Get the free Property Tax Prepayment Plan Form - City of Vernon

Show details

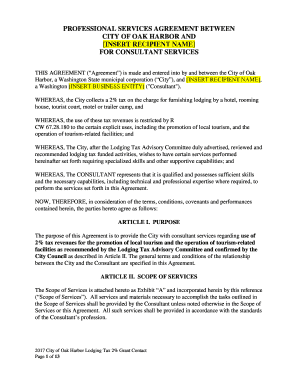

TAX PREPAYMENT PLAN AUTHORIZATION FORM *All outstanding property taxes must be paid in full to join the prepayment plan* First Name: Last Name: Folio Number: Birth Date: / / Start Date: / / DAY MONTH

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign property tax prepayment plan

Edit your property tax prepayment plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your property tax prepayment plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing property tax prepayment plan online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit property tax prepayment plan. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out property tax prepayment plan

How to fill out property tax prepayment plan:

01

Gather necessary documents: Before filling out a property tax prepayment plan, collect all relevant documents such as your property tax bill, income statements, and any other supporting documentation required by the taxing authority.

02

Understand the terms and conditions: Familiarize yourself with the terms and conditions of the property tax prepayment plan. This includes the interest rate, payment schedule, and any penalties or fees associated with early termination or missed payments.

03

Contact your local taxing authority: Reach out to your local taxing authority to inquire about their property tax prepayment plan options. They will provide you with the necessary forms or direct you to the online platform where you can access the forms.

04

Fill out the application form: Complete the application form provided by the taxing authority. Be sure to provide accurate and up-to-date information about your property, income, and any other required details. Double-check your entries to avoid errors.

05

Calculate your prepayment amount: Determine how much you want to prepay towards your property tax. You can choose to pay the full tax amount or a portion of it. Consider your financial situation and budget when deciding on the prepayment amount.

06

Submit the application: Once you have filled out the application form and determined the prepayment amount, submit it to the taxing authority through the designated method. This could be online submission, mail, or in-person submission at the taxing authority's office.

07

Review and confirmation: After submitting the application, carefully review the confirmation received from the taxing authority. Ensure that all the information provided is accurate and matches your intent. Contact the taxing authority if there are any discrepancies or concerns.

Who needs property tax prepayment plan:

01

Homeowners with financial stability: A property tax prepayment plan can be beneficial for homeowners who have a stable income and can afford to make advanced payments towards their property taxes. It allows them to plan their expenses and potentially reduce their financial burden in the future.

02

Individuals seeking tax deductions: Some jurisdictions offer tax deductions or incentives for prepaying property taxes. This can be advantageous for individuals who want to maximize their tax benefits and lower their overall tax liability.

03

Those facing impending financial difficulty: Property tax prepayment plans can also be helpful for individuals who anticipate upcoming financial hardships. By prepaying their property taxes when they have the means to do so, they can alleviate some financial strain during challenging times.

04

Individuals planning to sell their property: If you are considering selling your property in the near future, prepaying property taxes can be advantageous. It allows you to clear any outstanding tax obligations before transferring ownership to the buyer, streamlining the sale process.

05

Homeowners who prefer financial planning: Some homeowners simply prefer to plan their finances in advance. By participating in a property tax prepayment plan, they can spread out their tax payments over time, ensuring they have sufficient funds available when the taxes are due.

It is advisable to consult with a financial advisor or tax professional to understand if a property tax prepayment plan is suitable for your specific circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is property tax prepayment plan?

A property tax prepayment plan allows property owners to pay their property taxes in advance.

Who is required to file property tax prepayment plan?

Property owners who wish to pay their property taxes in advance may be required to file a property tax prepayment plan.

How to fill out property tax prepayment plan?

To fill out a property tax prepayment plan, property owners must provide information about their property and choose a prepayment plan option.

What is the purpose of property tax prepayment plan?

The purpose of a property tax prepayment plan is to allow property owners to spread out their property tax payments over time and potentially save money on interest charges.

What information must be reported on property tax prepayment plan?

Property owners must report information such as property address, assessed value, prepayment amount, and chosen prepayment plan option on the property tax prepayment plan.

How do I modify my property tax prepayment plan in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign property tax prepayment plan and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I get property tax prepayment plan?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific property tax prepayment plan and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How can I fill out property tax prepayment plan on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your property tax prepayment plan, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

Fill out your property tax prepayment plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Property Tax Prepayment Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.