Get the free kych

Show details

74th Annual Conclave Convent General, Knights of the York Cross of Honor Dear Knights: On behalf of my officers and me, I wish to invite you to attend the 74th Annual Conclave of the Convent General,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign convent general kych form

Edit your kych form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your kych form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit kych form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit kych form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

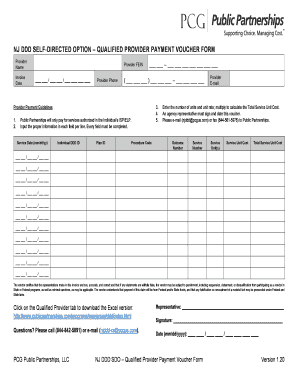

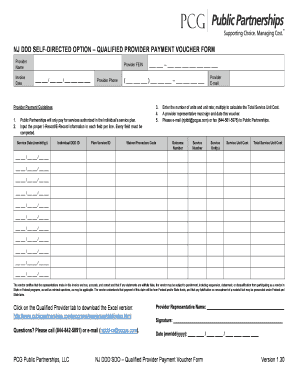

How to fill out kych form

How to fill out KYC (Know Your Customer)?

01

Gather the necessary documents: Begin by collecting all the required documents for KYC verification. These typically include identification proofs such as passport, driver's license, or national identification card, as well as address proofs like utility bills, bank statements, or rental agreements.

02

Fill in personal information: Provide accurate personal details such as your full name, date of birth, gender, and nationality. Make sure to double-check the information for any errors to avoid complications during the verification process.

03

Provide contact information: Include your current phone number and email address. This information is crucial as it allows the organization to communicate with you regarding the KYC process and any related updates.

04

Declare the purpose of the account: Briefly explain the reason behind opening the account or availing the service. It may be for personal use, business purposes, investment, or any other relevant purpose.

05

Submit proof of identity: Provide a legible copy of your identification document, ensuring that all the details are clearly visible. The document should be valid and not expired.

06

Submit proof of address: Attach a copy of a recent utility bill, bank statement, or any other official document that clearly shows your current residential address. Ensure that the document is not older than a few months.

07

Verify the provided information: Before submitting the form, carefully review all the details you have filled in to confirm their accuracy. Any mistakes or discrepancies might lead to delays in the KYC verification process.

08

Sign and date the form: Once you have reviewed and confirmed the accuracy of all the information provided, sign and date the KYC form in the designated spaces.

Who needs KYC?

01

Banks and financial institutions: KYC is crucial for banks and financial institutions to comply with regulatory requirements and prevent money laundering, fraud, and terrorist financing. It helps them verify the identity of their customers and assess potential risks associated with financial transactions.

02

Cryptocurrency exchanges: As the cryptocurrency market has gained popularity, KYC has become an essential step for most reputable cryptocurrency exchanges. This ensures that transactions are conducted securely and helps mitigate illegal activities within the crypto space.

03

Online payment platforms: Platforms that allow users to make online payments typically require KYC to authenticate the identity of their users. This adds a layer of security to transactions and reduces the risk of fraudulent activities.

04

Investment firms: Investment firms, including mutual funds, require KYC from their clients to comply with regulations and assess the suitability of potential investors. This helps protect both the investors and the firm from any financial risks.

05

Insurance companies: KYC is necessary for insurance companies to verify the identity and assess the risks associated with their policyholders. This enables them to provide accurate coverage and prevent fraudulent claims.

Note: The need for KYC may vary depending on the country and industry. It is always advisable to check with the specific organization or entity for their KYC requirements.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is kych?

KYC, or Know Your Customer, is a process used by financial institutions to verify the identity of their clients and assess potential risks for illegal activities such as money laundering or fraud.

Who is required to file kych?

Financial institutions such as banks, insurance companies, and investment firms are required to file KYC for their clients.

How to fill out kych?

To fill out KYC, clients need to provide identification documents such as passport or driver's license, proof of address, and sometimes additional documents depending on the requirements of the financial institution.

What is the purpose of kych?

The purpose of KYC is to prevent financial crimes such as money laundering, terrorist financing, and fraud by verifying the identity of clients and assessing the risks associated with them.

What information must be reported on kych?

Information reported on KYC includes client's name, date of birth, address, identification number, occupation, source of funds, and purpose of the account.

How can I edit kych form from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including kych form, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How can I send kych form to be eSigned by others?

Once your kych form is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

Where do I find kych form?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the kych form in seconds. Open it immediately and begin modifying it with powerful editing options.

Fill out your kych form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Kych Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.