Get the free Substitute Check Recredit Claim Form - ufcu

Show details

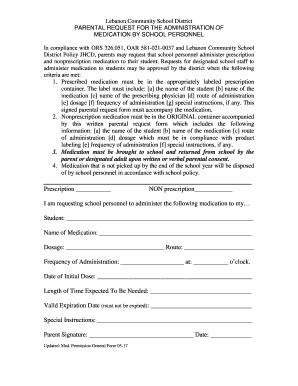

This form is used to submit a claim regarding a substitute check that may have been processed incorrectly or has discrepancies.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign substitute check recredit claim

Edit your substitute check recredit claim form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your substitute check recredit claim form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing substitute check recredit claim online

To use our professional PDF editor, follow these steps:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit substitute check recredit claim. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out substitute check recredit claim

How to fill out Substitute Check Recredit Claim Form

01

Obtain the Substitute Check Recredit Claim Form from your bank or financial institution's website.

02

Fill out your personal information at the top of the form, including your name, address, and contact information.

03

Provide details about the substitute check in question, including the check number, date, and amount.

04

Explain the reason for your claim in the designated section. Be clear and concise.

05

Attach any supporting documentation that validates your claim, such as original receipts or bank statements.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form where indicated.

08

Submit the form to your bank according to their specified submission guidelines, which may include mailing it or submitting it electronically.

Who needs Substitute Check Recredit Claim Form?

01

Individuals or businesses who believe they have been wrongly charged due to a substitute check that was processed incorrectly.

02

Customers who did not receive the funds from a substitute check that they expected to.

03

Anyone who has identified discrepancies related to a substitute check transaction.

Fill

form

: Try Risk Free

People Also Ask about

Why would I get a substitute check?

Substitute checks are used by banking institutions. What it is, is an 'image of an actual check'. This saves the banks the issues of transporting the actual checks from location to location -- bank to bank -- especially if the banks are far away.

How can I cash a substitute check?

To cash a substitute check, you have to simply deposit it into your bank account through a branch, ATM, or mobile banking app. The bank will process it like a regular check, verifying its authenticity and legality through electronic systems, and then credit the deposited amount to your account.

What must a substitute check have?

The substitute check is a paper reproduction of the original check that must (1) contain an image of the front and back of the original check; (2) bear a MICR line containing all the information appearing on the MICR line of the original check; (3) conform, in paper stock, dimension, and otherwise, with generally

How to get a substitute check?

To obtain one, request a 'substitute check' or 'legal copy' from your bank. Keep documentation of your request and the bank's response. If the provided copy lacks required details, clarify with the bank or consult probate court rules on acceptable evidence.

What is an expedited recredit?

Check 21 provides a special process that allows you to claim a refund (also known as an expedited recredit) when you receive a substitute check from a bank and you think there is an error because of the substitute check. For example, you may think that you were charged twice for the same check.

What type of check is a substitute for a regular check?

A substitute check is a paper copy of the digital image of your original check - both front and back, with all endorsements - and is about the size of a business check. Check 21 legislation sets standards for quality and allows for substitute checks to be legal copies of the originals.

Why did I receive a substitute check from my bank?

To make check processing faster, federal law permits banks to replace original checks with "substitute checks." These checks are similar in size to original checks with a slightly reduced image of the front and back of the original check.

What to do with a substitute check?

Substitute check is a legal copy they are required to mail you which states why the original was declined. You can endorse it and deposit it. They cannot reprocess the original or manually override it.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Substitute Check Recredit Claim Form?

The Substitute Check Recredit Claim Form is a document used by consumers to request a refund from their financial institution for a substitute check that was processed incorrectly or caused a loss.

Who is required to file Substitute Check Recredit Claim Form?

Consumers who believe they were erroneously charged due to a substitute check or experienced a loss because the substitute check did not hold the same obligations as the original check are required to file this form.

How to fill out Substitute Check Recredit Claim Form?

To fill out the Substitute Check Recredit Claim Form, you need to provide information such as your contact details, the details of the substitute check including the date, amount, and check number, as well as providing a description of the claim and any supporting documents.

What is the purpose of Substitute Check Recredit Claim Form?

The purpose of the Substitute Check Recredit Claim Form is to allow consumers to formally request compensation for any financial loss resulting from the wrongful processing of a substitute check.

What information must be reported on Substitute Check Recredit Claim Form?

The Substitute Check Recredit Claim Form must report information such as the name of the claimant, the financial institution involved, details of the substitute check, the reason for the claim, and any relevant account details.

Fill out your substitute check recredit claim online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Substitute Check Recredit Claim is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.