Get the free Long-Term Care Insurance - The Krause Agency

Show details

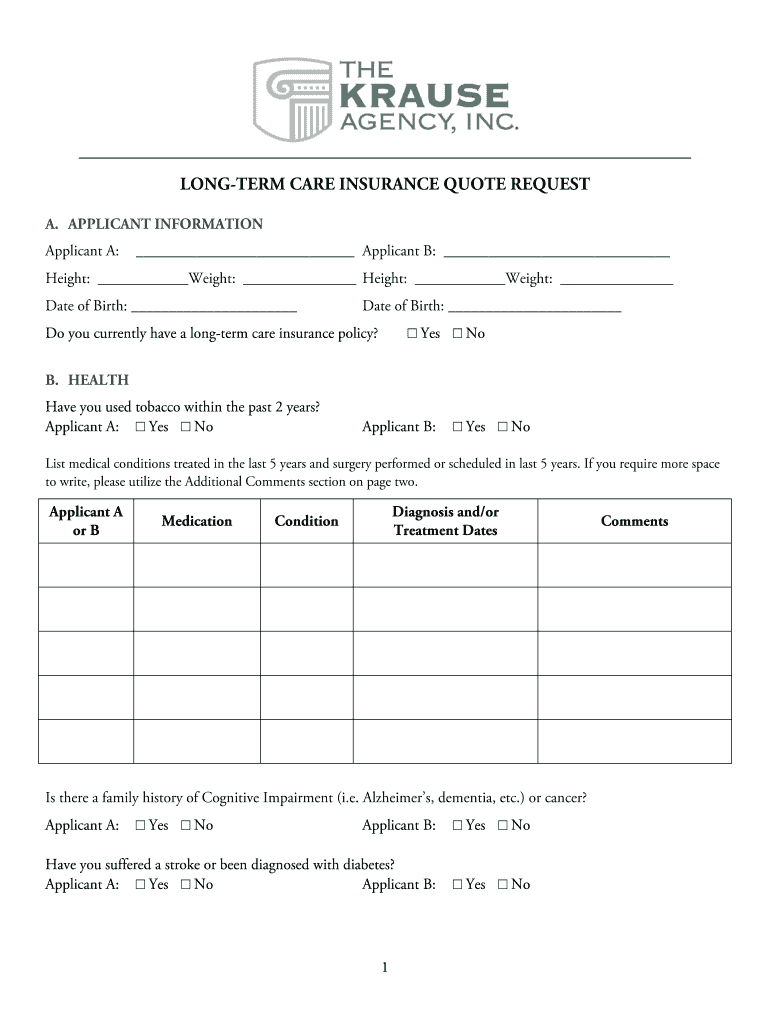

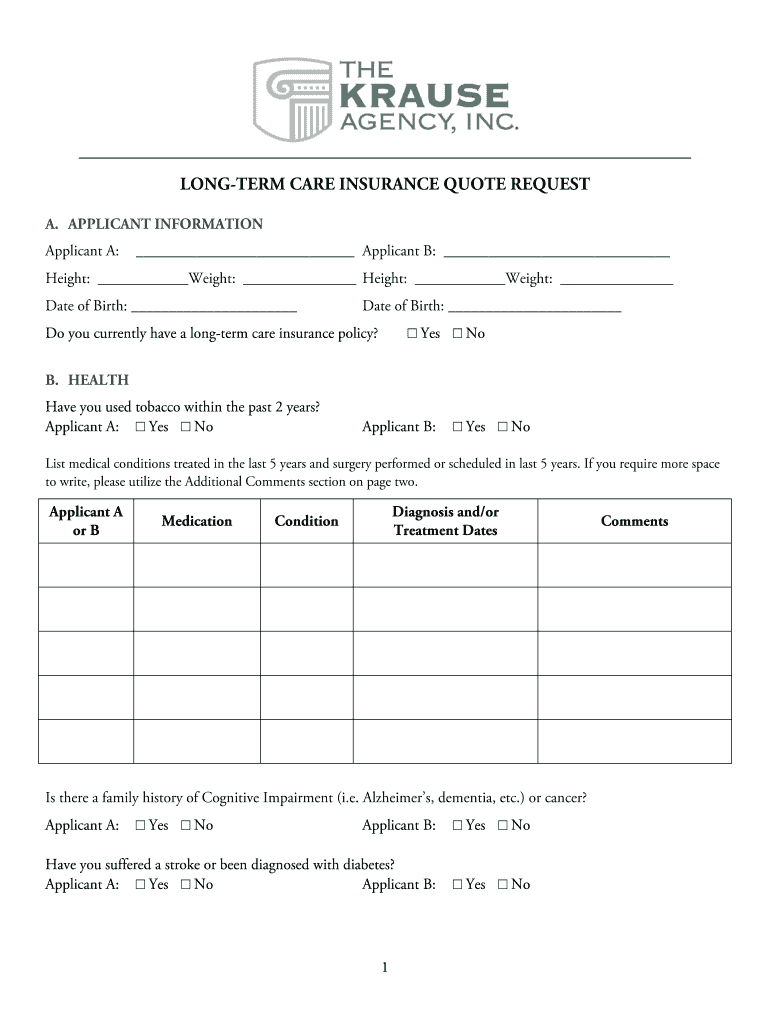

Do you currently have a long-term care insurance policy? Yes No B. HEALTH Have you used tobacco within the past 2 years?

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign long-term care insurance

Edit your long-term care insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your long-term care insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing long-term care insurance online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit long-term care insurance. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out long-term care insurance

How to fill out long-term care insurance:

01

Gather necessary documents: Before starting the application process, make sure you have all the required documents in hand. These may include personal identification, medical history records, financial information, and any other relevant paperwork requested by the insurance provider.

02

Research and compare different insurance options: There are various long-term care insurance policies available, so it is important to do some research to find the one that best suits your needs. Compare different providers, policy features, coverage options, and costs to make an informed decision.

03

Determine the coverage you require: Consider your current health status and any specific long-term care needs you anticipate in the future. Assess whether you need coverage for in-home care, assisted living facilities, nursing homes, or other services. This will help you determine the level of coverage required and the corresponding cost.

04

Fill out the application accurately: When filling out the application form, provide accurate and honest information. This includes personal details, medical history, lifestyle habits, and any pre-existing conditions. Incorrect or misleading information can lead to claim denial or policy cancellation.

05

Seek professional guidance if necessary: If you find the application process overwhelming or have any doubts, consider seeking guidance from an insurance agent or financial advisor. They can provide expert advice based on your individual circumstances and assist you in making the right choices.

06

Review the policy terms and conditions: Once you have filled out the application, carefully review the policy terms and conditions provided by the insurance provider. Make sure you understand the coverage limitations, waiting periods, exclusions, premium payment schedule, and any other important clauses. Seek clarification from the insurance company if anything is unclear.

07

Pay the premium: If you are satisfied with the policy terms and have decided to move forward, pay the initial premium as per the instructions provided. This will activate your long-term care insurance coverage.

08

Keep a copy of the policy: It is crucial to keep a copy of the filled-out application, along with the policy document and any receipts or payment records. These documents will serve as proof of your coverage and will be important in case you need to file a claim or make any changes to your policy.

09

Periodically review your coverage: As your circumstances change over time, it is important to review your long-term care insurance coverage periodically. This will ensure that your policy remains appropriate and meets your evolving needs.

Who needs long-term care insurance:

01

Individuals nearing retirement age: As people get older, the risk of needing long-term care services increases. Long-term care insurance can provide financial protection against the high costs of care in retirement.

02

Individuals with a family history of chronic illnesses: If you have a family history of diseases such as Alzheimer's, Parkinson's, or other conditions that may require long-term care, having insurance can help ensure that you receive quality care without burdening your family financially.

03

Those who want to protect their assets: Long-term care can quickly deplete the savings and assets you have worked hard to accumulate. Having insurance can help protect your assets and prevent them from being used up solely on medical expenses.

04

Individuals who prefer to age at home: Many people prefer to stay in their own homes as they age, even if they require assistance with daily activities. Long-term care insurance can cover the costs of in-home care services, allowing individuals to age in place comfortably.

05

Those who don't want to rely solely on government programs: Government-funded programs such as Medicaid may provide some coverage for long-term care. However, these programs have strict eligibility requirements and may not cover the level of care or services you desire. Having long-term care insurance offers more flexibility and control over the type and quality of care you receive.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send long-term care insurance for eSignature?

Once your long-term care insurance is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

Can I sign the long-term care insurance electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your long-term care insurance in seconds.

How can I edit long-term care insurance on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit long-term care insurance.

What is long-term care insurance?

Long-term care insurance is a type of insurance designed to cover the costs of long-term care services, such as assistance with activities of daily living or nursing home care.

Who is required to file long-term care insurance?

Individuals who wish to protect themselves against the high costs of long-term care services may choose to purchase long-term care insurance.

How to fill out long-term care insurance?

To fill out long-term care insurance, individuals typically need to provide personal information, medical history, and choose coverage options that suit their needs and budget.

What is the purpose of long-term care insurance?

The purpose of long-term care insurance is to help individuals cover the costs of long-term care services, which can be expensive and may not be fully covered by other types of insurance.

What information must be reported on long-term care insurance?

Information such as personal details, medical history, desired coverage options, and payment details may need to be reported on long-term care insurance.

Fill out your long-term care insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Long-Term Care Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.