Get the free Flood insurance coverage may be terminated by either

Show details

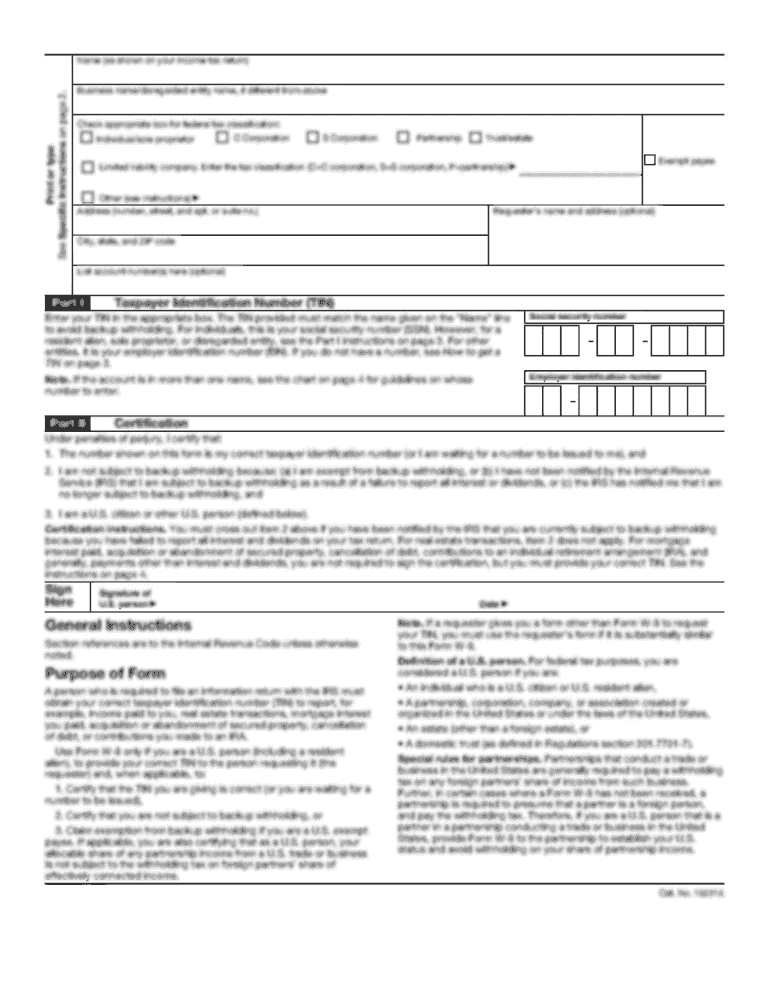

CANCELLATION/NULLIFICATION Flood insurance coverage may be terminated by either canceling or nullifying the policy, only in accordance with a valid reason for the transaction, as described in Paragraphs

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign flood insurance coverage may

Edit your flood insurance coverage may form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your flood insurance coverage may form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing flood insurance coverage may online

To use the professional PDF editor, follow these steps below:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit flood insurance coverage may. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out flood insurance coverage may

How to Fill Out Flood Insurance Coverage May:

01

Gather necessary information: Collect all relevant information such as your policy number, contact information, and details about the property being insured. Make sure to have accurate details about the property's location and any previous flood insurance claims.

02

Review coverage details: Understand the scope of your flood insurance coverage by carefully reading the policy documents. Take note of the coverage limits, deductibles, and any additional endorsements or riders that may apply.

03

Assess your needs: Evaluate your property and its vulnerability to flooding. Consider factors such as proximity to bodies of water, flood history in the area, and local flood zone classifications. This assessment will guide you in determining the appropriate coverage levels.

04

Determine desired coverage: Based on your assessment, decide the amount of coverage you need to protect your property adequately. Consider both the structure and contents of your property, ensuring that you have sufficient coverage for both.

05

Complete the application: Fill out the flood insurance application accurately and thoroughly. Provide all requested information, including personal details, property information, and any additional data required. Double-check for accuracy and make corrections, if needed.

06

Consider additional coverage options: If necessary, review and include any additional coverage options suited to your needs. This may include coverage for basement improvements, increased cost of compliance, or replacement cost coverage for personal property.

Who Needs Flood Insurance Coverage May:

01

Homeowners: Individuals who own or are purchasing a home in areas prone to flooding should strongly consider having flood insurance coverage. This includes both primary and secondary homeowners.

02

Renters: Renters living in flood-prone areas should also consider obtaining flood insurance coverage for their personal belongings, as most standard renter's insurance policies do not cover flood damage.

03

Business Owners: If you own a business or commercial property in a flood-prone area, securing flood insurance is crucial. It can protect your assets, inventory, and help cover potential business interruptions caused by flooding.

04

Mortgage Holders: In some cases, mortgage lenders may require homeowners to obtain flood insurance if the property is located in a designated flood zone. It is essential to comply with these requirements to satisfy the terms of the loan.

05

Special Flood Hazard Areas (SFHAs): FEMA designates particular areas as SFHAs based on historical flood data. If your property is located within an SFHA, flood insurance is highly recommended, as the risk of flooding is significantly higher.

Remember, it is always advisable to consult with a licensed insurance professional to determine the specific flood insurance requirements based on your location and circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is flood insurance coverage may?

Flood insurance coverage may include coverage for the structure of a property, as well as contents within the property that are damaged by flooding.

Who is required to file flood insurance coverage may?

Property owners in designated flood zones are typically required to have flood insurance coverage.

How to fill out flood insurance coverage may?

To fill out flood insurance coverage, you will need to provide information about the property, its value, and the desired coverage amounts.

What is the purpose of flood insurance coverage may?

The purpose of flood insurance coverage is to provide financial protection in the event of property damage caused by flooding.

What information must be reported on flood insurance coverage may?

Information such as property address, value, desired coverage amounts, and details about the property's flood risk are typically required on flood insurance coverage forms.

Where do I find flood insurance coverage may?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the flood insurance coverage may in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

Can I create an electronic signature for the flood insurance coverage may in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your flood insurance coverage may.

How do I edit flood insurance coverage may straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing flood insurance coverage may right away.

Fill out your flood insurance coverage may online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Flood Insurance Coverage May is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.