Get the free SOLO 401K Real Estate Investment Purchase Authorization - mysolo401k

Show details

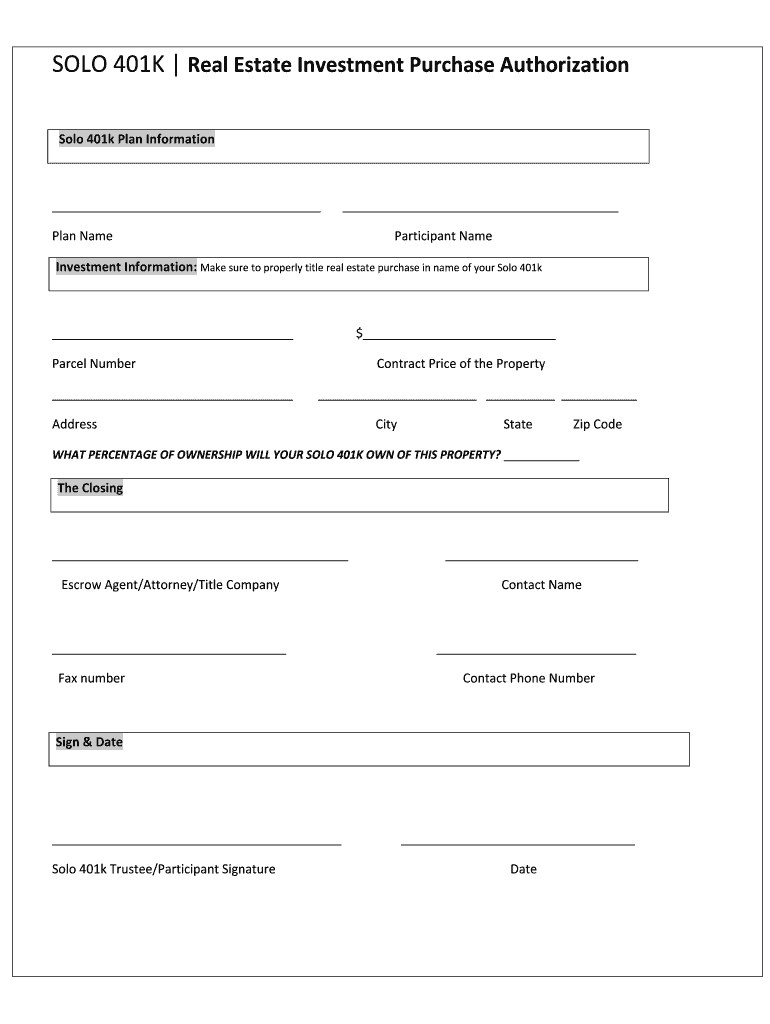

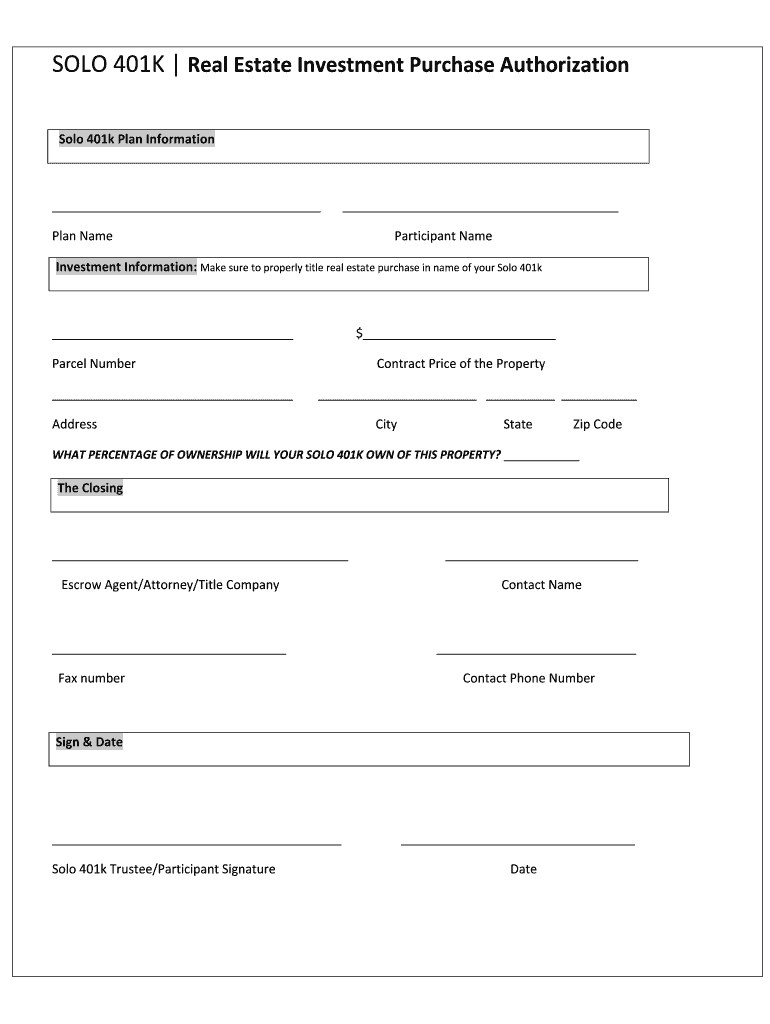

SOLO 401K Real Estate Investment Purchase Authorization ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign solo 401k real estate

Edit your solo 401k real estate form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your solo 401k real estate form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing solo 401k real estate online

To use our professional PDF editor, follow these steps:

1

Log into your account. It's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit solo 401k real estate. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out solo 401k real estate

How to fill out solo 401k real estate:

01

Determine your eligibility: Before filling out a solo 401k for real estate, you need to make sure you qualify for this type of retirement plan. Generally, solo 401k plans are available to self-employed individuals with no employees, or to business owners with a spouse who is also a participant in the plan.

02

Choose a provider: Look for a solo 401k provider that offers the option to invest in real estate. Not all providers allow for this type of investment, so make sure to compare different options and choose one that meets your needs.

03

Set up your solo 401k account: Once you have chosen a provider, you will need to fill out the necessary paperwork to establish your solo 401k account. This typically involves providing personal information, business details, and beneficiary designations.

04

Fund your account: After your solo 401k account is set up, you need to fund it. You can do this by making contributions from your self-employment income or by rolling over funds from other retirement accounts. The amount you can contribute is subject to annual limits set by the IRS.

05

Research and identify real estate investment opportunities: Once your solo 401k account is funded, you can start exploring real estate investment opportunities. Conduct thorough research, analyze the market, and consider factors such as location, potential return on investment, and risk before making a decision.

06

Complete the necessary documentation: When you find a real estate investment opportunity that aligns with your goals, you will need to complete the required documentation. This may include purchase agreements, loan applications, lease agreements, or any other relevant legal paperwork.

07

Execute the real estate investment: Once all the necessary documentation is in place, you can proceed with the real estate investment. This may involve purchasing a property, securing financing, or entering into a lease agreement, depending on the specific investment strategy you have chosen.

Who needs solo 401k real estate:

01

Self-employed individuals: Solo 401k plans are specifically designed for self-employed individuals who don't have any employees, or for business owners with a spouse who is also a participant in the plan. If you fall into these categories, and you have an interest in real estate investing, a solo 401k real estate can be a valuable tool for building wealth and saving for retirement.

02

Individuals looking for tax advantages: One of the benefits of a solo 401k real estate is the potential tax advantages it offers. Contributions to the plan are tax-deductible, and any income generated from real estate investments within the plan is tax-deferred or tax-free, depending on the type of account. This can result in significant tax savings for individuals who are actively involved in real estate investing.

03

Investors seeking diversification: Real estate can be a valuable addition to an investment portfolio, providing potential income and appreciation. By including real estate in a solo 401k, investors can diversify their holdings and potentially mitigate risk. This can be particularly appealing for individuals who already have a significant portion of their retirement savings invested in traditional assets like stocks and bonds.

04

Individuals interested in greater control: With a solo 401k real estate, individuals have greater control over their investment decisions compared to traditional retirement plans. This allows you to choose the properties or real estate projects that align with your investment strategy and goals. Having this level of control can be appealing to individuals who want to actively manage their retirement savings and have a hands-on approach to real estate investing.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit solo 401k real estate from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including solo 401k real estate, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

Can I create an eSignature for the solo 401k real estate in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your solo 401k real estate and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I fill out solo 401k real estate using my mobile device?

Use the pdfFiller mobile app to fill out and sign solo 401k real estate. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

What is solo 401k real estate?

Solo 401k real estate refers to using a self-employed 401k plan to invest in real estate.

Who is required to file solo 401k real estate?

Individuals who have a solo 401k plan and invest in real estate using that plan are required to report their real estate transactions.

How to fill out solo 401k real estate?

To fill out solo 401k real estate, one must report the details of the real estate transactions, including property address, purchase price, rental income, expenses, and any financing details.

What is the purpose of solo 401k real estate?

The purpose of solo 401k real estate is to provide self-employed individuals with a tax-advantaged way to invest in real estate for retirement savings.

What information must be reported on solo 401k real estate?

Information such as property address, purchase price, rental income, expenses, financing details, and any gains or losses from the real estate investment must be reported.

Fill out your solo 401k real estate online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Solo 401k Real Estate is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.