Get the free Requirements for Bank Owned or HUD. Listing Transfer Authorization Form

Show details

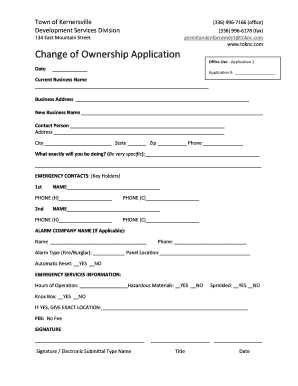

Requirements for Bank Owned or HUD

1. Transaction Management New File Request (found at Zipformsonline.com)

2. State contract (Purchase Contract) or HUD contract

3. Agency addendum

4. AS-IS addendum

5.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign requirements for bank owned

Edit your requirements for bank owned form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your requirements for bank owned form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing requirements for bank owned online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit requirements for bank owned. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out requirements for bank owned

How to fill out requirements for bank owned?

01

Understand the specific requirements: Start by thoroughly reading and understanding the requirements provided by the bank for the property to be owned. This may include documentation, financial information, and other relevant details. Take note of any deadlines or specific formats required for submission.

02

Gather necessary documents: Collect all the required documents and ensure they are accurate and up to date. This may include bank statements, tax returns, pay stubs, identification documents, property documents, and any other relevant paperwork.

03

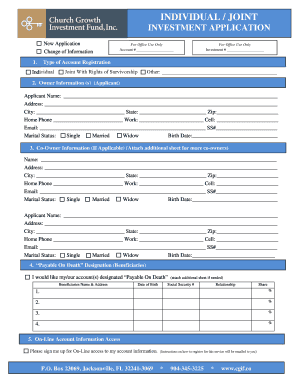

Complete the application forms: Fill out the application forms provided by the bank for acquiring the property. Provide accurate and truthful information, double-checking for any errors or missing information. Include any additional documents or explanations that may be required.

04

Prepare a financial statement: Banks typically require potential buyers to provide a financial statement, which outlines their income, expenses, assets, and liabilities. Make sure to accurately represent your financial situation and provide any supporting documents requested by the bank.

05

Consult with professionals if needed: If you have any doubts or uncertainties about the requirements or application process, consider consulting with professionals like real estate agents, attorneys, or financial advisors. They can provide guidance and ensure that you are filling out the requirements correctly.

Who needs requirements for bank owned?

01

Potential buyers: Individuals or companies interested in purchasing bank-owned properties need to fulfill the specific requirements set by the bank. These requirements ensure that the buyer meets the necessary criteria and can complete the transaction successfully.

02

Banks or financial institutions: The requirements for bank-owned properties are set by the financial institutions that own the properties. These requirements serve to protect the bank's interests, ensure proper documentation, and verify the qualifications of potential buyers.

03

Real estate agents: Real estate agents representing buyers or sellers of bank-owned properties should also be aware of the requirements involved. They play a crucial role in guiding their clients through the process and ensuring all necessary requirements are met for a successful transaction.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify requirements for bank owned without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including requirements for bank owned. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I execute requirements for bank owned online?

With pdfFiller, you may easily complete and sign requirements for bank owned online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I make edits in requirements for bank owned without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit requirements for bank owned and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

What is requirements for bank owned?

The requirements for bank owned include documentation related to the ownership, management, and operation of a bank.

Who is required to file requirements for bank owned?

Banks are required to file requirements for bank owned with the appropriate regulatory authorities.

How to fill out requirements for bank owned?

Requirements for bank owned can be filled out by providing the necessary information and documentation as requested by regulatory authorities.

What is the purpose of requirements for bank owned?

The purpose of requirements for bank owned is to ensure transparency and compliance with regulations in the banking sector.

What information must be reported on requirements for bank owned?

Information such as ownership structure, financial statements, management team details, and operational procedures must be reported on requirements for bank owned.

Fill out your requirements for bank owned online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Requirements For Bank Owned is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.