Get the free EA - Part 2 - Federal Emergency Management Agency

Show details

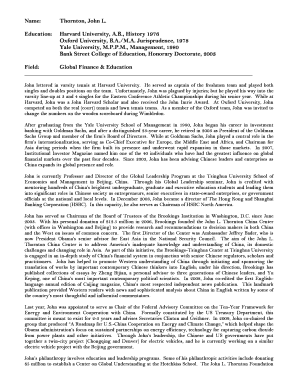

Lauren. Broomfield la.gov Cell (225) 281-6405 Desk (225) 379-4055 From: Young, Joe F (CTR) Joe. Young associates.FEMA.DHS.gov Sent: Friday, May 25, 2012 12:57 PM To: L 5 Bowen. Odessa (CTR) From:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ea - part 2

Edit your ea - part 2 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ea - part 2 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ea - part 2 online

In order to make advantage of the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit ea - part 2. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ea - part 2

How to fill out EA - Part 2:

01

Start by gathering all the necessary information. This includes your personal details, such as your name, address, and social security number. It also includes information about your income, deductions, and credits. Make sure you have all the relevant documents, such as W-2 forms, 1099 forms, and receipts for deductions.

02

Use the right software or tax preparation tool. There are many options available, including popular ones like TurboTax, H&R Block, and TaxAct. Choose the one that suits your needs and follow the instructions provided by the software.

03

Enter your personal information. This includes your name, address, and social security number. Double-check the accuracy of the information before moving on.

04

Follow the prompts to input your income. This may include wages, self-employment income, rental income, investment income, and more. Make sure to enter all the details accurately and report all your sources of income.

05

Enter your deductions and credits. This is where you can reduce your taxable income and potentially lower your tax liability. Common deductions include mortgage interest, student loan interest, medical expenses, and charitable contributions. Credits, on the other hand, provide a direct reduction in your tax liability. Examples include the Child Tax Credit and the Earned Income Credit.

06

Review your entries and double-check for any errors. It's essential to review your tax return thoroughly to ensure accuracy. Take your time to go through each section and verify that all information has been entered correctly.

07

File your tax return. Once you are satisfied with all the information provided, you can submit your tax return electronically or by mail. If you owe taxes, make sure to include the payment along with your return. If you are due a refund, you can choose to have it directly deposited into your bank account or receive a physical check in the mail.

Who needs EA - Part 2?

01

Individuals who have complex financial situations. If you own a business, have multiple sources of income, or have significant deductions and credits, you may benefit from using EA - Part 2. This software is designed to handle more complex tax situations and can help ensure that you are accurately reporting and maximizing your deductions and credits.

02

Self-employed individuals. If you are self-employed, you may have additional considerations when filing your taxes, such as reporting business income and expenses, paying self-employment taxes, and calculating estimated tax payments. EA - Part 2 can guide you through these additional complexities and help you file your taxes correctly.

03

Those who want a more convenient and efficient filing process. Using tax software like EA - Part 2 can streamline the tax filing process. It eliminates the need for manual calculations, provides step-by-step guidance, and automatically checks for errors. This can save you time and ensure that your tax return is accurately completed.

In summary, to fill out EA - Part 2, gather all necessary information, use the right software, enter personal information, input income, deductions, and credits, review for accuracy, and file your tax return accordingly. Those who have complex financial situations, are self-employed, or want a convenient filing process may benefit from using EA - Part 2.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute ea - part 2 online?

pdfFiller has made it simple to fill out and eSign ea - part 2. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

Can I create an eSignature for the ea - part 2 in Gmail?

Create your eSignature using pdfFiller and then eSign your ea - part 2 immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I edit ea - part 2 on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share ea - part 2 from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is ea - part 2?

EA - Part 2 refers to the second part of the Environmental Assessment, which is a detailed analysis of the potential environmental impacts of a proposed project or action.

Who is required to file ea - part 2?

The responsible party or entity proposing the project or action is required to file EA - Part 2.

How to fill out ea - part 2?

EA - Part 2 must be filled out in accordance with the guidelines provided by the regulatory authorities overseeing the environmental assessment process.

What is the purpose of ea - part 2?

The purpose of EA - Part 2 is to assess and document the potential environmental impacts of a proposed project or action, and to identify measures to mitigate or avoid adverse effects.

What information must be reported on ea - part 2?

EA - Part 2 must include detailed information on the proposed project, its location, potential environmental impacts, measures to mitigate adverse effects, and consultation with stakeholders.

Fill out your ea - part 2 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ea - Part 2 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.