Get the free Deduct the following INSTANT CASHDeduct the following ...

Show details

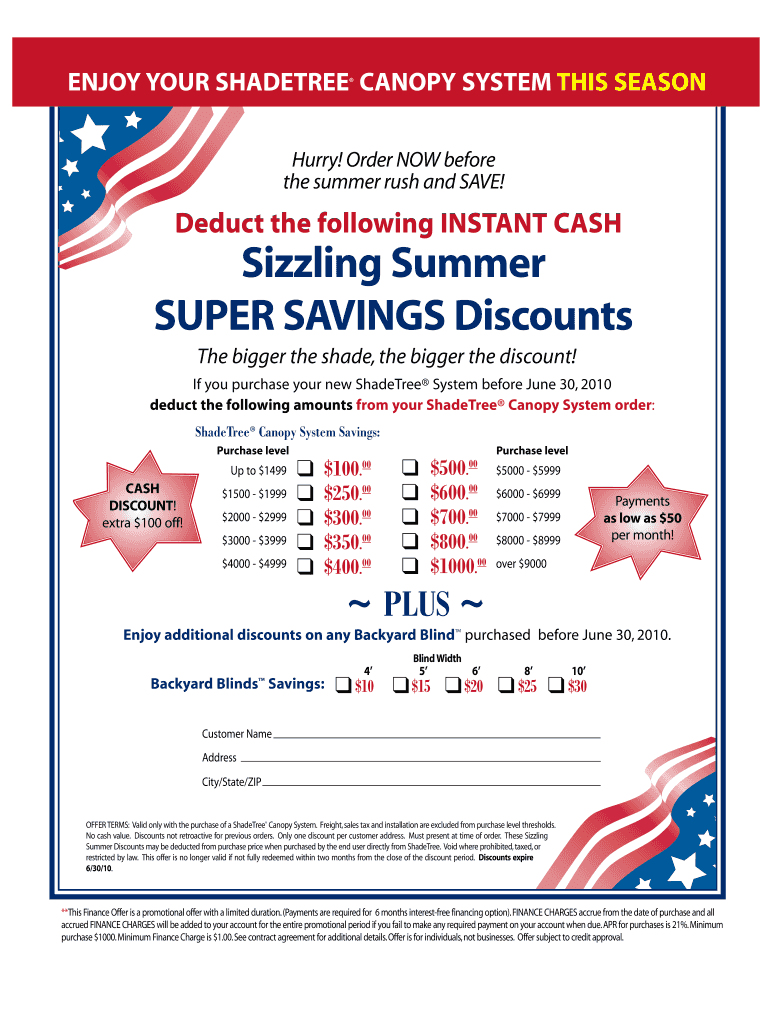

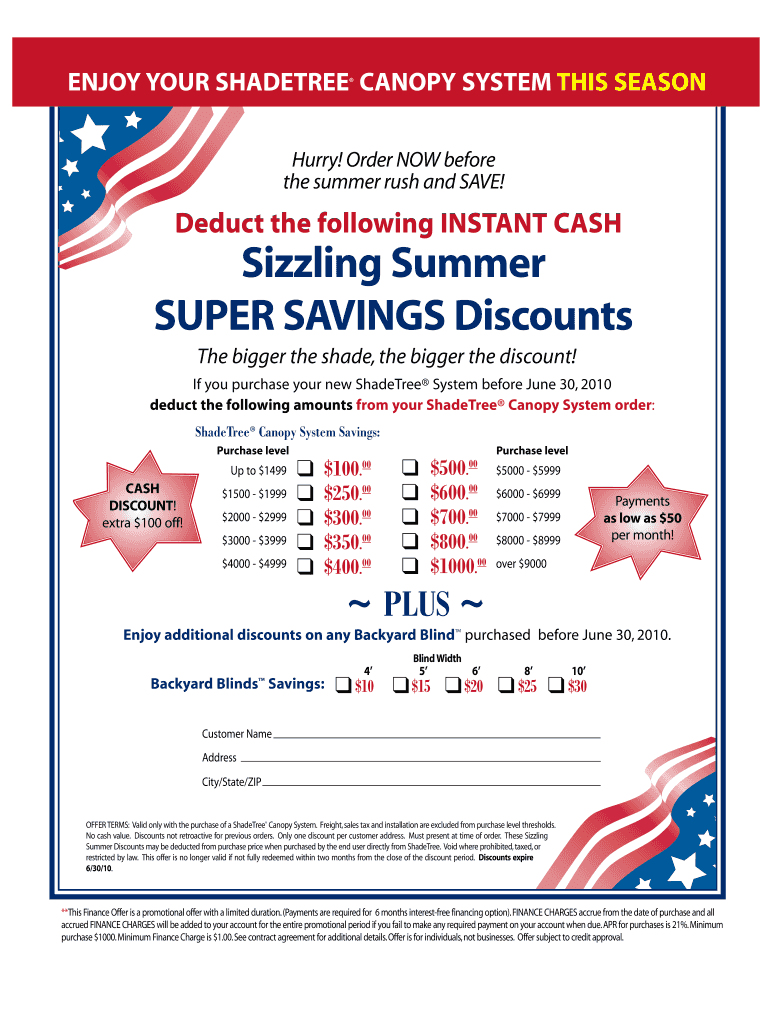

ENJOY YOUR SHOETREE CANOPY SYSTEM THIS SEASON Hurry! Order NOW before the summer rush and SAVE! Deduct the following INSTANT CASH Sizzling Summer SUPER SAVINGS Discounts The bigger the shade, the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign deduct form following instant

Edit your deduct form following instant form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your deduct form following instant form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit deduct form following instant online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit deduct form following instant. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out deduct form following instant

How to Fill Out Deduct Form Following Instant:

01

Obtain the deduct form following instant from the concerned authority or download it from their official website.

02

Begin by carefully reading the instructions provided on the form to understand the specific requirements and guidelines.

03

Ensure that you have all the necessary documents and information required to fill out the form accurately. This may include personal identification details, financial records, or any supporting documents relevant to the deduction.

04

Clearly write or type your personal information such as name, address, contact details, and any other required identification information in the designated sections of the form.

05

Follow the instructions provided to accurately report the nature of the expense for which you are claiming the deduction. This may involve providing detailed explanations, attaching receipts or invoices, and specifying relevant amounts or percentages.

06

Double-check your entries to avoid any errors or omissions that may affect the validity of your deduction claim.

07

Sign and date the form in the designated area to validate your submission.

08

Make a copy of the completed form and any attached documents for your records before submitting it to the appropriate authority.

Who Needs Deduct Form Following Instant?

01

Individuals who have incurred expenses that are eligible for deduction according to the relevant tax or financial regulations.

02

Business owners or professionals who have incurred business-related expenses that qualify for deductions.

03

Taxpayers who have participated in specific programs or activities that offer deductions for certain expenses, such as education, healthcare, or charitable contributions.

04

Anyone who wants to claim deductions on their tax return or seek reimbursement for qualified expenses from a relevant institution or organization.

Remember to consult with a tax professional or seek guidance from the appropriate authority if you have any specific questions or uncertainties regarding filling out the deduct form following instant.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send deduct form following instant for eSignature?

When your deduct form following instant is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I make changes in deduct form following instant?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your deduct form following instant to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I edit deduct form following instant on an iOS device?

Create, edit, and share deduct form following instant from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

What is deduct form following instant?

Deduct form following instant is a form used to report deductions made from payments.

Who is required to file deduct form following instant?

Individuals or entities who have made deductions during the specified period are required to file deduct form following instant.

How to fill out deduct form following instant?

Deduct form following instant can be filled out by providing details of the deductions made, including the amount deducted and the recipient of the payment.

What is the purpose of deduct form following instant?

The purpose of deduct form following instant is to report deductions made and ensure compliance with tax regulations.

What information must be reported on deduct form following instant?

Information such as the date of deduction, amount deducted, recipient's details, and reason for deduction must be reported on deduct form following instant.

Fill out your deduct form following instant online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Deduct Form Following Instant is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.