Get the free Aging of Accounts Receivable - bpostsuretybondsbbcomb

Show details

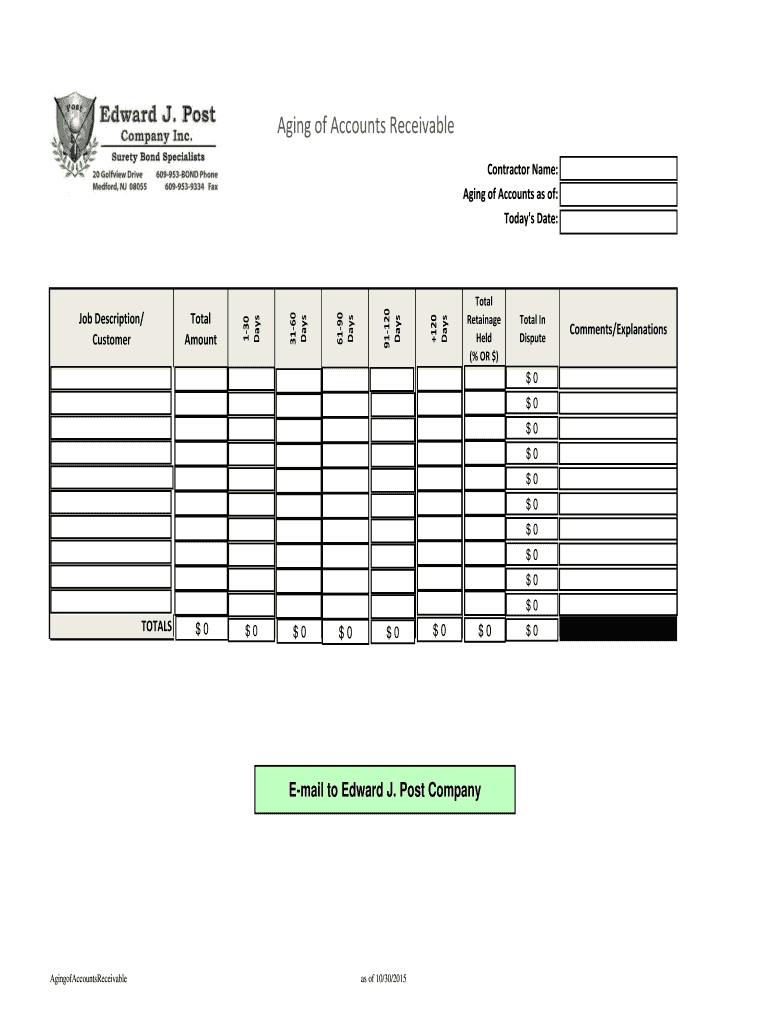

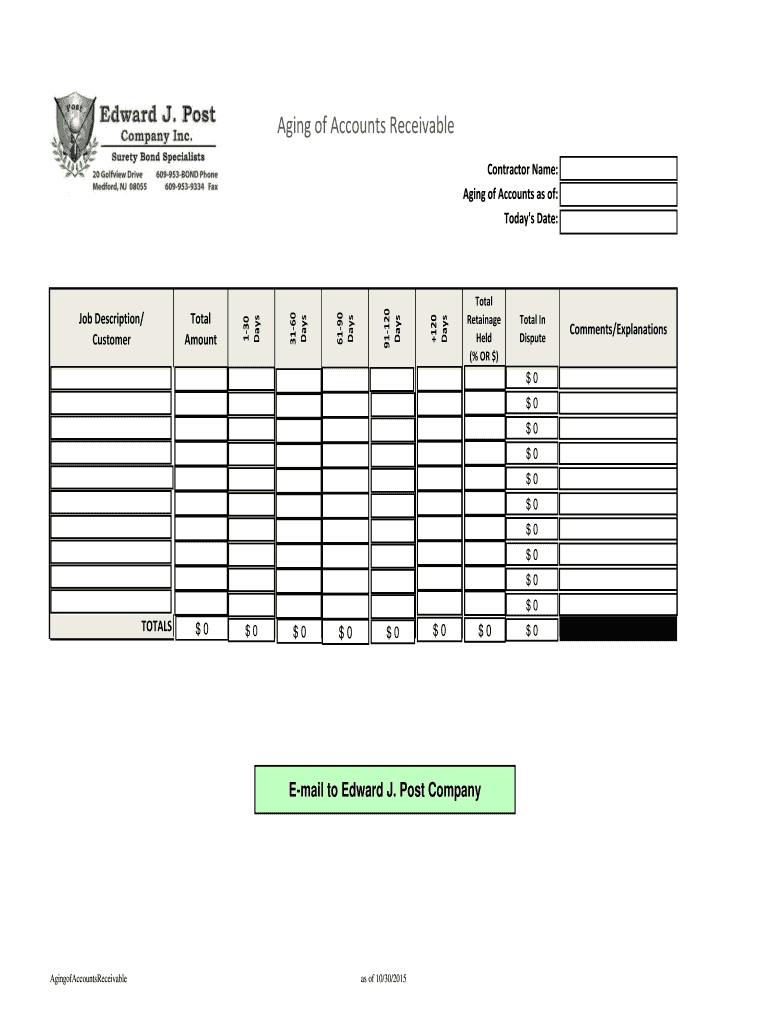

1-30 Days. 31-60 61-90 91-120 +120 Total Retain age ... Total In Dispute: Comments/Explanations.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign aging of accounts receivable

Edit your aging of accounts receivable form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your aging of accounts receivable form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing aging of accounts receivable online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit aging of accounts receivable. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out aging of accounts receivable

How to fill out aging of accounts receivable:

01

Gather all the relevant data: Start by collecting all the necessary information related to accounts receivable, including invoices, payments received, and any outstanding balances. This will help you determine the aging of the accounts.

02

Categorize by time periods: Divide the accounts receivable into different time periods, typically 30, 60, 90, and 120+ days. This categorization will provide a clear picture of the aging of the accounts and help you identify any potential issues or areas of improvement.

03

Calculate outstanding balances: For each time period category, calculate the total amount of outstanding balances. This will give you an overview of the amount of money owed to the company and the average time it takes to collect payments.

04

Analyze and interpret the results: Once the aging of accounts receivable is complete, analyze the data to identify any trends, patterns, or anomalies. For example, you may notice a significant number of overdue payments in a specific time period, indicating potential collection issues.

Who needs aging of accounts receivable:

01

Businesses: Aging of accounts receivable is crucial for businesses of all sizes and industries. It helps them monitor their cash flow, identify potential bad debts, and take appropriate actions to collect outstanding payments.

02

Creditors: Creditors, such as banks or financial institutions, may request aging of accounts receivable to assess the creditworthiness of a company. It provides insights into their ability to collect outstanding payments and manage their finances effectively.

03

Investors: Investors often analyze aging of accounts receivable to evaluate the financial health and performance of a company. It gives them an understanding of the company's liquidity, profitability, and potential risks associated with outstanding receivables.

In conclusion, filling out aging of accounts receivable involves gathering relevant data, categorizing accounts by time periods, calculating outstanding balances, and analyzing the results. This information is essential for businesses, creditors, and investors to manage cash flow, assess creditworthiness, and evaluate financial performance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get aging of accounts receivable?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the aging of accounts receivable in seconds. Open it immediately and begin modifying it with powerful editing options.

How can I fill out aging of accounts receivable on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your aging of accounts receivable, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

Can I edit aging of accounts receivable on an Android device?

You can make any changes to PDF files, such as aging of accounts receivable, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is aging of accounts receivable?

Aging of accounts receivable is a process of categorizing and analyzing invoices or outstanding payments based on their age from the due date.

Who is required to file aging of accounts receivable?

Businesses and organizations that have accounts receivable are required to file aging of accounts receivable.

How to fill out aging of accounts receivable?

To fill out aging of accounts receivable, you need to categorize outstanding payments into different age brackets based on how long they have been overdue.

What is the purpose of aging of accounts receivable?

The purpose of aging of accounts receivable is to track and manage overdue payments, identify potential bad debts, and improve cash flow.

What information must be reported on aging of accounts receivable?

The information reported on aging of accounts receivable typically includes customer name, invoice number, original due date, current balance, and the number of days past due.

Fill out your aging of accounts receivable online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Aging Of Accounts Receivable is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.