Get the free Fair Lending for Community Bank

Show details

Fair Lending for Community Bank

Lenders

Webinar ? October 8, 2013 ? 1:30 – 3:30 p.m. CT

Understanding and Dealing with Increased Regulatory Scrutiny on

Fair Lending In a Community Bank Environment

This

We are not affiliated with any brand or entity on this form

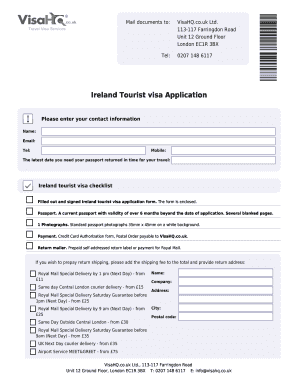

Get, Create, Make and Sign fair lending for community

Edit your fair lending for community form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fair lending for community form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit fair lending for community online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit fair lending for community. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fair lending for community

How to fill out fair lending for community:

01

Begin by gathering all necessary documentation and information related to your community lending practices. This may include loan applications, approval and denial records, credit scores, and other relevant data.

02

Review the fair lending guidelines provided by the regulatory authorities to understand the specific requirements for your community. This may include the Equal Credit Opportunity Act (ECOA), Fair Housing Act (FHA), Community Reinvestment Act (CRA), and other applicable laws and regulations.

03

Evaluate your lending policies and procedures to ensure they align with the principles of fair lending. This involves assessing whether your community lending practices exhibit any discriminatory patterns or unintentional biases.

04

Conduct thorough training sessions for your staff members involved in lending decisions. They should be educated on fair lending laws, regulations, and practices, and understand how to apply them correctly.

05

Establish clear processes and guidelines for handling loan applications and making lending decisions. This includes ensuring transparency and consistency in evaluating loan applications, regardless of factors such as race, ethnicity, gender, or any other protected characteristics.

06

Regularly monitor your lending activities to identify any potential disparities or discriminatory practices. Utilize statistical analysis and other tools to evaluate lending patterns and assess if there are any disparities that cannot be explained by legitimate factors.

07

Implement corrective measures if any disparities or discriminatory practices are identified. This may involve revising lending policies, providing additional training for staff members, and establishing mechanisms for addressing customer complaints or grievances.

08

Document and maintain comprehensive records of all fair lending activities, including the steps taken to ensure compliance with applicable laws and regulations. This documentation should be readily accessible for audits or inquiries from regulatory authorities.

Who needs fair lending for community?

Fair lending for community applies to various entities involved in lending activities, including but not limited to:

01

Banks and financial institutions offering loans to individuals or businesses within the community.

02

Non-profit organizations providing financial support through community lending programs.

03

Credit unions and cooperative societies engaged in lending activities.

04

Mortgage lenders and brokers serving the community.

05

Government agencies or departments that administer community lending programs.

It is important for all these entities to adhere to fair lending practices in order to promote equality, discourage discrimination, and ensure fair access to credit and financial services for all members of the community.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my fair lending for community directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your fair lending for community and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How can I get fair lending for community?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific fair lending for community and other forms. Find the template you want and tweak it with powerful editing tools.

How do I complete fair lending for community on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your fair lending for community. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is fair lending for community?

Fair lending for community refers to the practice of providing loans and financial services in a non-discriminatory manner to all members of a community, regardless of race, ethnicity, gender, or other protected characteristics.

Who is required to file fair lending for community?

Financial institutions such as banks, credit unions, and mortgage lenders are required to file fair lending reports for community.

How to fill out fair lending for community?

Fair lending reports for community can be filled out online through the designated regulatory agency's website or by submitting the necessary documentation through the mail.

What is the purpose of fair lending for community?

The purpose of fair lending for community is to ensure equal access to credit and financial services for all members of a community, while also preventing discriminatory lending practices.

What information must be reported on fair lending for community?

Information such as the number of loan applications received, approved, and denied, as well as the demographics of the applicants, must be reported on fair lending reports for community.

Fill out your fair lending for community online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fair Lending For Community is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.