Get the free Automatic Regular Savings Plan Form V2 - Easy Street

Show details

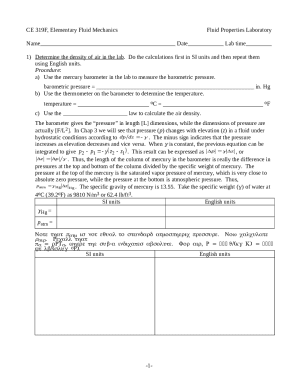

REQUEST FOR AUTOMATIC REGULAR SAVINGS PLAN At your request, we can set up an automatic regular savings plan up to a maximum of $2,000 per month on your behalf from any Australian bank account. You

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign automatic regular savings plan

Edit your automatic regular savings plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your automatic regular savings plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing automatic regular savings plan online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit automatic regular savings plan. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out automatic regular savings plan

How to fill out an automatic regular savings plan?

01

Research different financial institutions: Start by researching different banks or financial institutions that offer automatic regular savings plans. Look for ones that have competitive interest rates and fees that align with your financial goals.

02

Understand the terms and conditions: Once you have narrowed down your options, carefully read and understand the terms and conditions of the automatic regular savings plan. Pay attention to factors such as minimum deposit requirements, withdrawal restrictions, and any fees associated with the account.

03

Choose the right savings plan: Determine the type of automatic regular savings plan that suits your needs. Some plans may require a fixed monthly deposit, while others may allow more flexibility in terms of withdrawal options. Consider your financial goals and the level of liquidity you require before making a decision.

04

Gather necessary documentation: Before filling out the application, gather all the necessary documentation, such as identification, proof of address, and social security number. These documents may vary depending on the financial institution, so it's always a good idea to check their requirements beforehand.

05

Fill out the application form: Once you have all the required documents, fill out the application form for the automatic regular savings plan. Provide accurate and up-to-date information to ensure a smooth application process. If you have any doubts, don't hesitate to ask for assistance from the financial institution's customer service.

06

Specify the deposit amount and frequency: When filling out the application, indicate the desired deposit amount and frequency for your automatic regular savings plan. This will determine how much money you will be saving regularly and how often the deposits will be made.

07

Set up automatic transfers: To fully utilize the automatic regular savings plan, you will need to set up automatic transfers from your checking account to the savings account. This can usually be done online or through the bank's mobile app. Specify the start date and frequency of the transfers according to your preferences.

Who needs an automatic regular savings plan?

01

Individuals looking to build an emergency fund: An automatic regular savings plan can be an excellent tool for individuals who want to save money for unexpected expenses or emergencies. By regularly depositing money into the account, you can build up a safety net for any unforeseen circumstances.

02

People saving for specific goals: Automatic regular savings plans are also beneficial for individuals who have specific financial goals in mind. Whether it's saving for a down payment on a house or planning for a dream vacation, setting up automatic transfers can help keep you on track and ensure consistent progress towards your goals.

03

Those seeking to develop a saving habit: For individuals who struggle with saving money, an automatic regular savings plan can be an effective way to develop a saving habit. By automating the process, you remove any temptation to spend the money and make saving a regular part of your financial routine.

In conclusion, filling out an automatic regular savings plan involves researching financial institutions, understanding the terms and conditions, choosing the right plan, gathering necessary documentation, filling out the application form, specifying the deposit amount and frequency, and setting up automatic transfers. It is beneficial for individuals looking to build an emergency fund, save for specific goals, or develop a saving habit.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit automatic regular savings plan from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including automatic regular savings plan, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I fill out automatic regular savings plan using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign automatic regular savings plan and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

Can I edit automatic regular savings plan on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute automatic regular savings plan from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is automatic regular savings plan?

Automatic regular savings plan is a program where a set amount of money is regularly transferred from one's checking account to a savings account, usually on a monthly basis.

Who is required to file automatic regular savings plan?

Individuals who participate in automatic regular savings plan are required to file this plan with their financial institution.

How to fill out automatic regular savings plan?

To fill out automatic regular savings plan, individuals need to provide details such as the amount to be transferred, the frequency of transfers, and the source and destination accounts.

What is the purpose of automatic regular savings plan?

The purpose of automatic regular savings plan is to help individuals save money consistently and improve their financial discipline.

What information must be reported on automatic regular savings plan?

Information such as the amount transferred, the date of transfer, and the account details must be reported on automatic regular savings plan.

Fill out your automatic regular savings plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Automatic Regular Savings Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.