device?

You can make any changes to PDF files, like individual term life insurance, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is individual term life insurance?

Individual term life insurance is a type of life insurance that provides coverage for a specified term or period of time.

Who is required to file individual term life insurance?

Individuals who are looking to protect their loved ones financially in the event of their death are required to file individual term life insurance.

How to fill out individual term life insurance?

Individuals can fill out individual term life insurance by contacting an insurance provider, providing necessary personal information, and selecting a coverage amount and term length.

What is the purpose of individual term life insurance?

The purpose of individual term life insurance is to provide financial protection for the policyholder's beneficiaries in the event of their death.

What information must be reported on individual term life insurance?

Information such as the policyholder's personal details, coverage amount, beneficiaries, and term length must be reported on individual term life insurance.

Fill out your individual term life insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Individual Term Life Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.