Get the free cash flow analysis

Show details

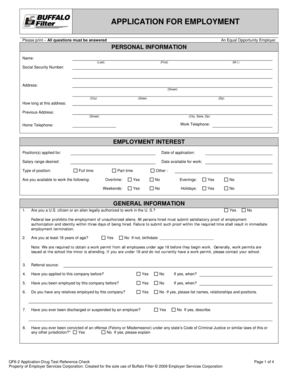

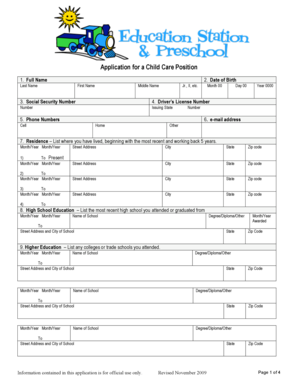

Este documento es una hoja de trabajo para que los prestamistas evalúen el ingreso personal de un prestatario autónomo, utilizando los ingresos o pérdidas de sus declaraciones de impuestos personales

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign cash flow analysis

Edit your cash flow analysis form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cash flow analysis form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit cash flow analysis online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit cash flow analysis. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out cash flow analysis

How to fill out self employed worksheet Fannie:

01

Gather all necessary information and documentation, such as income statements, tax returns, and business expenses.

02

Complete the "Income" section of the worksheet by entering your total gross income from self-employment, dividends, interest, and any other sources.

03

Deduct any allowable expenses related to your self-employment, such as business expenses and deductions.

04

Calculate your net self-employment income by subtracting the total expenses from the gross income.

05

Move on to the "Expenses" section and fill out the worksheet by listing all the expenses related to your self-employment, including travel expenses, office supplies, and advertising costs.

06

Include any additional information required by Fannie Mae, such as business activity descriptions or explanations for any irregularities in your income or expenses.

07

Double-check all the figures and ensure that you have accurately filled out all sections of the worksheet.

08

Sign and date the worksheet to certify the accuracy of the information provided.

Who needs self employed worksheet Fannie:

01

Individuals who are self-employed and seeking a mortgage loan.

02

Borrowers who need to provide documentation of their self-employment income for Fannie Mae.

03

Mortgage lenders and underwriters who require a comprehensive understanding of a self-employed borrower's income and expenses before approving a loan.

Fill

form

: Try Risk Free

People Also Ask about

How do you calculate self-employed income for a mortgage?

To calculate your self-employment income for a mortgage application, follow these simple steps: Find your net income from Schedule C on your tax returns for the two most recent years. Add the two figures together. Divide the result by 24.

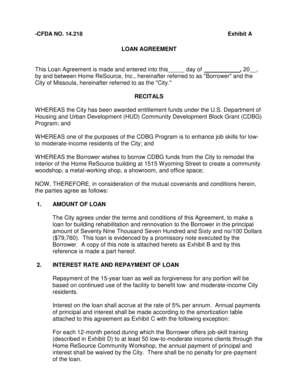

What is Form 1084 used for?

This worksheet may be used to prepare a written evaluation of the analysis of income related to self-employment. The purpose of this written analysis is to determine the amount of stable and continuous income that will be available to the borrower for loan qualifying purposes. 5.

What is the Form 1084?

This worksheet may be used to prepare a written evaluation of the analysis of income related to self-employment. The purpose of this written analysis is to determine the amount of stable and continuous income that will be available to the borrower for loan qualifying purposes. 5.

Which type of income documentation is acceptable for a self-employed borrower?

Proof of income For homebuyers with a traditional job, paystubs and W-2s serve as proof of regular income. But for self-employed individuals, income records could include: Two years of personal tax returns. Two years of business tax returns including schedules K-1, 1120, 1120S.

How do underwriters verify income for self-employed?

The lender may verify a self-employed borrower's employment and income by obtaining from the borrower copies of their signed federal income tax returns (both individual returns and in some cases, business returns) that were filed with the IRS for the past two years (with all applicable schedules attached).

What tax forms do I need for self-employment?

In order to report your Social Security and Medicare taxes, you must file Schedule SE (Form 1040 or 1040-SR ), Self-Employment TaxPDF. Use the income or loss calculated on Schedule C to calculate the amount of Social Security and Medicare taxes you should have paid during the year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit cash flow analysis straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing cash flow analysis right away.

How do I fill out cash flow analysis using my mobile device?

Use the pdfFiller mobile app to fill out and sign cash flow analysis. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

How do I edit cash flow analysis on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share cash flow analysis on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is self employed worksheet fannie?

The Self Employed Worksheet for Fannie Mae is a document used by self-employed individuals to report their income and financial information when applying for a mortgage. It helps lenders assess the borrower's ability to repay the loan.

Who is required to file self employed worksheet fannie?

Self-employed individuals seeking a mortgage through Fannie Mae are required to file the Self Employed Worksheet. This includes individuals who operate their own businesses or have freelance income.

How to fill out self employed worksheet fannie?

To fill out the Self Employed Worksheet, an applicant should gather their financial documents, including profit and loss statements, business tax returns, and other relevant income information. Following the instructions on the worksheet, they will input their earnings, expenses, and net income.

What is the purpose of self employed worksheet fannie?

The purpose of the Self Employed Worksheet for Fannie Mae is to provide a structured format for self-employed borrowers to report their income and expenses, helping lenders evaluate their financial stability and lending risk.

What information must be reported on self employed worksheet fannie?

Information that must be reported on the Self Employed Worksheet includes gross income, operating expenses, net income, business tax returns, and any other sources of income or deductions that could impact the borrower's financial profile.

Fill out your cash flow analysis online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cash Flow Analysis is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.