Get the free Analyzing Business Loans - CU Business Group - cubusinessgroup

Show details

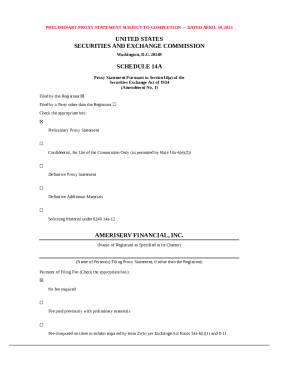

Analyzing Business Loans Course Overview Program Level: Basic Delivery Method: Group-Live Prerequisite: Basic understanding of business loans and accounting Advanced Preparation: Review your credit

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign analyzing business loans

Edit your analyzing business loans form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your analyzing business loans form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit analyzing business loans online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit analyzing business loans. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out analyzing business loans

How to fill out analyzing business loans:

01

Start by gathering all the necessary financial documents for your business, such as income statements, balance sheets, and cash flow statements.

02

Analyze your business's current financial situation and identify any strengths or weaknesses that may impact your ability to secure a loan.

03

Assess your business's creditworthiness by reviewing your credit score and credit history. Pay any outstanding debts or bills to improve your credit standing.

04

Research different loan options available to businesses and compare interest rates, terms, and repayment schedules.

05

Determine the amount of money you need to borrow and prepare a detailed business plan that outlines how you will use the loan funds and repay the loan.

06

Fill out the loan application accurately and completely, providing all required information and supporting documents.

07

Submit the loan application to the lender or financial institution, making sure to follow any specific instructions or requirements.

08

Await a response from the lender and be prepared to provide additional information or documentation if requested.

09

Carefully review the terms and conditions of any loan offer before accepting or rejecting it.

10

If approved, use the loan funds responsibly and make timely payments to repay the loan as agreed.

Who needs analyzing business loans:

01

Small business owners who are looking to expand their operations or invest in new equipment or technology.

02

Startups and entrepreneurs who need capital to launch their business or bring a new product to market.

03

Established businesses that are experiencing financial difficulties and need a loan to help them stabilize and grow.

04

Companies seeking to acquire another business or merge with a competitor.

05

Business owners who want to refinance their existing debt or consolidate multiple loans into a single payment.

06

Industries and sectors that require significant upfront capital investment, such as manufacturing, construction, or technology.

07

Businesses looking to take advantage of growth opportunities or respond to market changes and trends.

08

Entrepreneurs seeking funding to support research and development efforts or pursue new innovations.

09

Non-profit organizations that require funding to support their programs and initiatives.

10

Any business owner or manager who wants to evaluate their company's financial health and make informed decisions about their borrowing needs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send analyzing business loans for eSignature?

analyzing business loans is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How can I edit analyzing business loans on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing analyzing business loans.

How do I fill out the analyzing business loans form on my smartphone?

Use the pdfFiller mobile app to complete and sign analyzing business loans on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

Fill out your analyzing business loans online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Analyzing Business Loans is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.