Get the free Spending Accounts An Employer Guide - Willis

Show details

U NLRB PARTNERING WITH YOU ON TRENDS AND BEST PRACTICES supporting YOUR HUMAN RESOURCES INITIATIVES SPENDING ACCOUNTS: AN EMPLOYER GUIDE TABLE OF CONTENTS Section Page What are Spending Accounts?

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign spending accounts an employer

Edit your spending accounts an employer form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your spending accounts an employer form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing spending accounts an employer online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit spending accounts an employer. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out spending accounts an employer

Point by point, here is how to fill out spending accounts as an employer:

01

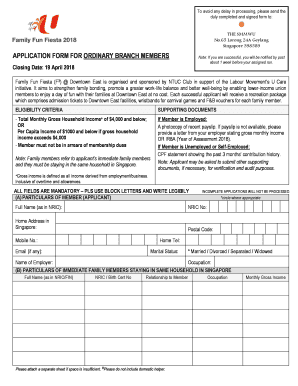

Review the eligibility criteria: Before initiating the process, it is important for the employer to review the eligibility criteria for spending accounts. This typically includes details such as the employee's full-time or part-time status, length of employment, and any specific requirements set by the employer.

02

Determine the type of spending accounts: There are various types of spending accounts an employer can offer, such as flexible spending accounts (FSAs), health savings accounts (HSAs), or dependent care flexible spending accounts (DCFSAs). It is important to determine which type(s) will be offered to employees and understand the rules and regulations associated with each type.

03

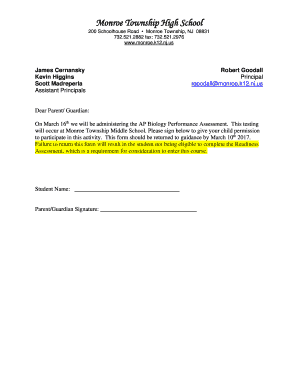

Communicate with employees: Once the types of spending accounts have been decided, it is crucial to communicate this information to all employees. Hold meetings or provide written communication explaining the benefits, rules, and deadlines for enrollment and spending. Offering educational resources or presentations can also be helpful in ensuring employees understand the process.

04

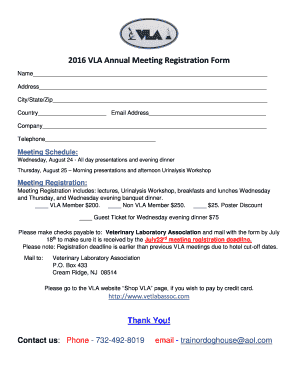

Set enrollment periods: Determine specific periods in which employees can enroll in the spending accounts. These enrollment periods should be communicated well in advance, allowing employees sufficient time to gather information and make informed decisions about participating.

05

Provide necessary forms and documentation: Create or obtain the appropriate forms, enrollment packets, and documentation required for employees to enroll in the spending accounts. This may include forms for personal information, beneficiary designations, and elections for contribution amounts. Ensure these materials are readily available, easy to understand, and accessible to all employees.

06

Offer employee support: Establish a support system for employees who have questions or need assistance with filling out the spending account forms. This could include providing contact information for a designated representative who can offer guidance, hosting informational sessions, or providing online resources to answer frequently asked questions.

07

Review submissions and verify accuracy: Once employees have submitted their enrollment forms, it is the employer's responsibility to review and verify the accuracy of the information provided. This includes confirming that all required fields have been completed, ensuring the chosen contribution amounts align with legal limits, and double-checking that the documentation provided is valid and complete.

08

Educate employees on account usage: Even after employees have successfully enrolled in the spending accounts, it is crucial to educate them on how to effectively use the accounts. Inform them about eligible expenses, submission processes, and any deadlines or restrictions that may apply. Regularly remind employees of the resources available to them for tracking expenses and submitting reimbursement requests.

Who needs spending accounts as an employer?

01

Small business owners: Offering spending accounts can be an attractive perk for small business owners looking to provide competitive benefits to their employees. It can help attract and retain skilled workers, offering them a way to save money on healthcare or dependent care expenses.

02

Employers looking to reduce taxes: By offering spending accounts, employers can potentially reduce their tax liability. Contributions made by employees to these accounts are typically deducted from their taxable income, leading to potential tax savings for both the employee and employer.

03

Employers aiming for employee satisfaction: Providing spending accounts demonstrates a commitment to employee well-being and can enhance overall job satisfaction. It allows employees to save money on eligible expenses and provides a sense of financial security, which can positively impact their overall happiness and productivity in the workplace.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is spending accounts an employer?

Spending accounts are accounts that allow employees to set aside pre-tax money for eligible expenses such as medical costs or dependent care.

Who is required to file spending accounts an employer?

Employers who offer spending accounts to their employees are required to file and report the information to the IRS.

How to fill out spending accounts an employer?

Employers can fill out spending accounts by providing the necessary information about the accounts and the contributions made by employees.

What is the purpose of spending accounts an employer?

The purpose of spending accounts is to help employees save money on eligible expenses by allowing them to use pre-tax dollars.

What information must be reported on spending accounts an employer?

Employers must report the total contributions made by employees to their spending accounts and any withdrawals or reimbursements made from the accounts.

How can I send spending accounts an employer to be eSigned by others?

Once your spending accounts an employer is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

Can I create an eSignature for the spending accounts an employer in Gmail?

Create your eSignature using pdfFiller and then eSign your spending accounts an employer immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I edit spending accounts an employer straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing spending accounts an employer right away.

Fill out your spending accounts an employer online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Spending Accounts An Employer is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.