Get the free 2003 - 3533. Tax Form

Show details

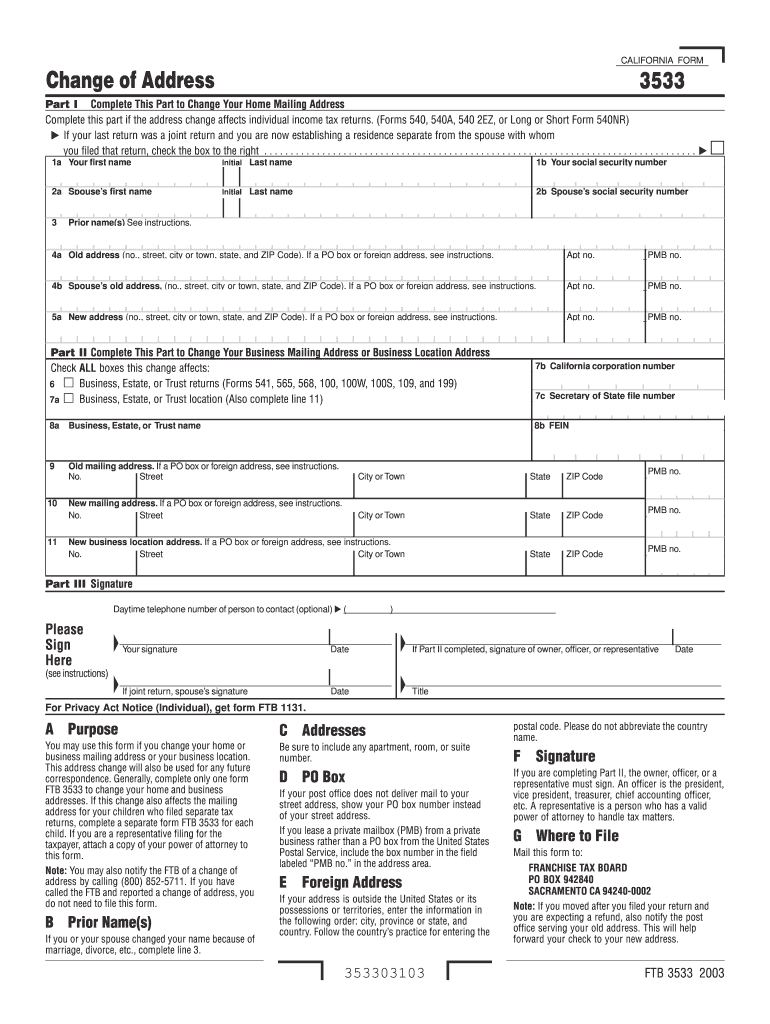

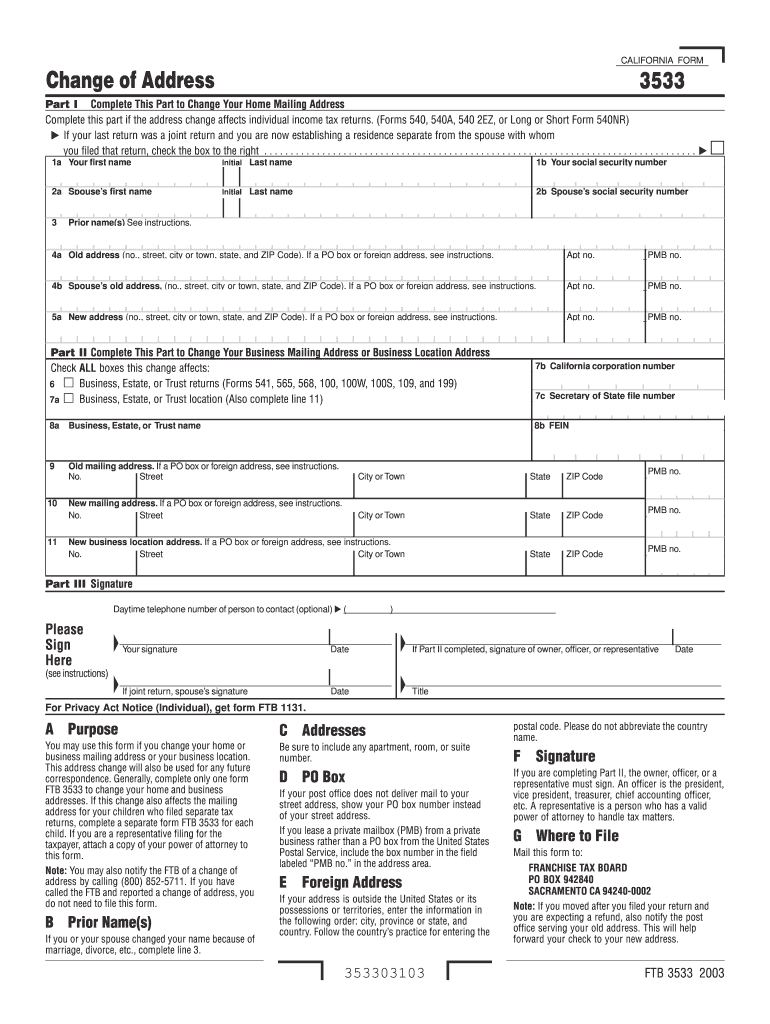

FT 3533 2003 1a Your first name ... Change of Address CALIFORNIA FORM 3533 353303103- ... (Forms 540, 540A, 540 2EZ, or Long or Short Form 540NR)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2003 - 3533 tax

Edit your 2003 - 3533 tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2003 - 3533 tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2003 - 3533 tax online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit 2003 - 3533 tax. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2003 - 3533 tax

How to fill out 2003 - 3533 tax?

01

Gather all the necessary documents and information: Before filling out the 2003 - 3533 tax form, make sure you have gathered all the required documents and information. This may include your W2s, 1099s, receipts, bank statements, and any other relevant financial records.

02

Understand the instructions: Read through the instructions provided with the 2003 - 3533 tax form carefully. Familiarize yourself with the different sections, lines, and requirements mentioned in the form.

03

Fill in your personal information: Begin by entering your personal information at the top of the form, such as your name, address, Social Security number, and any other requested details. Ensure that you provide accurate information to avoid any complications.

04

Report your income: Proceed to report your income in the appropriate sections. Depending on your situation, you may need to report different types of income, such as wages, self-employment income, dividends, or interest. Review the instructions for each section and provide the necessary figures.

05

Deductions and credits: Take advantage of any available deductions and credits. The form will have designated sections where you can claim deductions and credits to reduce your tax liability. Properly document and calculate these amounts to ensure accuracy.

06

Calculate your tax liability: After completing the income, deductions, and credits sections, calculate your tax liability. Use the provided tables or formulas, based on your specific situation, to determine the amount you owe to the IRS. Double-check your calculations to avoid errors.

07

Review and sign the form: Before submitting your 2003 - 3533 tax form, carefully review all the information you have entered. Make sure there are no mistakes or missing details. Once you are certain that everything is accurate, sign and date the form as required.

Who needs 2003 - 3533 tax?

01

Individuals: Individuals who have a specific tax year falling within the range of 2003 - 3533 may need to fill out this tax form. This includes those who have income from various sources and need to report it to the IRS.

02

Self-employed individuals: Self-employed individuals, such as freelancers or independent contractors, who have earned income during this specific tax year may also need to fill out the 2003 - 3533 tax form. They are required to report their business income, expenses, and deductions accurately.

03

Taxpayers with specific tax situations: Certain taxpayers may have specific tax situations that require them to file the 2003 - 3533 tax form. This can include individuals who have received certain types of income, such as rental income or capital gains, or those who qualify for specific deductions and credits.

It is important to consult the IRS guidelines and instructions or seek professional help to determine if you need to fill out the 2003 - 3533 tax form based on your individual circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 2003 - 3533 tax directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your 2003 - 3533 tax and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I execute 2003 - 3533 tax online?

pdfFiller has made it easy to fill out and sign 2003 - 3533 tax. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How can I fill out 2003 - 3533 tax on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your 2003 - 3533 tax from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is 3533 tax form?

The 3533 tax form is a document used by individuals to report income earned from sources other than an employer.

Who is required to file 3533 tax form?

Individuals who have received income from sources such as freelance work, rental properties, or investments are required to file the 3533 tax form.

How to fill out 3533 tax form?

To fill out the 3533 tax form, individuals must provide information about their income from non-employer sources, deductions, and submit the form to the IRS.

What is the purpose of 3533 tax form?

The purpose of the 3533 tax form is to report income earned from sources other than traditional employment and calculate any taxes owed on that income.

What information must be reported on 3533 tax form?

The 3533 tax form requires individuals to report all income earned from non-employer sources, including any deductions or credits that apply.

Fill out your 2003 - 3533 tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2003 - 3533 Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.