Get the free tax compliance form - dfcs dhs georgia

Show details

TAX COMPLIANCE INSTRUCTIONS TO SUPPLIERS Please complete the following information: Suppliers Name: Physical Location Address: Federal Identification Number (FEI): Have you ever been registered in

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax compliance form

Edit your tax compliance form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax compliance form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax compliance form online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit tax compliance form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

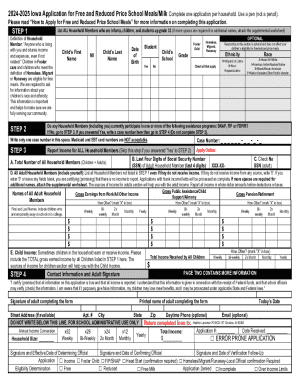

How to fill out tax compliance form

How to fill out tax compliance form:

01

First, gather all the necessary documents such as W-2 forms, 1099 forms, and any other relevant income or deduction records.

02

Carefully read the instructions accompanying the tax compliance form to understand the specific requirements and guidelines.

03

Begin by filling in your personal information, including your full name, social security number, and current address.

04

Provide details about your income sources, including wages, salaries, self-employment earnings, and any other taxable income.

05

Deduct any eligible expenses such as business expenses, education expenses, or any other deductions you qualify for.

06

Report any credits you are eligible for, such as the child tax credit or education credits.

07

Calculate your total tax liability by following the instructions provided. Take into account any taxes already withheld from your income.

08

If you owe taxes, include payment details or consider setting up a payment plan if necessary.

09

Double-check all the information you have entered to ensure accuracy and correctness.

10

Sign and date the tax compliance form before submitting it to the appropriate tax authorities.

Who needs tax compliance form:

01

Individuals who have earned income throughout the year are required to complete the tax compliance form.

02

Self-employed individuals, freelancers, and independent contractors need to fill out the tax compliance form to report their income and deductions.

03

Business owners, whether as sole proprietors or partners in a partnership, are also required to file a tax compliance form.

04

Corporations, both small and large, must complete the tax compliance form to report their income and tax liabilities.

05

Non-profit organizations and certain tax-exempt entities need to file the tax compliance form to maintain their tax-exempt status.

06

Generally, any individual or entity that is obligated to pay taxes or report income to the relevant tax authorities will need to fill out the tax compliance form.

Fill

form

: Try Risk Free

People Also Ask about

What is a tax information authorization form 8821?

Form 8821 authorizes the IRS to disclose your confidential tax information to the person you appoint. This form is provided for your convenience and its use is voluntary. The information is used by the IRS to determine what confidential tax information your appointee can inspect and/or receive.

What is US tax compliance certificate?

A tax clearance certificate is a document issued by a state government agency, usually the Department of Revenue. It certifies that a business or individual has met their tax obligations as of a certain date.

What is a tax information authorization?

A tax information authorization gives that person the legal right to review some confidential taxpayer information. A TIA relationship does not allow the representative to act on a taxpayer's behalf to resolve their tax issues with FTB.

What is a tax compliance document?

A Tax Compliance Certificate is a document issued by a Secretary of State or State Department of Revenue. The Tax Compliance Certificate is evidence that a Corporation, LLC or Non Profit is in Good Standing with respect to any tax returns due and taxes payable to the state.

What is a compliance letter from the IRS?

The IRS uses non-examination reviews called compliance checks to determine whether specific items have been reported properly.

Is form 8821 a power of attorney?

IRS Form 8821, Tax Information Authorization, allows you certain access to your client's information. In that way, it is similar to a power of attorney but grants less authority.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in tax compliance form?

The editing procedure is simple with pdfFiller. Open your tax compliance form in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I make edits in tax compliance form without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing tax compliance form and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

Can I create an electronic signature for signing my tax compliance form in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your tax compliance form right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

What is tax compliance form?

A tax compliance form is a document that individuals or businesses submit to report their tax obligations and ensure they comply with tax laws.

Who is required to file tax compliance form?

Individuals or businesses earning income and subject to taxation, including self-employed individuals and corporations, are typically required to file a tax compliance form.

How to fill out tax compliance form?

To fill out a tax compliance form, gather necessary financial information, accurately report income and deductions, follow the instructions provided with the form, and submit it by the deadline.

What is the purpose of tax compliance form?

The purpose of a tax compliance form is to provide the government with information about taxpayer income and expenditures to calculate tax liabilities and ensure compliance with tax laws.

What information must be reported on tax compliance form?

Information that must be reported includes taxpayer identification, total income, deductions, credits, and any tax payments made during the tax year.

Fill out your tax compliance form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Compliance Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.