Get the free com VAT no

Show details

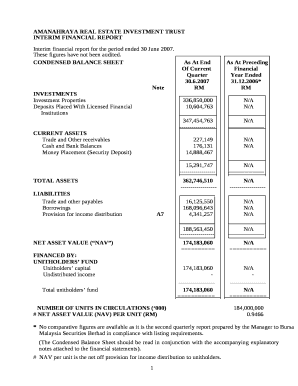

Highway Pinball Limited Units 34 Cyfarthfa Industrial Estate Martyr Tail CF47 8PE UK Company Number 8087382 Tel: +44 (0) 1685 370190 Fax: +44 (0) 1685 377238 Email: info heighwaypinball.com Web: www.heighwaypinball.com

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign com vat no

Edit your com vat no form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your com vat no form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing com vat no online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit com vat no. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out com vat no

How to fill out com vat no:

01

First, gather all the necessary information required to fill out the com vat no form. This may include your company's registered name, address, tax identification number, and any other relevant details.

02

Next, visit the official website of your country's taxation authority or the specific department responsible for handling VAT registrations.

03

Look for the appropriate form or online registration portal to fill out for com vat no.

04

Carefully enter all the required information into the designated fields on the form. Take your time to ensure accuracy and double-check all the details before submitting.

05

Provide any supporting documents or additional information that may be requested during the registration process. This could include copies of relevant business or tax-related documents.

06

If there are any specific instructions or guidelines provided by the taxation authority, make sure to follow them closely while filling out the form.

07

Once you have completed the form and attached the necessary documents, submit it as per the instructions provided. This may involve submitting the form online or mailing it to the relevant authority.

08

After submission, you may receive a confirmation or acknowledgement of your com vat no application. Keep this for future reference and follow any further instructions provided.

Who needs com vat no:

01

Businesses or individuals engaged in selling goods or services are typically required to obtain a com vat no. This registration number helps the taxation authorities track and monitor the collection and payment of value-added tax (VAT).

02

Companies or individuals involved in cross-border trade, including imports and exports, usually need a com vat no to comply with international tax regulations and ensure proper invoicing and tax reporting.

03

Businesses that exceed a certain annual turnover threshold, as defined by the taxation authority, may be required to register for a com vat no. This threshold varies by country and should be checked according to the specific jurisdiction.

04

Even if a business is not currently required to register for VAT, obtaining a com vat no voluntarily can often provide advantages, such as reclaiming VAT on eligible expenses or easily conducting business with other VAT-registered entities.

05

It's essential to consult with a qualified tax advisor or refer to the specific regulations of your country to determine if you need a com vat no and the exact requirements for registration.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is com vat no?

Com VAT no stands for Company Value Added Tax Number. It is a unique identification number assigned to companies registered for VAT.

Who is required to file com vat no?

All companies registered for VAT are required to file com VAT no.

How to fill out com vat no?

Com VAT no can be filled out online through the official VAT portal of the respective country.

What is the purpose of com vat no?

The purpose of com VAT no is to track and monitor VAT transactions of companies.

What information must be reported on com vat no?

Com VAT no typically requires reporting of company details, VAT transactions, and total VAT amount.

How can I send com vat no for eSignature?

Once your com vat no is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Can I create an electronic signature for the com vat no in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your com vat no in minutes.

How can I edit com vat no on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing com vat no right away.

Fill out your com vat no online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Com Vat No is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.