Get the free RISK TOLERANCE QUESTIONNAIRE - White Horse Advisors

Show details

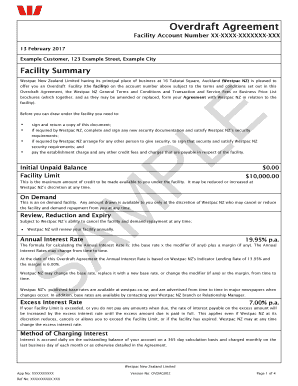

RISK TOLERANCE QUESTIONNAIRE CLIENT NAME: JOINT OWNER NAME: ACCOUNT TYPE: 1. 2. Which of the following most accurately describes your general attitude towards investing? A. In order to minimize fluctuations

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign risk tolerance questionnaire

Edit your risk tolerance questionnaire form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your risk tolerance questionnaire form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit risk tolerance questionnaire online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit risk tolerance questionnaire. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out risk tolerance questionnaire

How to fill out a risk tolerance questionnaire:

01

Start by gathering all the necessary information: Before filling out the questionnaire, make sure you have all the relevant financial information at hand. This includes details about your income, assets, debts, and financial goals.

02

Read each question carefully: Take your time to read and understand each question on the risk tolerance questionnaire. It's important to answer honestly and thoughtfully to get an accurate assessment of your risk tolerance.

03

Consider your investment goals: The questionnaire will likely ask about your investment goals and objectives. Think about whether you want to prioritize growth, income, or preservation of capital. This will help determine your risk tolerance level.

04

Assess your time horizon: Consider your investment time horizon, which refers to the length of time you plan to invest your funds. Longer time horizons generally allow for greater risk tolerance, as there is more opportunity to recover from potential losses.

05

Evaluate your risk tolerance capacity: Assess your financial situation and ability to withstand potential losses. Consider factors such as your income, assets, and liabilities. This will help determine how much risk you can afford to take.

06

Reflect on your risk preferences: Think about how comfortable you are with taking risks. Some individuals may be more risk-averse, preferring safer investments with lower potential returns, while others may be more risk-tolerant, willing to take on higher levels of risk for potentially higher returns.

07

Answer based on your personal circumstances: Provide accurate and honest answers based on your personal circumstances. Avoid trying to answer in a way that you think the questionnaire wants to hear. It's important to provide authentic responses to ensure an accurate assessment of your risk tolerance.

Who needs a risk tolerance questionnaire:

01

Individuals who are planning to invest: Anyone who is considering investing their money should complete a risk tolerance questionnaire. It helps assess how much risk an individual is willing and able to take, which is crucial in constructing an appropriate investment portfolio.

02

Financial advisors and wealth managers: Professionals in the finance industry often use risk tolerance questionnaires to understand their clients' risk profiles. This information helps them tailor investment strategies and recommendations that align with their clients' risk preferences and goals.

03

Retirement planners: Risk tolerance questionnaires are commonly used in retirement planning. They assist individuals in determining suitable investment options for their retirement savings, taking into account their risk tolerance and time horizon.

In conclusion, filling out a risk tolerance questionnaire involves carefully considering your financial situation, investment goals, time horizon, risk tolerance capacity, and risk preferences. These questionnaires are useful for individuals planning to invest, financial advisors, wealth managers, and retirement planners.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is risk tolerance questionnaire?

A risk tolerance questionnaire is a series of questions designed to assess an individual's willingness and ability to take on financial risk.

Who is required to file risk tolerance questionnaire?

Individuals or organizations involved in investments or financial planning may be required to fill out a risk tolerance questionnaire.

How to fill out risk tolerance questionnaire?

To fill out a risk tolerance questionnaire, individuals must answer the questions honestly and provide accurate information about their financial goals and risk preferences.

What is the purpose of risk tolerance questionnaire?

The purpose of a risk tolerance questionnaire is to help individuals determine their risk tolerance level and make informed investment decisions.

What information must be reported on risk tolerance questionnaire?

Information such as financial goals, investment time horizon, risk preferences, and current financial situation may need to be reported on a risk tolerance questionnaire.

How can I edit risk tolerance questionnaire from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your risk tolerance questionnaire into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I edit risk tolerance questionnaire online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your risk tolerance questionnaire to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I edit risk tolerance questionnaire on an Android device?

The pdfFiller app for Android allows you to edit PDF files like risk tolerance questionnaire. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

Fill out your risk tolerance questionnaire online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Risk Tolerance Questionnaire is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.