Get the free WEUSA - Independent Job Offer Form 2014 - ccusa

Show details

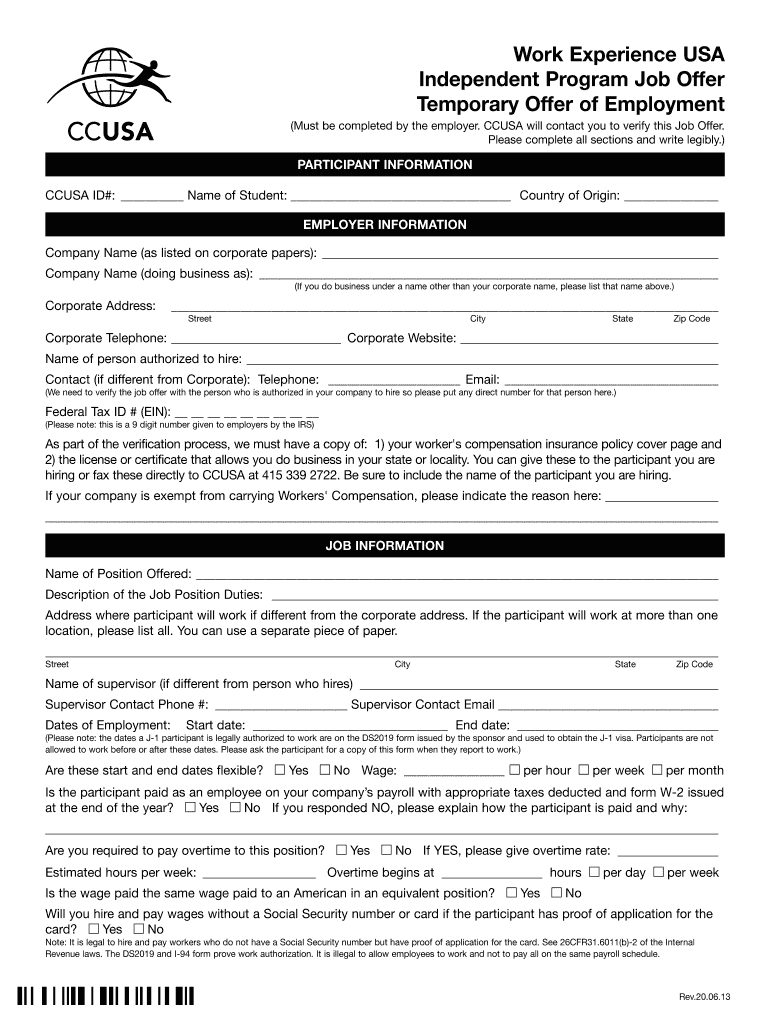

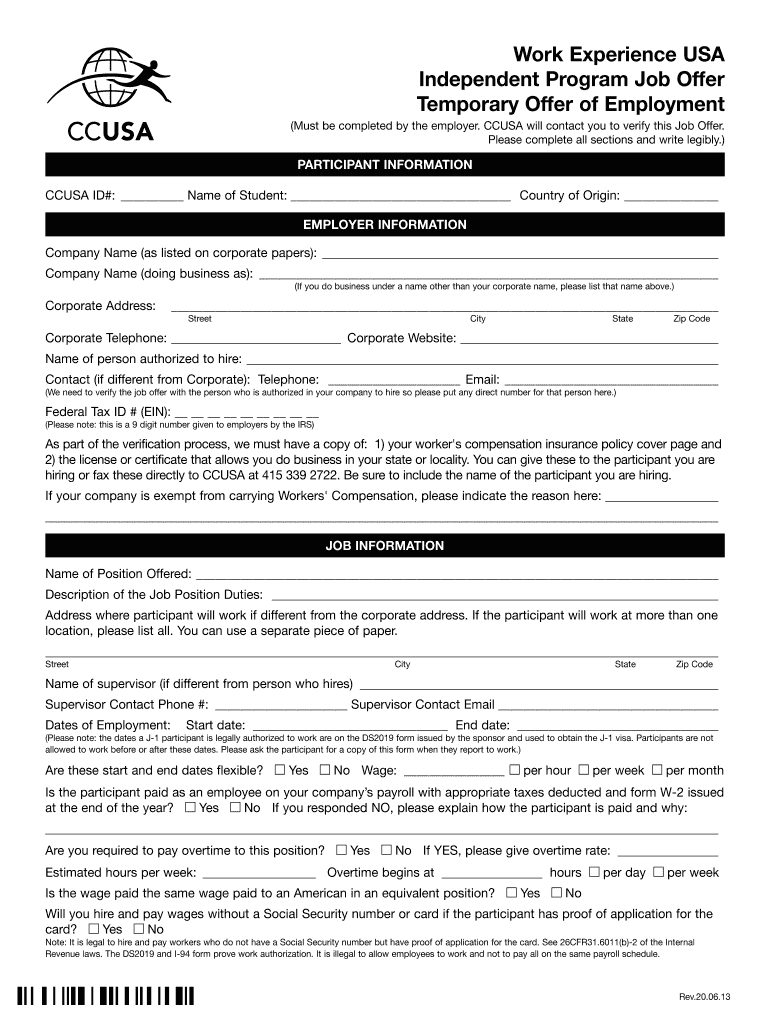

CC USA Work Experience 2330 Marin ship Way, Suite 300 Causality, CA 94965 1 888 449 3872 (toll-free) 1 415 339 2740 1 415 339 2722 (fax) work experience ccusa.com Dear Employer By completing this

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign weusa - independent job

Edit your weusa - independent job form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your weusa - independent job form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit weusa - independent job online

Follow the steps down below to benefit from a competent PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit weusa - independent job. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out weusa - independent job

Point by point, here's how to fill out WEUSA - Independent Job:

01

Start by gathering all the necessary information. This includes your personal details, such as your name, contact information, and Social Security number. You'll also need to provide information about your employment history, including the names of previous employers and the dates of your employment.

02

Next, you'll need to specify the type of work you do as an independent contractor. This could include freelance writing, graphic design, consulting, or any other type of self-employed work. Be specific and provide as much detail as possible.

03

Once you've provided your personal and work information, you'll need to fill out the financial section of the form. This includes reporting your income as an independent contractor. You'll need to provide an estimate of how much you earned during the specific tax year covered by the form.

04

In addition to your income, you'll also need to report any eligible deductions or expenses related to your independent job. This can include things like business expenses, office supplies, and travel expenses. Keep your receipts and documents handy to ensure accurate reporting.

05

Finally, review the form for any errors or missing information before submitting it. Double-check all the sections to ensure everything is filled out accurately and completely. If there are any questions or uncertainties, consult with a tax professional or refer to the instructions provided with the form.

Now let's address the second part of the question: Who needs WEUSA - Independent Job?

01

Self-employed individuals: Anyone who works as an independent contractor or freelancer, earning income through self-employment, may need to fill out WEUSA - Independent Job. This includes professionals in various fields, such as writers, consultants, artists, photographers, and more.

02

Small business owners: If you own a small business and operate as a sole proprietor, you may need to fill out this form to report your income and deductions related to your business. This is particularly relevant if you do not have any employees and operate solely as an independent contractor.

03

Gig economy workers: With the rise of the gig economy, more individuals are earning income through platforms like ride-sharing services, food delivery apps, and online freelance marketplaces. If you fall into this category and are considered an independent contractor, you may need to fill out WEUSA - Independent Job to report your income.

In summary, individuals who work as independent contractors, freelancers, small business owners, or gig economy workers may need to fill out WEUSA - Independent Job. It is essential to accurately and thoroughly complete the form by following the provided instructions and consulting with a tax professional if needed.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send weusa - independent job to be eSigned by others?

Once your weusa - independent job is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I edit weusa - independent job on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share weusa - independent job from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

Can I edit weusa - independent job on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as weusa - independent job. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is weusa - independent job?

Weusa - independent job is a report for individuals who have income from self-employment or freelancing.

Who is required to file weusa - independent job?

Individuals who have income from self-employment or freelancing are required to file weusa - independent job.

How to fill out weusa - independent job?

Weusa - independent job can be filled out online or on paper by providing information about income from self-employment or freelancing.

What is the purpose of weusa - independent job?

The purpose of weusa - independent job is to report income from self-employment or freelancing for tax purposes.

What information must be reported on weusa - independent job?

Information such as income, expenses, and deductions related to self-employment or freelancing must be reported on weusa - independent job.

Fill out your weusa - independent job online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Weusa - Independent Job is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.