Get the free Opening a subaccount - Deutsche Handelsbank

Show details

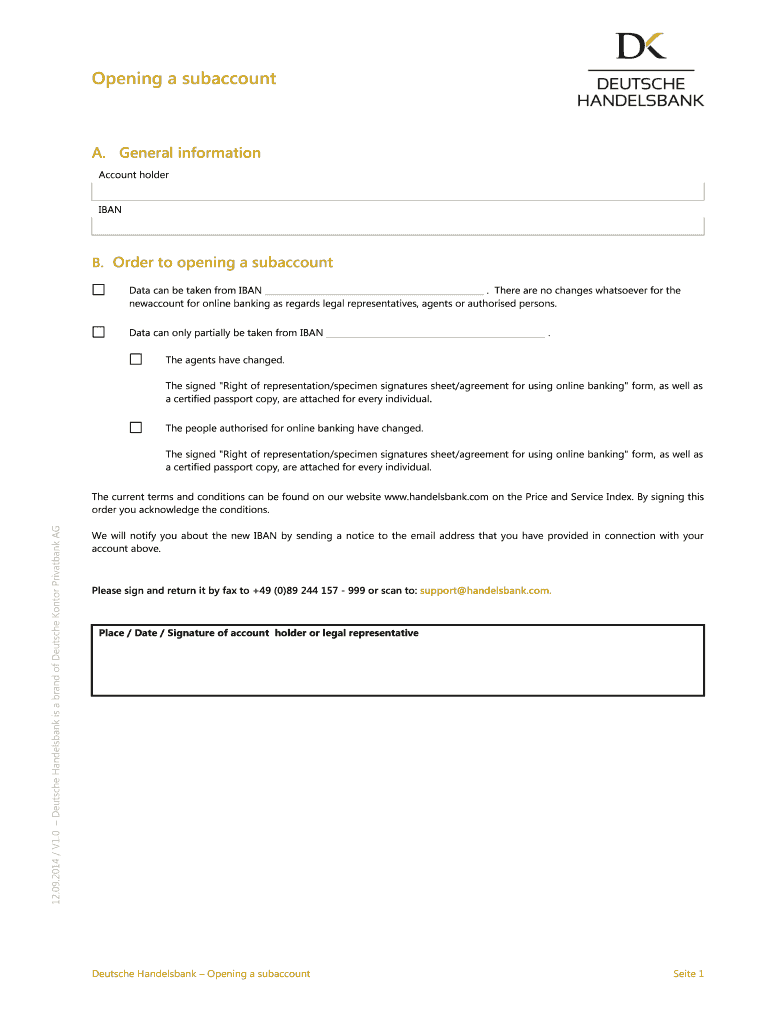

Opening a subaccount Deutsche Bundesbank Opening a subaccount Sate 1 09 0 e Che G A. General information Account holder IBAN B. Order to open a subaccount

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign opening a subaccount

Edit your opening a subaccount form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your opening a subaccount form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit opening a subaccount online

Follow the steps below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit opening a subaccount. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out opening a subaccount

How to fill out opening a subaccount:

01

Start by visiting the official website of your bank or financial institution.

02

Look for the option to open a new account or subaccount. This may be located under the "Accounts" or "Services" section.

03

Click on the option to open a new subaccount.

04

Fill out the necessary personal information, such as your name, address, and social security number.

05

Provide any additional required details, such as your employment information or income sources.

06

Select the type of subaccount you want to open. This could be a savings account, checking account, investment account, or any other offered by your financial institution.

07

Specify the desired account features and options. This may include things like overdraft protection, online banking access, or debit card issuance.

08

Agree to the terms and conditions set by the bank or financial institution.

09

Review all the provided information for accuracy.

10

Submit the application for opening the subaccount.

11

Wait for the bank or financial institution to review and process your application.

12

Once approved, you will receive confirmation and details about your newly opened subaccount.

Who needs opening a subaccount:

01

Individuals who want to separate their funds for specific purposes. For example, someone may open a subaccount to save for a vacation, a home down payment, or emergency funds.

02

Entrepreneurs or business owners who want to keep their personal and business finances separate. They may open a subaccount specifically for business-related expenses and transactions.

03

Parents or guardians who want to create subaccounts for their children. This can help teach them financial responsibility and provide a sense of independence while also offering parental oversight.

04

Individuals who want to simplify their budgeting and organization by allocating specific funds to different subaccounts for expenses like groceries, bills, entertainment, etc.

05

People who are preparing for a major life event, such as buying a car or planning a wedding, may open a subaccount to save and track funds specifically for that purpose.

06

Anyone who wants to take advantage of the benefits and features offered by their financial institution. Subaccounts can offer advantages like higher interest rates, specific rewards programs, or special account perks.

Overall, opening a subaccount can be beneficial for various individuals, depending on their financial goals, needs, and preferences.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send opening a subaccount to be eSigned by others?

Once you are ready to share your opening a subaccount, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I fill out the opening a subaccount form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign opening a subaccount and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

Can I edit opening a subaccount on an Android device?

The pdfFiller app for Android allows you to edit PDF files like opening a subaccount. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is opening a subaccount?

Opening a subaccount is creating a secondary account under a main account.

Who is required to file opening a subaccount?

Any individual or entity who wants to create a subaccount is required to file for opening a subaccount.

How to fill out opening a subaccount?

To fill out opening a subaccount, one must provide the necessary information such as account holder details, subaccount name, and purpose of the subaccount.

What is the purpose of opening a subaccount?

The purpose of opening a subaccount is to segregate funds or assets for specific purposes or projects.

What information must be reported on opening a subaccount?

Information such as account holder details, subaccount name, purpose of the subaccount, and initial deposit amount must be reported on opening a subaccount.

Fill out your opening a subaccount online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Opening A Subaccount is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.