Get the free Penalty APR and When It

Show details

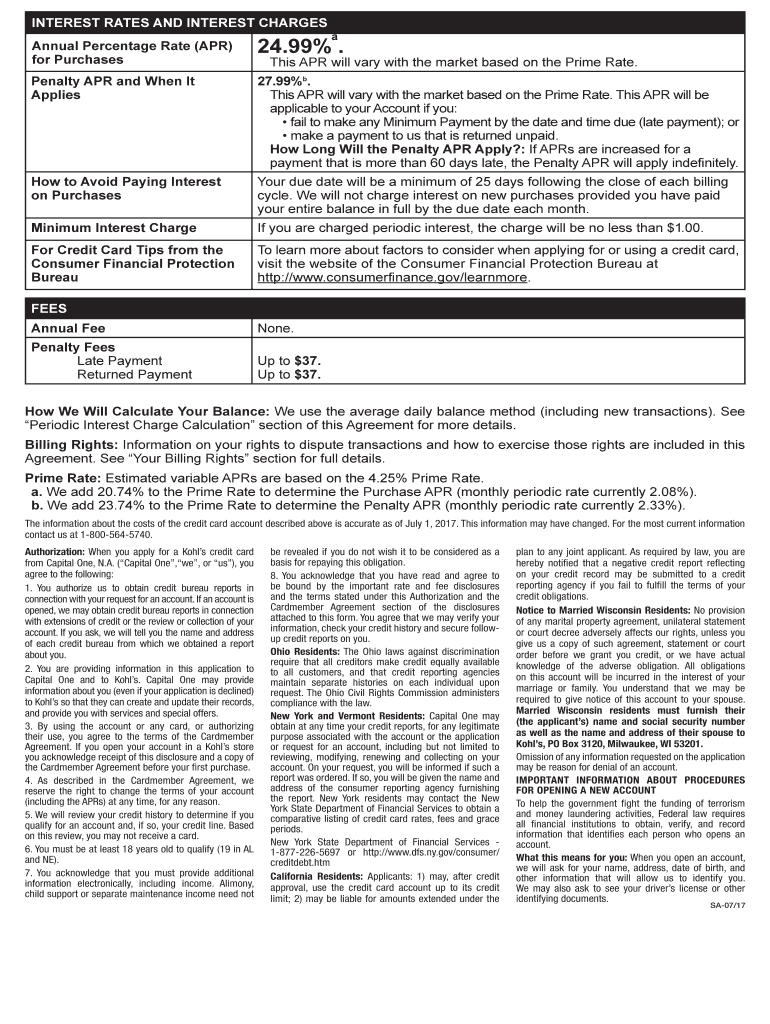

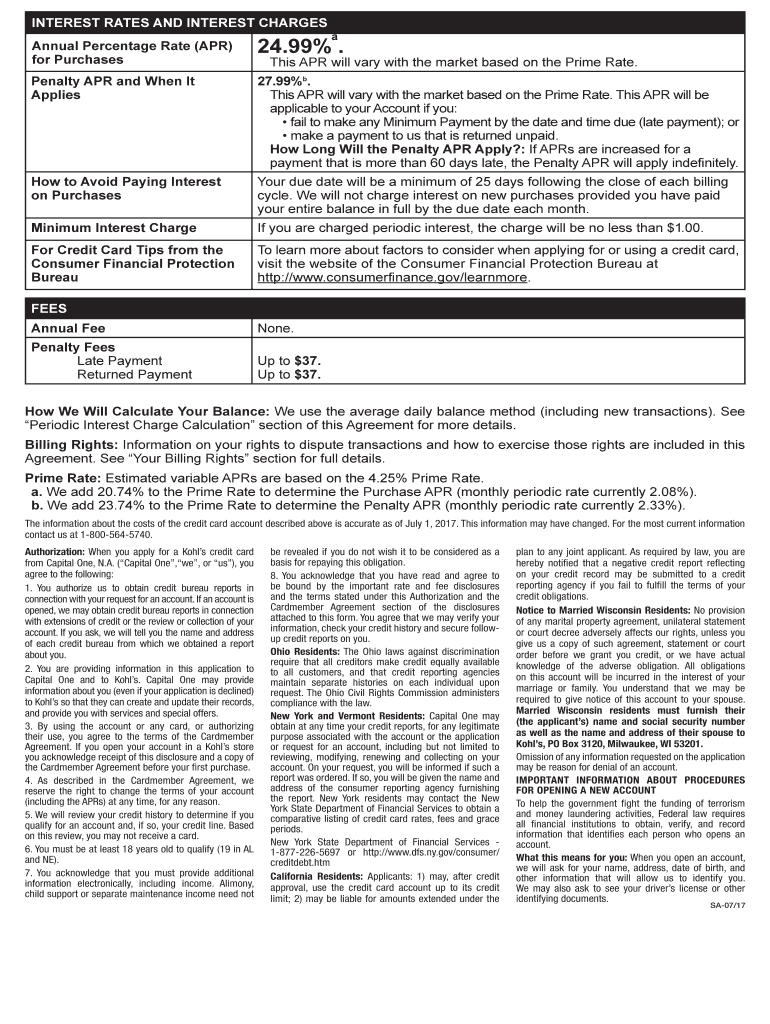

INTEREST RATES AND INTEREST CHARGESaAnnual Percentage Rate (APR) for Purchases24.99×. Penalty APR and When It Applies27.99×b. This APR will vary with the market based on the Prime Rate. This APR

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign penalty apr and when

Edit your penalty apr and when form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your penalty apr and when form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit penalty apr and when online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit penalty apr and when. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out penalty apr and when

Point by point instructions on how to fill out penalty APR and when it is needed, as well as who needs it and when:

01

To fill out penalty APR, start by gathering all relevant information about the interest rates associated with specific credit cards or loans. This includes the regular APR (annual percentage rate), any promotional APRs, and the penalty APR.

02

Identify the circumstances under which the penalty APR may be applied. Typically, this occurs when a cardholder fails to make minimum payments on time or breaches the terms of the credit agreement.

03

Review the terms and conditions of the credit card or loan agreement to understand the specific guidelines for penalty APR implementation. This information can usually be found in the fine print or disclosure documents provided by the issuer or lender.

04

If penalty APR is applicable, understand the conditions under which it can be lifted or reduced. Some credit card companies may provide options for reinstating the regular APR after a certain period of responsible payment behavior.

05

It is important to determine who needs penalty APR. Generally, penalty APR is a consequence for individuals who fail to meet their payment obligations promptly or violate terms of their credit agreements. Therefore, anyone with a credit card or loan should be aware of the potential for a penalty APR.

06

The timing of when penalty APR is needed can vary. It is typically triggered when a cardholder misses a payment due date or fails to make the minimum required payment. However, it is crucial to refer to the specific terms and conditions of each credit card or loan to understand the exact circumstances and deadlines.

07

Key individuals who may need penalty APR include those who struggle with timely payments or have a history of late or missed payments. It serves as a deterrent to encourage responsible payment behavior and acts as a consequence for late payments.

In summary, filling out penalty APR involves understanding the terms and conditions of a credit card or loan, identifying when and how the penalty APR is applicable, and gathering the required information. Penalty APR is relevant to anyone with a credit card or loan and is typically triggered by missed payments or failure to meet the payment obligations outlined in the agreement.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get penalty apr and when?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the penalty apr and when. Open it immediately and start altering it with sophisticated capabilities.

Can I sign the penalty apr and when electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your penalty apr and when in minutes.

How can I edit penalty apr and when on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing penalty apr and when right away.

What is penalty apr and when?

Penalty APR, also known as penalty Annual Percentage Rate, is a higher interest rate that credit card issuers can apply to your account if you make a late payment or violate other terms of the agreement. It is typically triggered when you make a late payment.

Who is required to file penalty apr and when?

Credit card issuers are required to disclose the penalty APR in their cardholder agreement, which is provided to consumers when they apply for a credit card.

How to fill out penalty apr and when?

Credit card issuers automatically apply the penalty APR to your account if you trigger it by making a late payment or violating the terms of the agreement.

What is the purpose of penalty apr and when?

The purpose of the penalty APR is to encourage customers to make timely payments and adhere to the terms of their credit card agreement.

What information must be reported on penalty apr and when?

The penalty APR must be clearly disclosed in the credit card agreement, including the specific circumstances under which it will be applied.

Fill out your penalty apr and when online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Penalty Apr And When is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.