Get the free Mutual Funds. An Introduction to the Core Concepts - Research and ...

Show details

Brochure More information from http://www.researchandmarkets.com/reports/2244189/ Mutual Funds. An Introduction to the Core Concepts Description: Each book in the series cuts through the jargon and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mutual funds an introduction

Edit your mutual funds an introduction form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mutual funds an introduction form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mutual funds an introduction online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit mutual funds an introduction. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mutual funds an introduction

How to fill out mutual funds an introduction:

01

Research and gather information about mutual funds: Start by understanding what mutual funds are, how they work, their benefits, and risks involved. Learn about different types of mutual funds, investment strategies, and performance metrics.

02

Set financial goals: Determine your investment objectives, whether it is for retirement, education, or wealth accumulation. Assess your risk tolerance to identify the level of risk you are comfortable with.

03

Evaluate your investment horizon: Consider your time frame for investment. If you have a longer horizon, you might be more inclined to invest in growth-oriented funds. On the other hand, if you have a short-term goal, you may opt for more conservative options.

04

Assess your financial situation: Evaluate your current financial position, including income, expenses, and existing investments. Consider your liquidity needs and ensure you have emergency funds available before investing in mutual funds.

05

Select a reputable mutual fund provider: Research and compare different mutual fund providers based on their track record, reputation, fees, and customer service. Look for providers that align with your investment goals and offer a wide range of fund options.

06

Choose the right mutual funds: Based on your research and goals, select mutual funds that fit your investment objectives. Consider factors like risk, return potential, investment style, fund size, and expense ratios. Diversify your portfolio by investing in different types of mutual funds.

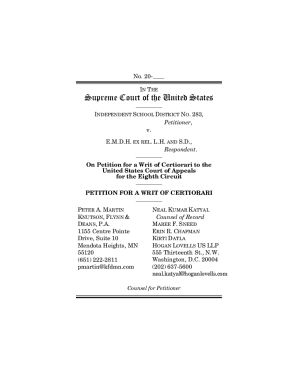

07

Understand fund documentation: Read through the mutual fund's prospectus, statement of additional information (SAI), and shareholder reports to understand important details about the fund, its investment strategy, fees, and historical performance. Pay attention to any risks associated with the particular mutual fund.

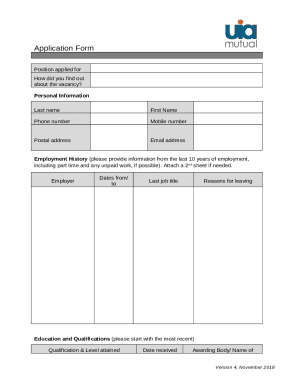

08

Complete the required forms: Fill out the necessary forms provided by the mutual fund provider. These may include a new account application, investor information, and investment allocation forms. Provide accurate and up-to-date information.

09

Fund your account: Transfer the desired amount of money into your mutual fund account. This can typically be done through online banking, wire transfer, or by issuing a check.

10

Monitor and review your investment: Keep track of your mutual fund's performance and review your investment strategy periodically. Consider rebalancing your portfolio if needed, based on changes in your financial goals or market conditions.

Who needs mutual funds an introduction?

01

Individuals new to investing: Mutual funds can serve as an ideal starting point for individuals who are new to investing and want to learn about different investment options.

02

Investors seeking diversification: Mutual funds provide access to a diversified portfolio of assets, reducing the risk associated with investing in individual securities or sectors.

03

Those looking for professional management: Mutual funds are managed by experienced fund managers who make investment decisions on behalf of investors. This can be beneficial for individuals who do not have the time or expertise to manage investments themselves.

04

Individuals with long-term financial goals: Mutual funds can help individuals achieve their long-term financial goals, such as retirement planning or saving for a child's education, by providing potential growth and compounding returns over time.

05

Investors looking for liquidity: Mutual funds offer easy liquidity, allowing investors to buy or sell their units at the fund's net asset value (NAV) on any business day.

06

Those seeking transparency and regulation: Mutual funds are regulated by financial authorities, providing investors with transparency regarding the fund's holdings, performance, and fees.

07

Investors seeking different risk levels: Mutual funds offer a range of risk options, catering to investors with varying risk appetites. From conservative options to aggressive growth funds, there is a mutual fund suitable for different types of investors.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit mutual funds an introduction from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your mutual funds an introduction into a dynamic fillable form that can be managed and signed using any internet-connected device.

How can I send mutual funds an introduction for eSignature?

When you're ready to share your mutual funds an introduction, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Can I create an electronic signature for signing my mutual funds an introduction in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your mutual funds an introduction and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

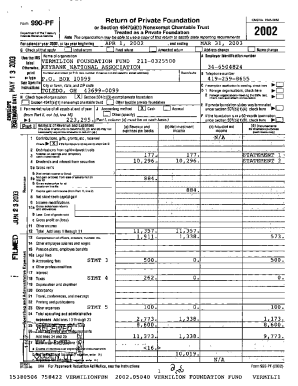

What is mutual funds an introduction?

Mutual funds are a type of financial vehicle made up of a pool of money collected from many investors to invest in securities such as stocks, bonds, money market instruments, and other assets.

Who is required to file mutual funds an introduction?

Mutual funds are typically managed by professional fund managers who are required to file an introduction to disclose important information about the fund.

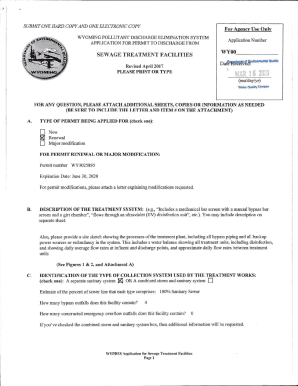

How to fill out mutual funds an introduction?

Filling out a mutual funds introduction involves providing details about the fund's objectives, investment strategies, risks, fees, performance, and other relevant information.

What is the purpose of mutual funds an introduction?

The purpose of a mutual funds introduction is to provide potential investors with comprehensive information about the fund to help them make informed investment decisions.

What information must be reported on mutual funds an introduction?

Information such as the fund's investment objectives, strategies, risks, fees, historical performance, and management team must be reported on a mutual funds introduction.

Fill out your mutual funds an introduction online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mutual Funds An Introduction is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.