Get the free Private Equity amp Venture Forum Europe 2012

Show details

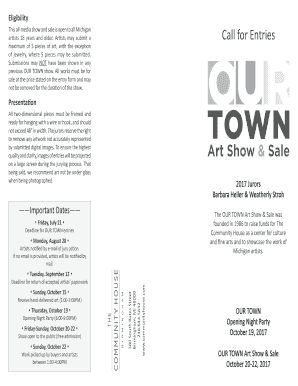

Private Equity & Venture Forum Europe 2012 11 October 2012 No 4 Hamilton Place, London GLOBAL PERSPECTIVE, LOCAL OPPORTUNITY avcjeurope.com Asia Calling: Finding Growth in a Global Landscape of Volatility

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign private equity amp venture

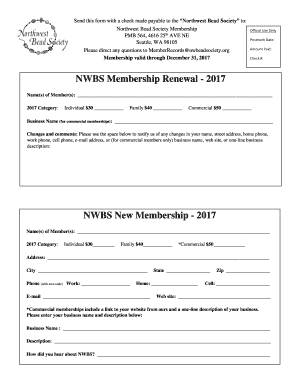

Edit your private equity amp venture form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your private equity amp venture form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing private equity amp venture online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit private equity amp venture. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out private equity amp venture

How to fill out private equity amp venture:

01

Research and understand the private equity and venture capital industry: Start by familiarizing yourself with the basic concepts, terms, and structures of private equity and venture capital. This will provide you with a foundation for effectively filling out private equity amp venture opportunities.

02

Identify your investment objectives and risk tolerance: Determine your financial goals and the level of risk you are comfortable with. Private equity and venture capital investments can range from high-risk, high-reward opportunities to more conservative and stable investments. Knowing your objectives and risk tolerance will guide you in selecting the right investments to fill out.

03

Evaluate opportunities and perform due diligence: Conduct thorough research on potential private equity amp venture opportunities. Assess the investment's track record, management team, industry trends, and financial performance. Perform due diligence by reviewing documents, analyzing financial statements, and conducting interviews or meetings with key stakeholders.

04

Assess your financial capacity: Private equity and venture capital investments often require significant capital commitments. Evaluate your financial capacity to determine if you can meet the financial obligations that come with filling out private equity amp venture opportunities. Consider factors such as liquidity, diversification, and potential exit strategies.

05

Seek professional advice: Engage the services of experienced investment professionals, such as financial advisors or wealth managers, who specialize in private equity and venture capital. They can provide valuable insights, guidance, and help navigate the complexities of the industry.

Who needs private equity amp venture:

01

Entrepreneurs and startups: Private equity and venture capital can provide funding and support to startups and entrepreneurs looking to grow their businesses. These investments can enable access to capital, industry knowledge, and networks that can drive business expansion.

02

Established companies seeking growth capital: Companies looking to expand, launch new products or enter new markets often turn to private equity amp venture for the necessary growth capital. These investments can help finance mergers and acquisitions, technology advancements, and operational improvements.

03

Institutional investors: Pension funds, endowments, and other institutional investors often allocate a portion of their portfolios to private equity amp venture investments. These assets offer the potential for high returns, diversification, and long-term investment opportunities not typically available in traditional asset classes.

04

Accredited and high-net-worth individuals: Individuals with significant investable assets may seek private equity and venture capital opportunities as part of their investment strategies. These investments can generate attractive returns but require a higher level of risk tolerance and financial capacity.

In conclusion, filling out private equity amp venture requires research, evaluation, financial capacity assessment, and potentially seeking professional advice. The audience for private equity amp venture includes entrepreneurs, startups, established companies, institutional investors, and accredited individuals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is private equity amp venture?

Private equity and venture capital are types of investment strategies where investors provide funding to companies in exchange for ownership stakes.

Who is required to file private equity amp venture?

Investment firms and companies that are involved in private equity and venture capital investments are required to file.

How to fill out private equity amp venture?

To fill out private equity and venture forms, investors need to provide information about their investments, ownership stakes, financial performance, and any other relevant details.

What is the purpose of private equity amp venture?

The purpose of private equity and venture capital is to provide funding to companies in order to help them grow and expand their operations.

What information must be reported on private equity amp venture?

Information such as investment amounts, ownership stakes, financial performance, and any other relevant details must be reported on private equity and venture forms.

How can I get private equity amp venture?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific private equity amp venture and other forms. Find the template you need and change it using powerful tools.

How do I edit private equity amp venture in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing private equity amp venture and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How do I fill out private equity amp venture on an Android device?

Complete your private equity amp venture and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

Fill out your private equity amp venture online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Private Equity Amp Venture is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.