Get the free Alternate Payee Information - Kentucky Retirement Systems - kyret ky

Show details

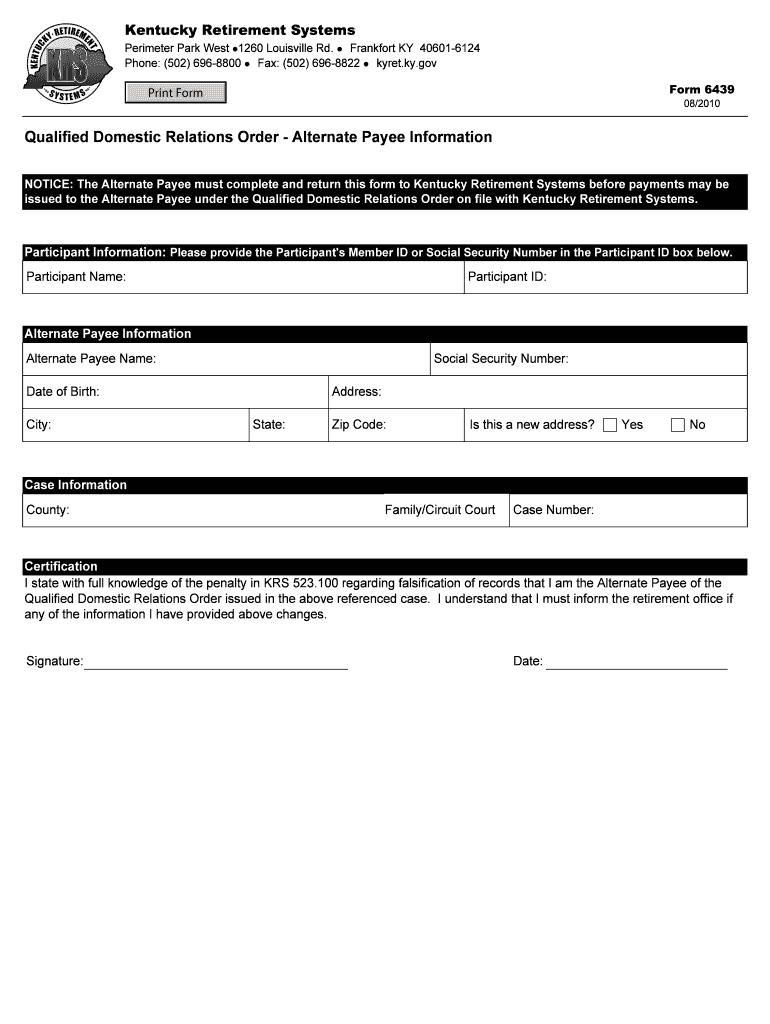

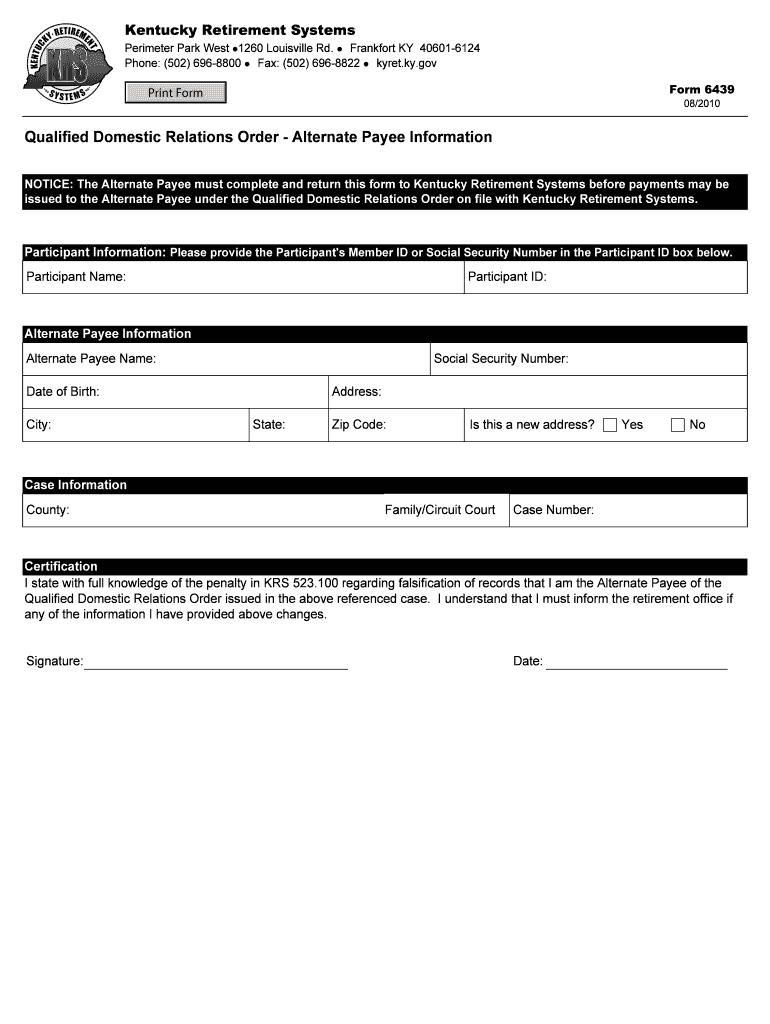

Kentucky Retirement Systems Perimeter Park West l1260 Louisville Rd. l Frankfort KY 40601-6124 Phone: (502) 696-8800 l Fax: (502) 696-8822 l yet.KY.gov Form 6439 Print Form 08/2010 Qualified Domestic

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign alternate payee information

Edit your alternate payee information form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your alternate payee information form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing alternate payee information online

Use the instructions below to start using our professional PDF editor:

1

Sign into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit alternate payee information. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out alternate payee information

How to fill out alternate payee information:

01

Gather the necessary information: Before starting to fill out the alternate payee information, make sure you have all the relevant details. This may include the name and contact information of the alternate payee, their relationship to the primary party (such as a former spouse or dependant), and any specific instructions or requirements provided by the entity requesting the information.

02

Understand the purpose of the form: Different organizations or entities might have their own specific forms or requirements for collecting alternate payee information. It is important to carefully read the instructions and understand why the information is being requested. This will help ensure that you provide accurate and relevant details.

03

Provide accurate personal information: Fill in the appropriate fields with accurate personal information for the alternate payee. This may include their full name, address, phone number, social security number, or other identification numbers as required. Double-check for any spelling errors or typos to avoid any complications or delays.

04

Indicate the relationship: As part of the alternate payee information, it is important to clearly state the relationship between the alternate payee and the primary party. This could be a former spouse, a dependant, or any other relevant connection. The organization may require additional documentation, such as marriage certificates, divorce decrees, or court orders, to verify the relationship.

05

Provide necessary financial details: Depending on the purpose of requesting alternate payee information, there may be a need to provide specific financial details. These can include bank account numbers, routing numbers, or other financial institution information if the alternate payee is eligible to receive payments. Ensure that all financial information is accurate and up to date.

Who needs alternate payee information:

01

Pension plans or retirement accounts: In cases of divorce or separation, where a portion of the primary party's pension or retirement benefits are awarded to an alternate payee, the pension plan administrator will typically require alternate payee information to process the division of benefits.

02

Insurance companies: In certain situations, insurance companies may need alternate payee information when processing claims or determining beneficiary payments. This could occur when an insurance policy has been assigned to someone other than the policyholder.

03

Government agencies: Various government agencies, such as the Social Security Administration or the Department of Veteran Affairs, may require alternate payee information to disburse certain benefits to designated individuals who are not the primary recipients.

04

Child support or alimony arrangements: In cases of court-ordered child support or alimony, alternate payee information may be necessary for both parties involved to ensure proper payment processing. This is typically required by the relevant government agency or court system.

05

Other financial institutions or organizations: Depending on the specific circumstances, other financial institutions, such as banks, investment firms, or loan providers, may require alternate payee information to facilitate specific financial transactions or approvals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute alternate payee information online?

Filling out and eSigning alternate payee information is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I edit alternate payee information in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing alternate payee information and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

Can I create an electronic signature for the alternate payee information in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your alternate payee information in seconds.

What is alternate payee information?

Alternate payee information is information regarding an individual who is entitled to receive benefits from a retirement plan as a result of a qualified domestic relations order (QDRO).

Who is required to file alternate payee information?

The plan administrator of the retirement plan is required to file alternate payee information.

How to fill out alternate payee information?

Alternate payee information can be filled out by providing the necessary details of the alternate payee, such as their name, address, social security number, and the relationship between the alternate payee and the participant.

What is the purpose of alternate payee information?

The purpose of alternate payee information is to ensure that the benefits due to the alternate payee are accurately paid out in accordance with the terms of the QDRO.

What information must be reported on alternate payee information?

The alternate payee information must include the name, address, social security number, and relationship to the participant of the alternate payee, as well as details of the QDRO.

Fill out your alternate payee information online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Alternate Payee Information is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.