Get the free Homebuying Checklist - Prudential Locations

Show details

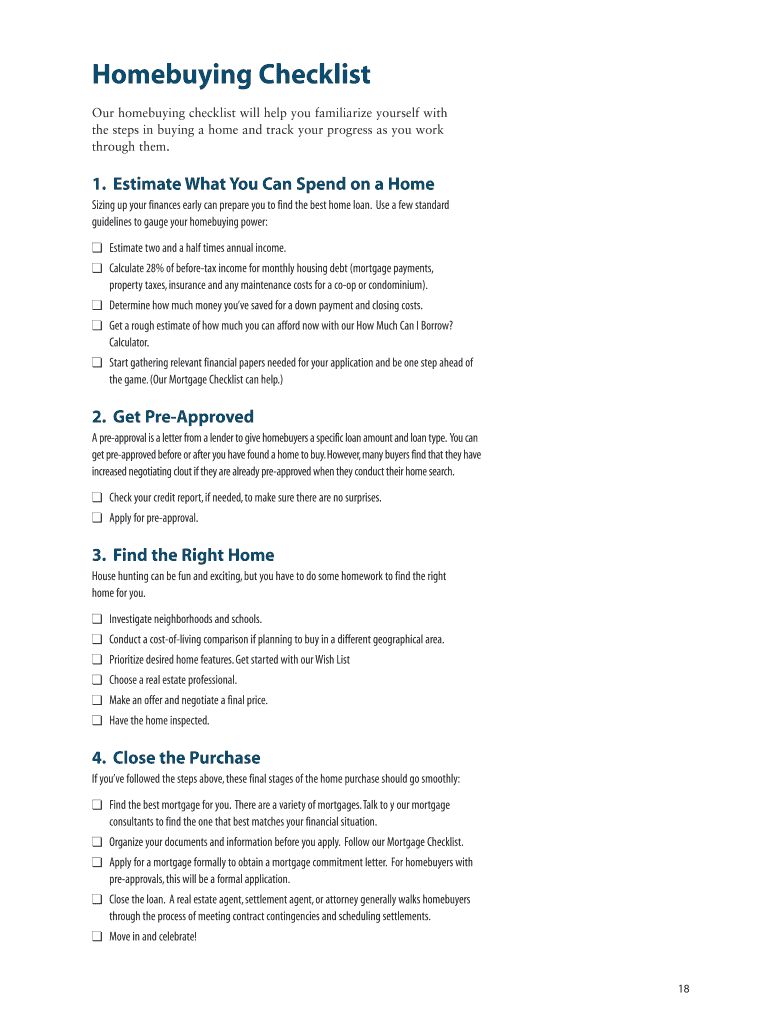

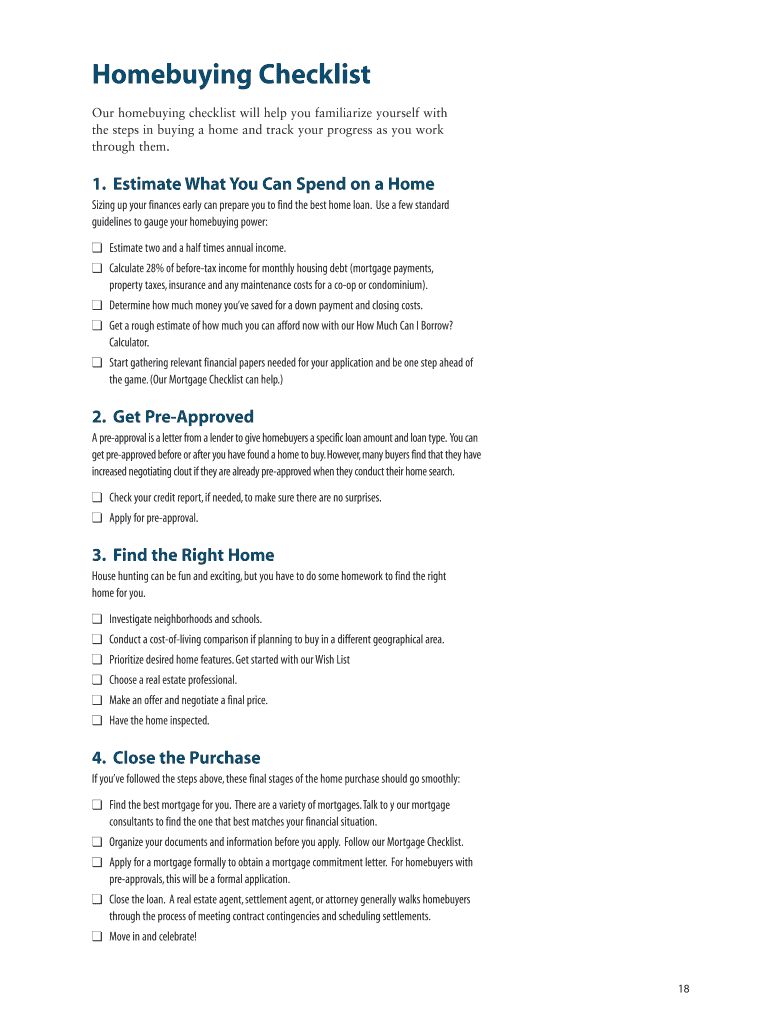

Home buying Checklist Our home buying checklist will help you familiarize yourself with the steps in buying a home and track your progress as you work through them. 1. Estimate What You Can Spend

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign homebuying checklist - prudential

Edit your homebuying checklist - prudential form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your homebuying checklist - prudential form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing homebuying checklist - prudential online

Follow the guidelines below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit homebuying checklist - prudential. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out homebuying checklist - prudential

How to Fill Out Homebuying Checklist - Prudential:

01

Start by gathering all the necessary documents and information. This includes proof of income, employment and tax documents, credit history, and any other relevant financial information.

02

Research the housing market and determine your budget. Consider factors such as the location, size, amenities, and condition of the property you are looking for, and ensure that it aligns with your financial capabilities.

03

Take a close look at your financial situation and determine how much you can afford for a down payment, closing costs, and monthly mortgage payments. Prudential can assist you in understanding various home affordability options and determining the appropriate price range for buying a home.

04

Make a list of your desired features and characteristics in a home. This may include the number of bedrooms and bathrooms, proximity to schools or transportation, and any specific requirements you may have.

05

Begin attending open houses or scheduling private tours of properties that meet your criteria. Take detailed notes and compare different options to ensure you choose the best fit for your needs and preferences.

06

Consult with a Prudential real estate professional who can guide you through the homebuying process and provide expert advice. They can help you understand the checklist requirements specific to Prudential, as well as any additional steps or considerations that may be necessary.

07

Once you have found the perfect home, complete the necessary paperwork, including the purchase agreement and any additional contracts or disclosures. Prudential can provide assistance in reviewing and completing these documents accurately.

08

Conduct a thorough home inspection to identify any potential issues or repairs that may need to be addressed. Consider obtaining a home warranty for added protection.

09

Work with Prudential to secure financing, such as a mortgage loan, that aligns with your specific needs and financial situation. They can help you understand the different loan options available and assist you throughout the loan application and approval process.

10

Finally, review and complete the homebuying checklist provided by Prudential, ensuring that all the necessary steps have been followed and requirements met.

Who Needs Homebuying Checklist - Prudential?

01

First-time homebuyers who are navigating the homebuying process for the first time and may need guidance on the necessary steps and requirements.

02

Individuals who are considering purchasing a home but are unsure of the specific checklist requirements and steps involved.

03

Those seeking professional assistance and advice throughout the homebuying process to ensure a smooth and successful transaction.

Remember, Prudential is there to provide expert guidance and support during your homebuying journey, helping you navigate through the checklist requirements and make informed decisions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my homebuying checklist - prudential in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign homebuying checklist - prudential and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I make changes in homebuying checklist - prudential?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your homebuying checklist - prudential to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

Can I create an eSignature for the homebuying checklist - prudential in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your homebuying checklist - prudential and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

What is homebuying checklist - prudential?

The homebuying checklist - prudential is a list of requirements and information needed for purchasing a home with Prudential.

Who is required to file homebuying checklist - prudential?

Anyone who is buying a home with Prudential is required to file the homebuying checklist.

How to fill out homebuying checklist - prudential?

The homebuying checklist - prudential can be filled out online via the Prudential website or by contacting a Prudential representative for assistance.

What is the purpose of homebuying checklist - prudential?

The purpose of the homebuying checklist - prudential is to ensure that all necessary information and requirements are met during the homebuying process.

What information must be reported on homebuying checklist - prudential?

The homebuying checklist - prudential may include information such as personal details, financial information, property details, and documentation.

Fill out your homebuying checklist - prudential online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Homebuying Checklist - Prudential is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.